Four Companies Leading the Rise of Lithium & Battery

Date: March 1, 2024 Topic: Thematic, Disruptive Technology The ongoing paradigm shift in the mobility segment toward electric vehicles (EVs) created a need to build out the entire value

2025 Global Lithium Battery Industry Pattern and Top 10 Leading Enterprises

1、 Global lithium battery market concentration: led by China, with TOP10 companies occupying over 90% of the market share According to SNE Research and industry data, the global lithium

Yiwei Lithium Energy: the rapid development of the enterprise

For the future, Iincheng Liu, said million weft lithium can vision is to "do the best in the world of lithium batteries, become the industry leading enterprise", hundred million can weft lithium is

Top 5 Energy Storage Companies in China – NPP

Dec 16, 2011 · Great Power entered the field of energy storage batteries in 2011, and is one of the earliest enterprises involved in energy storage batteries in

Top 10 Global EV/REEV Battery Pack Suppliers – LEAPENERGY

Jul 21, 2025 · In this blog, we explore the top 10 global battery pack suppliers—industry leaders who are shaping the future of mobility and energy with cutting-edge technology, mass

Top 18 lithium ion battery manufacturers in 2025

Jul 4, 2025 · When you have a project need Lithium-Ion Battery, you may need a Lithium-Ion Battery manufacturer to work for you, here we list out top 18 lithium ion battery manufacturers

The rise of China''s new energy vehicle lithium-ion battery

Mar 1, 2023 · Regarding knowledge development and exchange (F2 and F3), Chinese battery enterprises have increased their R&D expenditure, leading to several technological

Technology innovation of lithium-ion battery manufacturing

Oct 28, 2022 · Leading lithium-ion battery manufacturing enterprises are devoting themselves to accomplish the incoming technical revolution of battery manufacturing based on their

Smarter Energy: Leading Enterprise in Hundred Billion

Nov 28, 2017 · Smarter Energy: Leading Enterprise in Hundred Billion Worthy Lithium Battery Market with the Capacity Planning for More than 16GWh 详细页In order to enhance its voice in

Overview of the Chinese Lithium-ion Power Battery Export

Feb 15, 2023 · This article introduces the overview of the Chinese Lithium-ion Power Battery Export Industry as well as the lithium battery industry chain. Specifically, the article focuses on

Custom Lithium ion Battery Pack Manufacturer-15 years

Large Power is a Chinese high-tech enterprises which dedicated to the R&D, manufacture and sales of rechargeable lithium ion battery packs. Large Power was founded in 2002, with its

In 2022, the global shipment volume of cylindrical lithium

From the perspective of the shipment volume of each enterprise, the shipment volume of the four Japanese and Korean enterprises has maintained positive growth, with LGES ranking first with

Evaluating R&D efficiency of China''s listed lithium

Sep 6, 2022 · The first contribution is that characteristic of the lithium battery industry in China is we provide overviews on the efficiency of R&D activities that it is "top-heavy", thus making the

The 10 Best Lithium Battery Manufacturers in China

Apr 17, 2024 · Its leading products are exported to over 100 countries and regions around the world. The company''s comprehensive strength ranks 199th among

Top 10 Lithium ion battery manufacturers in

Aug 15, 2023 · So far, it can be said that China has been the leading country in lithium ion battery technology, and many companies are at the world''s leading

6 FAQs about [Lithium battery pack leading enterprise]

What is China's Lithium-ion battery industry?

China has become the center of this lithium-ion battery industry, home to many of the world’s top lithium battery manufacturers. These companies are leading the way in battery tech, creating everything from compact batteries for light electric vehicles to powerful systems that store renewable energy.

Who makes lithium ion batteries?

Farasis Energy produces lithium-ion batteries for electric vehicles (EVs) and hybrid vehicles, contributing to the electrification of the automotive industry. Energy Storage Systems (ESS): The company manufactures lithium-ion batteries for energy storage applications, supporting the efficient storage and utilization of renewable energy.

Who is the best lithium battery manufacturer in China?

1.CATL - Top Lithium Battery Manufacturer in China CATL is a globally renowned lithium - battery giant. It was founded in 2011 in Ningde. The company is committed to the research and development, production, and sales of power battery systems for new - energy vehicles and energy - storage systems.

Who makes lithium batteries in 2025?

In 2025, a mix of Chinese, South Korean, and Japanese giants dominate the lithium battery landscape. Companies like CATL, BYD, LG Energy Solution, and Panasonic lead in production capacity and innovation, shaping the global shift towards electrification.

How big is the lithium-ion battery market?

And this market isn’t slowing down anytime soon— it’s projected to grow steadily, reaching around $88.46 billion by 2033, with a yearly growth rate of 3.4% over the next decade. China has become the center of this lithium-ion battery industry, home to many of the world’s top lithium battery manufacturers.

Is CATL the world's largest lithium battery producer in 2025?

Yes, CATL continues to hold the top position as the world's largest lithium battery producer in 2025. In 2024, they commanded approximately 38% of the global EV battery market, supplying giants like Tesla and Volkswagen, and this dominance is projected to extend into 2025 due to their continuous expansion and technological advancements.

Update Information

- Lithium iron phosphate battery pack 25 6v71 5ah

- Berlin lithium battery pack processing

- Lithium iron phosphate battery pack press assembly

- How much is the lithium iron phosphate battery pack

- Torch lithium battery pack customization

- Lithium battery pack active balancing BMS passive balancing

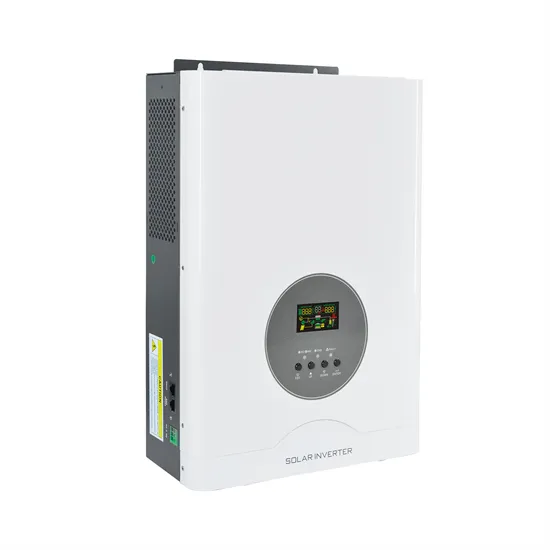

- The role of lithium battery pack with inverter

- Lithium battery splicing battery pack

- Production of lithium battery pack types

- San Diego Lithium Titanate Battery Pack BMS

- Timbu lithium battery pack customization

- Manila lithium battery pack company

- Juba lithium iron phosphate battery pack

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.