Exide In Talks With Two Leading 2W OEMs To Supply Lithium

May 26, 2025 · The battery maker expects to start trial production at its upcoming lithium-ion battery manufacturing facility this calendar year, followed by serial commercial production in

Project Report on LITHIUM-ION BATTERY PACK

Jul 13, 2025 · LITHIUM-ION BATTERY PACK - Project Report - Manufacturing Process - Cost - Investment Required. Report includes feasibility report, profitability analysis, raw materials,

Understanding the Lithium-Ion Battery Manufacturing Process

From powering electric two-wheelers and commercial EV fleets to enabling rooftop solar and smart grid systems, lithium ion battery manufacturers in India are now key players in the global

LIB About Us

Oct 23, 2024 · Lib India lithium ion battery manufacturing setup in Supa near Pune, Under Make in India initiative we have built India's first GIGA Factory. Establish a complete Indian

How can India Indigenise Lithium-Ion Battery

Feb 20, 2023 · While India''s battery manufacturing sector is yet to take of, globally the lithium-ion battery manufacturing capacity has been growing rapidly. A battery manufacturing capacity of

Lithium-ion cell manufacturing and value chain

Oct 16, 2023 · Electrolyte manufacturing in India for Lithium-Ion Battery (LiB) cells is currently in its nascent stages, but it has been attracting increasing interest

Rs 75,000 cr investments to upstream 150Gwh battery

22nd March 2025 India is poised to invest Rs 75,000 crore to enhance its battery cell production capacity by nearly 150 GWh by the year 2030, as indicated by a recent study from ICRA. At

Top Lithium Battery Companies in India: Supplier Guide

May 29, 2025 · Looking for reliable lithium battery suppliers in India? Discover top manufacturers in Haryana and Tamil Nadu, compare certifications, and verify delivery rates. Click to explore

Lithium-ion Battery Manufacturing in India –

May 12, 2023 · This article explores the current state of Lithium-ion battery manufacturing in India. Currently, either Li-ion cells are imported from China or

PRODUCTION PROCESS OF A LITHIUM-ION BATTERY CELL

Feb 7, 2024 · The manufacture of the lithium-ion battery cell comprises the three main process steps of electrode manufacturing, cell assembly and cell finishing. The electrode

Energy Transition and the Lithium Rush

Jan 31, 2024 · ICWAThe inclusion of lithium as a ''critical'' mineral in India''s Ministry of Mines Committee report of June 2023 highlights its vital role in India''s economic development and

Lithium-Ion Battery Pack Manufacturing Process

Jun 4, 2025 · Conclusion The process of lithium-ion battery pack manufacturing involves meticulous steps from cell sorting to final testing and assembly. Each

Giga-scale battery manufacturing in India: Powering

Mar 28, 2023 · ply chains will provide the foundation to meet the rising demand of battery storage in India. The battery manufacturing sector in India is still in its na cent stages, with a majority of

Li-ion cell manufacturing: A look at processes

Jun 10, 2021 · The production of the lithium-ion battery cell consists of three main stages: electrode manufacturing, cell assembly, and cell finishing. Each of

India''s EV Battery Plans May Run into Domestic

Mar 23, 2025 · "Battery cell manufacturing is a highly technologically complex process," ICRA points out. The suitability of technology for Indian climatic

6 FAQs about [Indian lithium battery pack processing]

What is the current state of lithium-ion battery manufacturing in India?

This article explores the current state of Lithium-ion battery manufacturing in India. Currently, either Li-ion cells are imported from China or Taiwan to be assembled into batteries in India, or already assembled battery packs are being imported. Considering the ambitious plans to push EVs, these imports are going to cost the economy dearly.

Why is India importing lithium-ion batteries?

Given India’s low natural endowment of most lithium-ion battery minerals, between 12–60 per cent of the value chain is subject to imports. USD 4.5 billion investment required to set up 50 GWh of lithium-ion cell and battery manufacturing plant under Production Linked Incentive (PLI) scheme.

Can India indigenise a large part of the lithium-ion battery manufacturing ecosystem?

Academia must immediately start designing courses and curricula to meet the increasing demands of the workforce. Through multiple interventions, India can indigenise a large part of the lithium-ion battery manufacturing ecosystem. Abhyankar, Nikit, Shruti Deorah, and Amol Phadke. 2021.

How many GWh is a lithium ion battery in India?

As of 2023, the domestic manufacturing of LIBs in India has reached 18 GWh. The current focus is primarily on assembling battery packs using imported cells.

How will India's lithium-ion battery market grow in 2022?

The lithium-ion battery market in India is expected to grow at a CAGR of 50% from 20 GWh in 2022 to 220 GWh by 2030. The current focus of Indian enterprises is on battery cell manufacture. However, as more cell manufacturing units are commissioned in India, the upstream process will most likely be the next priority area.

What is a battery manufacturing supply chain in India?

or battery manufacturing supply chain in India, raw material sourcing is the biggest concern. India currently has extremely low reserves of in-house materials like li hium, cobal and nickel, which are key constituents for manufacturing cathode and electrolyte. Additionally, the

Update Information

- Lithium battery pack processing in Southern Europe

- Nairobi lithium battery pack processing

- What is MOS for lithium battery pack

- Lithium iron phosphate battery pack 25 6v71 5ah

- San Diego Lithium Titanate Battery Pack BMS

- Timbu lithium battery pack customization

- San Salvador lithium battery production and processing

- Alofi replaces lithium battery pack

- Huanneng lithium battery pack

- Italian 21700 lithium battery pack

- Sales of lithium battery pack manufacturers

- 482XH lithium battery pack

- 11V lithium battery pack

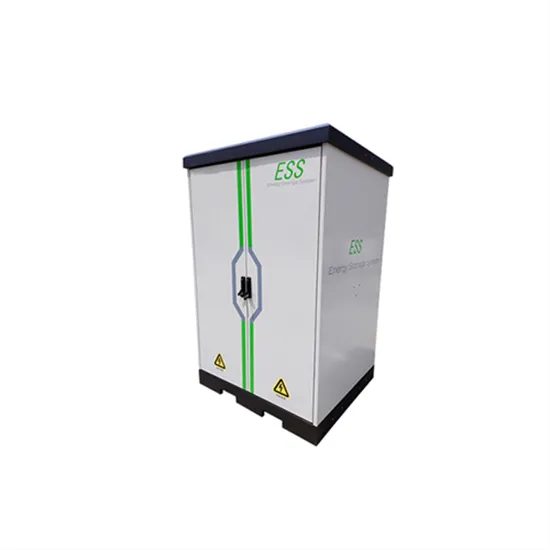

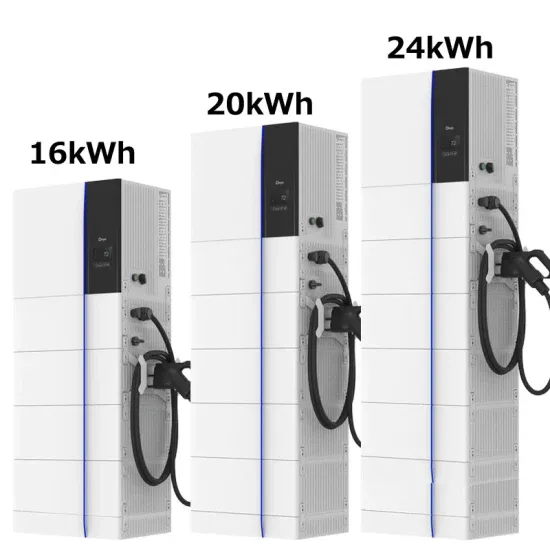

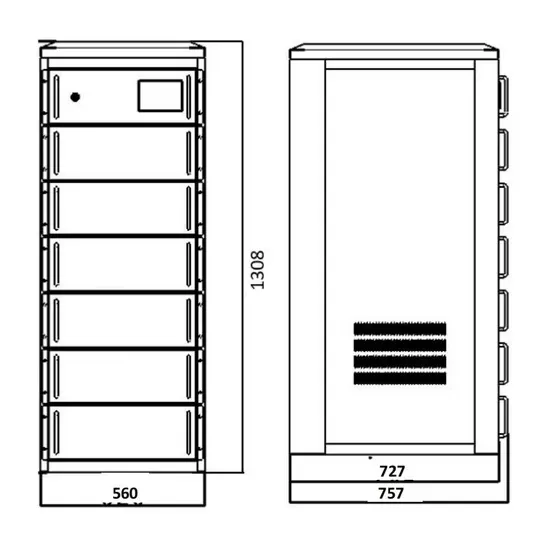

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.