Energy storage in Europe

Mar 11, 2025 · Because of water resources availability and tailored energy policies, Germany, Italy, and Spain accounted for the largest pumped hydro storage capacity in the region,

The major Battery Storage projects from around

Aug 8, 2025 · We provide a detailed report on all the major Battery Storage construction projects around the world with key focus on the largest projects in

New EU Platform Highlights Over 1771 Energy Storage Projects

The European Energy Storage Inventory, developed by the Joint Research Centre (JRC) of the European Commission, is a new interactive platform that maps and analyzes over 1771 energy

List of the 100 largest battery project developers

Jan 22, 2025 · Get access to our list of the most important European renewable energy developers that realize battery storage projects (like Enso Energy,

European Energy Storage Market Outlook for 2024

Aug 23, 2024 · 2024 European Energy Storage Market Outlook for Major Countries In summary, the European energy storage market in 2024 will witness a significant increase in large-scale

Biggest projects in the energy storage industry in 2024

Dec 25, 2024 · Following similar pieces in 2022/23, we look at the biggest energy storage projects, lithium and non-lithium, that we''ve reported on in 2024.

Five European energy storage markets to keep on your radar

By Scott Poulter Think of energy storage in Europe and the markets that most often come to mind are the UK and Germany. That''s no wonder: both have historically led European energy

The European Energy Storage Inventory: A comprehensive

Mar 8, 2025 · The dynamics of the European energy storage market are not limited to individual major projects, but also includes significant developments in the field of home storage and

Questions and Answers on the new list of EU energy

Projects of common interest (PCIs) are key infrastructure projects aimed at completing the European internal energy market and help the EU to achieve its energy and climate objectives:

New analysis reveals European solar battery storage market

Jun 11, 2024 · Latest analysis from SolarPower Europe reveals that, in 2023, Europe installed 17.2 GWh of new battery energy storage systems (BESS); a 94% increase compared to 2022.

Europe''s energy storage fleet reaches 89 GW

Apr 1, 2025 · Europe continues to grow its energy storage fleet at pace, advancing its transition to a more sustainable and resilient energy system. According to a new report authored by LCP

New EU Tool Tracks Real-Time Energy Storage Across Europe

Jun 18, 2025 · A new interactive platform—the European Energy Storage Inventory —has been launched to provide near real-time insights into energy storage deployment across the EU,

Europe installed 12GW of energy storage in 2024

Apr 1, 2025 · A total of 11.9GW of energy storage across all scales and technologies was installed in Europe in 2024, bringing cumulative installations to 89GW. According to the ninth annual

New report: European battery storage grows 15% in 2024, EU energy

May 7, 2025 · 21.9 GWh of battery energy storage systems (BESS) was installed in Europe in 2024, marking the eleventh consecutive year of record breaking-installations, and bringing

6 FAQs about [EU energy storage major projects]

How big is Europe's energy storage capacity?

The latest edition of the European Market Monitor on Energy Storage by LCP Delta and The European Association for Storage of Energy (EASE), released today, highlights Europe's rapid expansion in energy storage capacity, which reached 89 gigawatts (GW) by the end of 2024.

How many battery energy storage systems were installed in Europe in 2024?

21.9 GWh of battery energy storage systems (BESS) was installed in Europe in 2024, marking the eleventh consecutive year of record breaking-installations, and bringing Europe’s total battery fleet to 61.1 GWh. However, the annual growth rate slowed down to 15% in 2024, after three consecutive years of doubling newly added capacity.

How big is energy storage in Europe in 2024?

Pumped-hydro storage (PHS) dominated the market, accounting for 53 GW of total capacity. Meanwhile, electrochemical storage reached 35 GW, with many installations in homes and businesses. Large-scale thermal projects accounted for around 1 GW. The rate of energy storage adoption varied across European countries in 2024. Image: EASE

Why is energy storage important in the EU?

It can also facilitate the electrification of different economic sectors, notably buildings and transport. The main energy storage method in the EU is by far 'pumped hydro' storage, but battery storage projects are rising. A variety of new technologies to store energy are also rapidly developing and becoming increasingly market-competitive.

What is Europe's most comprehensive energy storage archive?

The report, now in its ninth edition, compiled by the European Association for Storage of Energy (EASE) and LCP Delta tracks over 3,000 energy storage projects from over 27 countries to claim the moniker of the most comprehensive archive of European storage.

Which European countries adopted energy storage in 2024?

The rate of energy storage adoption varied across European countries in 2024. Pumped-hydro storage (PHS): Italy, France, Germany, and Spain had the largest capacities. Residential electrochemical storage: Germany and Italy remained the top markets despite a slowdown.

Update Information

- Four major cooperation models for industrial and commercial energy storage projects

- Major energy storage projects of Huawei

- VAT rate for chemical energy storage projects

- All-solid-state battery and energy storage projects

- 2025 Energy Storage Projects

- Recent energy storage projects in Kinshasa

- Pretoria energy storage related projects settled

- What are the three major systems of energy storage containers

- Taxes for new energy storage projects

- Some points to note when negotiating energy storage projects

- World Energy Storage Investment Projects

- Future prospects of photovoltaic energy storage projects

- Wind solar and energy storage projects were withdrawn

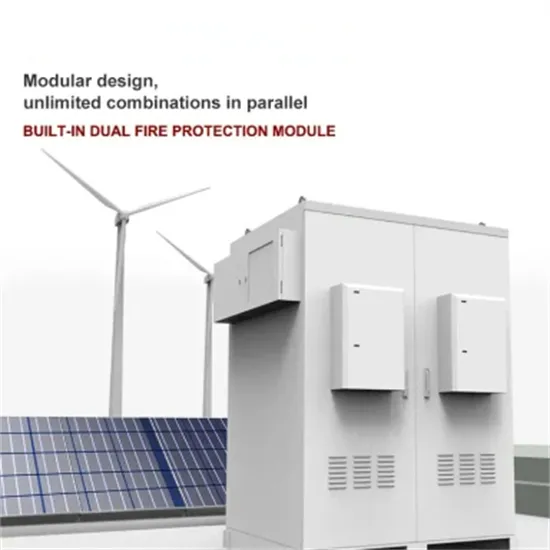

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

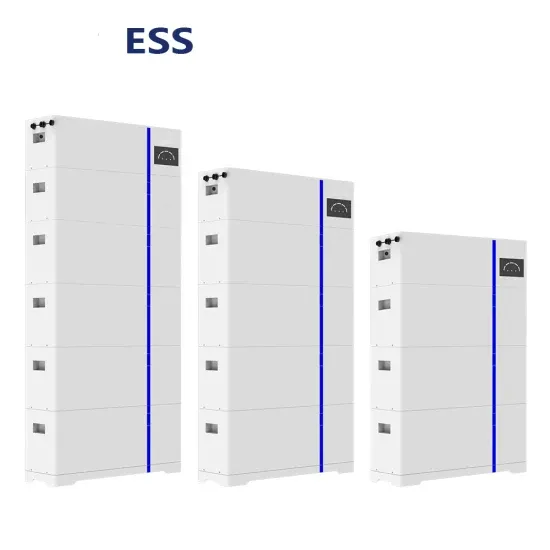

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.