Despite Tax Incentives, Wind and Solar Project

Jan 25, 2023 · A further problem is connecting the wind and solar projects to the grid. Before grid operators and interconnecting utilities sign off on new

$8 billion of US climate tech projects have been

Apr 21, 2025 · This year has been rough for climate technology: Companies have canceled, downsized, or shut down at least 16 large-scale projects worth $8

Why Energy Storage Projects Are Getting Cancelled: A Deep

Sep 24, 2020 · That''s when the government dropped a policy bombshell canceling mandatory energy storage allocations for new renewable projects [7]. Overnight, nearly 50% of planned

$1.4B in new clean energy factories, projects

Jun 24, 2025 · Companies canceled $1.4 billion in new clean energy factories and projects in May, as Congressional Republicans work through a reconciliation

$14 billion in clean energy projects have been cancelled in

May 29, 2025 · More than $14 billion in clean energy investments in the U.S. have been cancelled or delayed this year, according to an analysis released Thursday, as President Donald

Gridlock: Visualizing the U.S. Clean Energy Backlog

Mar 5, 2024 · The U.S. has almost 2 million megawatts (MW) of solar, wind, and storage capacity on hold in interconnection queues, seeking connection to the

Trump Prompts $19 Billion Worth of Wind and Solar Projects

3 days ago · Since President Trump took office, nearly $19 billion in U.S. wind and solar projects have been canceled as subsidies and federal support were rolled back.

$8 Billion in Clean Energy Projects Canceled in

Apr 21, 2025 · Approximately $8 billion in clean energy investments and 16 large-scale projects were canceled, closed, or scaled back during the first quarter of

Integrating solar and wind energy into the electricity grid for

Jan 1, 2025 · A rise in the need for the integration of renewable energy sources, such as wind and solar power, has been attributed to the search for sustainable en

The Interconnection Bottleneck: Why Most Energy Storage Projects

May 11, 2023 · This undercuts state policy goals and frustrates incentive programs. "Nationally, almost all of the projects waiting in interconnection queues are for solar, wind and storage

The Need for Continued Innovation in Solar, Wind, and Energy Storage

Sep 19, 2018 · Solar energy, wind energy, and battery energy storage are widely regarded as the three most prominent clean energy technology success stories. In 2017, the International

Grid connection backlog grows by 30% in 2023,

Apr 11, 2024 · Interconnection requests were already trending upward prior to the IRA, but that trend has only accelerated: over 1,100 GW of solar, storage, and

Queued Up: Status and Drivers of Generator

Jul 11, 2023 · The median duration from request to withdrawn date ticked up in 2022; wind projects typically spend more time in queues than gas or solar prior to withdrawing Duration

4 FAQs about [Wind solar and energy storage projects were withdrawn]

Which projects were withdrawn from Esai power?

Notably, the majority of all withdrawn projects were solar. Note that ESAI Power publishes the Generation Asset Monitor monthly as part of our Benchmark Energy Research. The GAM covers MISO, PJM, NYISO and ISO-New England.

Which TC1 projects have been withdrawn?

ESAI’s recent PJM GAM breaks down all withdrawn TC1 projects following PJM’s Phase I study by Renewable Energy type, including Offshore Wind, Solar, Storage and Onshore Wind. Notably, the majority of all withdrawn projects were solar. Note that ESAI Power publishes the Generation Asset Monitor monthly as part of our Benchmark Energy Research.

Why are some projects canceled?

So some of the project cancellations are a result of right-sizing, or getting supply and demand in sync. Other projects are still moving forward, with hundreds of manufacturing facilities under construction or operational. But it’s not as many as we’d see in a more stable policy landscape, Turner says.

Is all hope lost for the future of renewables?

In a sign that not all hope is lost for the future of renewables in the U.S., April alone saw nearly $500 million in new development, with Japanese manufacturing company Hitachi’s energy arm building out transmission and electrification operations in Virginia and materials and technology company Corning investing in solar manufacturing in Michigan.

Update Information

- What can wind solar and energy storage projects do

- How many wind and solar energy storage power stations are there in Beirut

- Lima Wind and Solar Energy Storage Project

- Battery energy storage for wind power projects

- The first choice for wind and solar energy storage

- Bolivia wind and solar energy storage power plant

- Energy storage projects boost wind power generation

- Equipment cost of wind and solar energy storage power station

- Photovoltaic combined with wind and solar energy storage

- Invest in wind and solar energy storage power stations

- High-end manufacturing of wind power solar power and energy storage

- Solar and energy storage projects

- Botswana wind and solar energy storage power generation

Solar Storage Container Market Growth

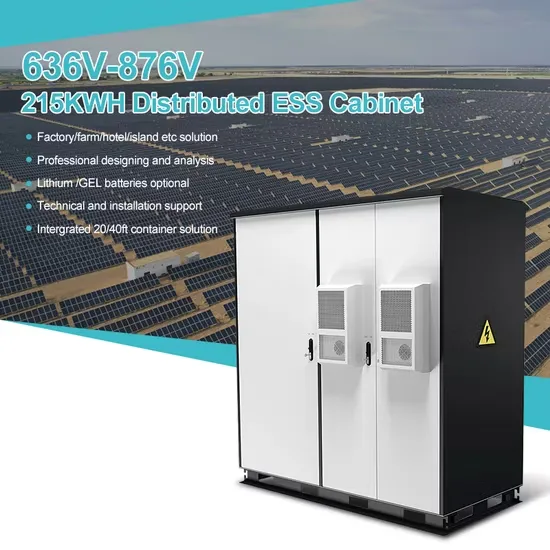

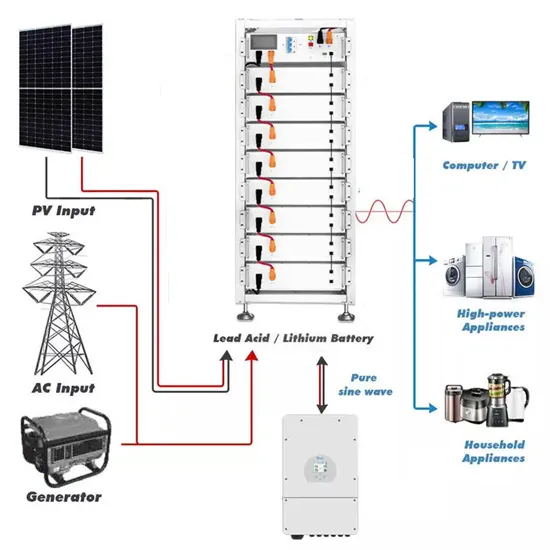

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.