China Double Glass PV Module Manufacturers Factory

SHINEFAR is one of the most professional bifacial single glass solar panels manufacturers and suppliers in China, specialized in providing high quality custom service. Please feel free to

Double Glass Module Photovoltaic Glass Market

Key Drivers Accelerating Double Glass Module Adoption in the Global Photovoltaic Market The shift toward double glass modules in the photovoltaic industry is driven by their **superior

The Difference Between Double-glass and Single

Aug 17, 2023 · The main difference between double-glass photovoltaic modules and single-sided glass solar panels lies in their construction and design, which

Double-glass PV modules with silicone encapsulation

May 21, 2024 · Recently several double-glass (also called glass–glass or dual-glass modules) c-Si PV modules have been launched on the market, many of them by major PV manufacturers.

The Difference Between Bifacial Module and

Sep 4, 2023 · Bifacial solar modules and double glass bifacial solar modules are both types of solar panels designed to capture sunlight from both sides (front

Photovoltaic Module Double Glass Manufacturers & Suppliers

photovoltaic module double glass manufacturers/supplier, China photovoltaic module double glass manufacturer & factory list, find best price in Chinese photovoltaic module double glass

Bifacial Solar Panel Double Glass Mono Perc 540W 545W 550W PV Module

Aug 14, 2025 · Bifacial Solar Panel Double Glass Mono Perc 540W 545W 550W PV Module Manufacturers Price in China, Find Details and Price about Solar Panels 550W Solar Panel

Experimental repair technique for glass defects of glass-glass

Aug 1, 2023 · The PV modules with glass defects under test did not show internal defects in the PV cells, while the repaired specimens performed properly at each phase in the repair process

Update Information

- Double-glass photovoltaic module bending

- How much electricity does a photovoltaic double-glass module generate

- Photovoltaic module manufacturers inventory prices

- Double-glass photovoltaic module efficiency improvement

- Sao Tome double-glass photovoltaic module prices

- Double-sided double-glass photovoltaic panel manufacturers

- Double-glass photovoltaic thin-film module price

- Photovoltaic double-glass module back connector

- Photovoltaic panel manufacturers for sale in Bandar Seri Begawan

- Number of photovoltaic module cells

- Solar photovoltaic module pressure equipment

- Africa photovoltaic panel installation manufacturers

- How many photovoltaic panel manufacturers are there in the Marshall Islands

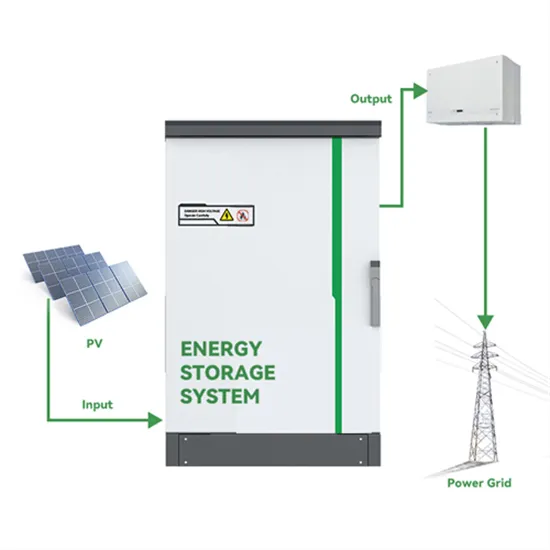

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.