What is Commercial and Industrial Energy Storage?

Jun 12, 2025 · Commercial and industrial energy storage systems (C&I ESS) refer to large-scale battery solutions designed to store electricity for businesses, manufacturing plants, and

Analysis of the Industrial and Commercial Energy

Sep 26, 2024 · In today''s rapidly evolving energy landscape, the industrial and commercial energy storage market is experiencing significant changes. As an

Industrial and commercial energy storage cooperation

Commercial and Industrial energy storage is one of the main types of user-side energy storage systems, which can maximize the self-consumption rate of photovoltaics, reduce the electricity

ZNTECH on LinkedIn: The three most common cooperation models

Aug 7, 2024 · The three most common cooperation models for industrial and commercial energy storage! 01- Owner Owned mode / Definition: Owner-invested mode means that enterprises

Industrial and Commercial Energy Storage: High Gro

With the increasing demand for renewable energy sources, industrial and commercial energy storage has emerged as a high-growth trend. This article explores the diverse development

Energy Storage Industry Trends: C&I Energy Storage Market

Feb 6, 2025 · With the transformation of the global energy structure and the rapid development of renewable energy, the commercial and industrial energy storage (C&I ESS) market will see

investment and cooperation model for energy storage

An option game model applicable to multi-agent cooperation investment in energy storage An option game model applicable to multi-agent cooperation investment in energy storage

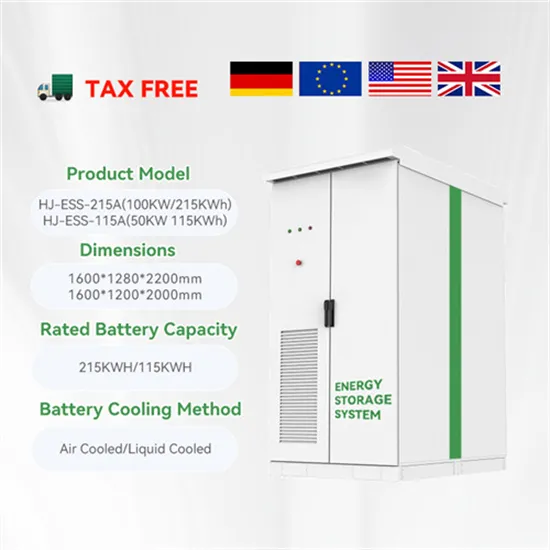

China Industrial and Commercial Energy Storage System

What is composite energy storage model in China? Composite energy storage model China is gradually forming an open electricity sales marketwith diversified competitors. With ancillary

Analysis of new energy storage policies and business models

Abstract: The development of energy storage technologies is still in its early stages, and a series of policies have been formulated in China and abroad to support energy storage development.

Build the New Pattern of Green Energy Cooperation

Dec 7, 2023 · 2.2 Build "Big-Comprehensive-New" Green Boutique Project CEEC proactively aligns itself with the global trend of green energy transformation and, in the realm of green

Commercial & Industrial Solar & Battery Energy Storage

Apr 25, 2024 · With the rapid advancements in clean energy technologies and evolving market dynamics, embracing solar photovoltaic (PV) and energy storage solutions will be key to

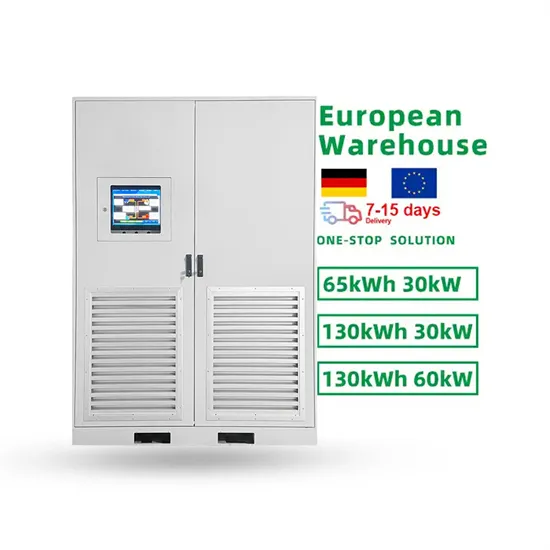

The Energy Storage Market in Germany

ISSUE 2019 Energy storage systems are an integral part of Germany''s Energiewende ("Energy Transition") project. While the demand for energy storage is growing across Europe, Germany

Cooperation model for industrial and commercial energy storage

The main body that utilizes energy storage systems to provide relevant energy storage services to users, usually energy groups and energy storage equipment manufacturers with rich

6 FAQs about [Four major cooperation models for industrial and commercial energy storage projects]

Why is cooperation difficult in CCUs business models?

Third, for business models such as CCS operator model and CO 2 transportation model, there are multiple stakeholders involved in the full-chain CCUS project and the profit maximization target for each stakeholder makes cooperation difficult to realize.

When can CCS operator and Co2 Transporter models be implemented?

For the large-scale deployment stage of CCUS technology, CCS operator and CO 2 transporter models could be implemented after experience has been accumulated and after the costs of carbon capture, transport and utilization or storage has been reduced. This paper is not without potential limitations.

What is Uthmaniyah's CO 2 EOR demonstration project?

Uthmaniyah's CO 2 EOR Demonstration Project can be summarized as a vertical integration model. This model has strict requirements for the degree of integration of the energy company; the energy company should have a capture source and a storage/EOR site as well as transportation facilities.

Which CCS projects are similar in China?

Some projects in China, such as the Yanchang Integrated Carbon Capture and Storage Demonstration Project and the Sinopec Shengli Power Plant CCS Project, currently share similar characteristics. The business model of the Quest CCS project can be summarized as a joint venture model.

What is the business model of the quest CCS project?

The business model of the Quest CCS project can be summarized as a joint venture model. In addition, the business models of the Snøhvit CO 2 Storage Project in Norway, the Petrobras Lula Oil Field CCS Project in Brazil, and the In Salah CO2 Storage Project in Algeria are similar to the Quest business model.

Should power plant companies use CCS operator model or joint venture model?

Second, if either the CCS operator model or joint venture model is applied, it is necessary for the power plant company to not be profit motivated; otherwise, higher capture costs may lead to a failure in cooperation among the companies. In addition, these two models are highly dependent on oil price, if no supporting policies are available.

Update Information

- Current industrial and commercial energy storage projects in Eritrea

- Industrial and commercial energy storage cabinet in Tampere Finland

- Prague Industrial and Commercial Energy Storage Cabinet Manufacturer

- Balkan Peninsula Industrial and Commercial Energy Storage Cabinet Customization

- Kinshasa Industrial and Commercial Energy Storage Battery Merchants

- Industrial and commercial energy storage with outdoor cabinets

- Belarusian industrial and commercial energy storage ems energy management system

- Energy storage industrial and commercial integrated cabinet

- Communication base station industrial and commercial energy storage solutions

- Industrial and commercial energy storage cabinet production process

- Finland s industrial and commercial energy storage system energy storage lithium battery

- Price of Eastern European Industrial and Commercial Energy Storage Cabinet

- Commercial energy storage projects in Venezuela

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.