From raw material processing to recycling: new

Apr 3, 2025 · Europe is, therefore, faced with the task of building a resilient value chain that includes both raw material extraction, further processing as well as

An Industrial Blueprint for Batteries in Europe

May 13, 2024 · Europe can become self-sufficient in battery cells by 2026, and manufacture most of its demand for key components (cathodes) and materials such as lithium by 2030. But over

Economic and structural challenges of lithium-ion battery

Aug 1, 2025 · Given the critical importance of lithium-ion batteries in the electric vehicle market and the limited availability of critical raw materials like lithium, cobalt, and graphite, effective

Lithium battery makers in Europe: Localizing production and

Apr 3, 2024 · While North America is making strides, with substantial investments aimed at achieving self-sufficiency in lithium batteries and EVs, Europe has yet to reach a comparable

Advanced lithium-ion battery process manufacturing

Jul 18, 2025 · Summary Lithium-ion battery cell manufacturing depends on a few key raw materials and equipment manufacturers. Battery manufacturing faces global challenges and

Lithium recovery and battery-grade materials production

May 7, 2025 · New technologies in Li processing and recovery Europe imports more than half of the necessary battery materials, such as lithium (Li), nickel (Ni), cobalt (Co) and magnesium

Battery Active Material Production in Europe

Jun 6, 2025 · Battery-News presents an up-to-date overview of planned and already realized projects in the field of active material production for lithium-ion batteries in Europe. Compared

Lithium-Ion Battery Manufacturing: Industrial

Nov 15, 2023 · In this review paper, we have provided an in-depth understanding of lithium-ion battery manufacturing in a chemistry-neutral approach starting

Lithium, Brexit and Global Britain: Onshoring battery

Dec 1, 2023 · Popularly referred to as a global ''battery race'', this geopolitical dynamic suggests the reassertion of national territory as a container of production in a reverse ''global shift'' (Gong

An Industrial Blueprint for Batteries in Europe

May 13, 2024 · Announced capacities in Europe will be able to process around 830 kt of batteries (or around 195 GWh) in the pre-processing stage and over 880 kt of batteries (or 205 GWh) in

Towards the lithium-ion battery production network:

Jul 1, 2022 · To remedy this, we deploy a global production network (GPN) approach that highlights the increasing intersection of battery manufacturing with the automotive and power

Top 10 Companies in the Europe Lithium-ion Battery

Jun 10, 2025 · The Europe Lithium-ion Battery Recycling Market was valued at US$ 1.85 Billion in 2024 and is projected to reach US$ 4.25 Billion by 2030, growing at a Compound Annual

The battery industry has entered a new phase –

Mar 5, 2025 · At the same time, the average price of a battery pack for a battery electric car dropped below USD 100 per kilowatt-hour, commonly thought of

Lithium battery makers in Europe: Localizing production and

Apr 3, 2024 · European lithium battery manufacturers are intensifying efforts to localize production, align with EU regulatory objectives, and safeguard their supply chains from

Why is Hungary becoming a hotspot for lithium

Sep 8, 2024 · Hungarian families say area risks becoming a ''battery wasteland'' in wake of Chinese lithium plant Mikepércs resident Éva Kozma fears CATL''s

Top 10 Companies in the Europe Lithium-ion Battery

Jun 10, 2025 · In this analysis, we examine the Top 10 Companies in the Europe Lithium-ion Battery Recycling Industry —pioneers in hydrometallurgy, mechanical processing, and closed

Europe has lots of lithium, but struggles to get it

Jan 9, 2025 · Streamlining the process would help. But unless Europe addresses these obstacles, lithium projects currently on the drawing board will stay there,

Current and future lithium-ion battery manufacturing

Apr 23, 2021 · Figure 1 introduces the current state-of-the-art battery manufacturing process, which includes three major parts: electrode preparation, cell assembly, and battery

210201 European Lithium

Mar 16, 2021 · The Presentation Materials are being supplied to you for information purposes only by European Lithium Limited (the "Company"). These Presentation Materials have been

Advanced lithium-ion battery process manufacturing

Jul 18, 2025 · Festo offers high-precision automation components for battery manufacturing with pneumatic and electric actuators, valves, and handling systems to improve electrode coating,

Top 10 Companies in the Europe Lithium-ion Battery

Jun 10, 2025 · In this blog, we profile the Top 10 Companies in the Europe Lithium-ion Battery Recycling Industry – market leaders transforming end-of-life batteries into high-value

Security for Europe''s Increasing Lithium Supply Security

Jan 18, 2024 · While the lithium-ion battery supply chain will likely remain Chinese-dominated until 2030, a European CRM supply security policy and other global supply diversification policies

6 FAQs about [Lithium battery pack processing in Southern Europe]

Does Europe import lithium ion batteries?

Europe imports more than half of the necessary battery materials, such as lithium (Li), nickel (Ni), cobalt (Co) and magnesium (Mg). Domestic production is important. In this context, the EU-funded LiCORNE project will establish the first-ever Li supply chain in Europe.

What is the demand for lithium-ion batteries in Europe?

The demand for lithium-ion batteries is expected to reach around 1,000 GWh (or 1 TWh) by 2030 in Europe driven by transport electrification and energy storage systems.4 All of this has spurred a flurry of announcements for setting up large lithium-ion battery cell production plants, or gigafactories.

Will Europe continue to rely on the global market for battery materials?

It is clear from the above that Europe will continue to rely on the global market to secure critical battery materials for decades to come. It is therefore in the EU's interest to ensure there is a diverse and transparent raw materials market, as well as pursuing its own onshoring efforts.

Where can lithium be extracted?

The alkali metal lithium, an important raw material for battery production, can be extracted from brine or ore rock - also in Europe. The mine in Beauvoir is just one part of the Emili project in France. Facilities for processing the lithium-bearing rock are now also being built.

How many GWh can a licorne battery supply in Europe?

The European primary resources that are considered in LiCORNE would be enough to supply ~3000 GWh of batteries (i.e. ~10 years to the expected 300 GWh/year production capacity in Europe by 2030).

How much lithium will Europe produce in 2023?

Europe's lithium demand is forecast to grow to over one million tons of lithium chemicals in the next decade (source: SCI Jul 2023). Each of Livista Energy’s lithium chemical refineries will produce forty thousand tons of battery grade lithium chemicals per year.

Update Information

- Southern Europe lithium battery pack supplier

- What is the minimum voltage of the 6-series lithium battery pack in China and Europe

- Indian lithium battery pack processing

- Lima Power Lithium Battery Pack Processing

- Castrie lithium battery pack processing

- Dakar lithium battery pack processing

- Nairobi lithium battery pack processing

- Dominic lithium battery pack processing

- Czech solar lithium battery pack

- 48v lithium battery pack manufacturer

- Solar Lithium Battery Pack

- Saudi Arabia lithium battery pack 3D configuration

- Lithium battery pack for new energy vehicles

Solar Storage Container Market Growth

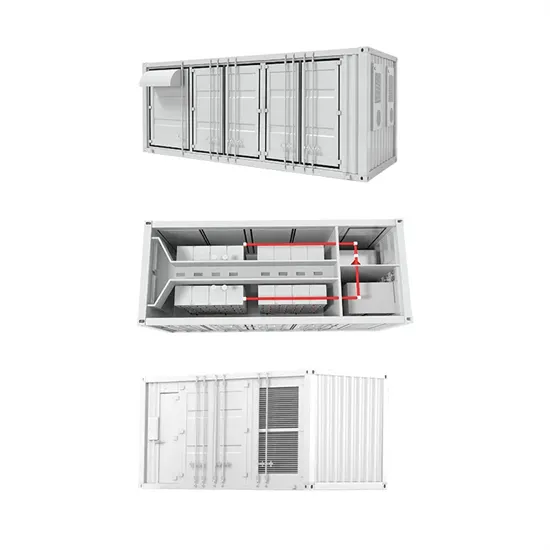

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

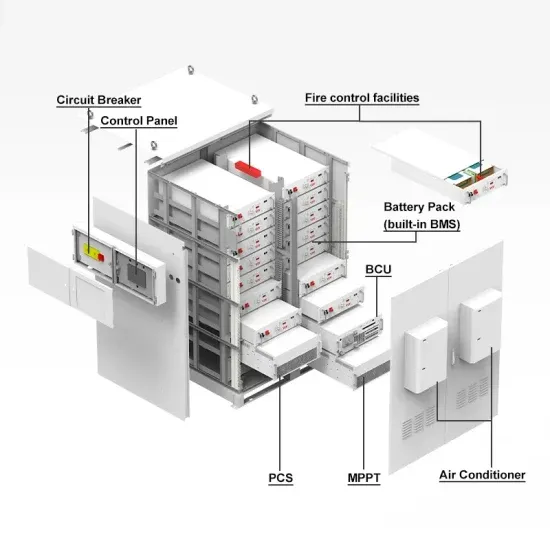

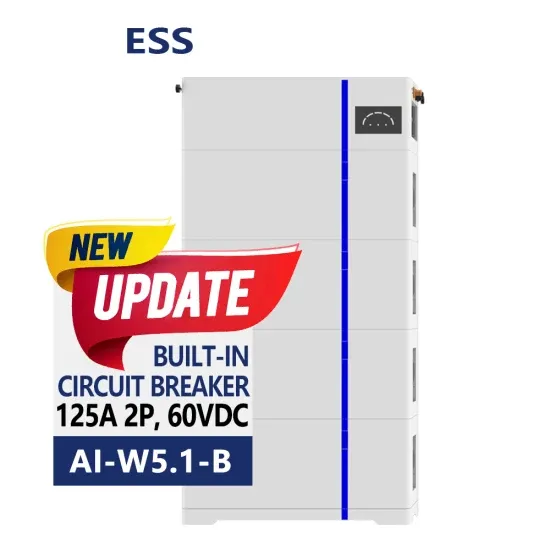

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.