What is the tax rate for energy storage projects?

Feb 13, 2024 · The tax rate for energy storage projects is influenced by several factors including location, type of project, and governmental regulations. 1.

Companies call on government to ''level the playing field'' by

"Locating energy storage in the home also supports the network and is a key enabler for the roll out of more solar PV and electric vehicles. It doesn''t make sense that VAT rates for coal and

VAT on Energy Storage: Policies, Impacts, and What You

Oct 12, 2021 · Why VAT Matters in the $33 Billion Energy Storage Industry Let''s face it: taxes aren''t exactly the life of the party. But when it comes to energy storage—a $33 billion global

Financing the Energy Transition – Funding battery storage projects

Jun 7, 2023 · Energy is generated intermittently by wind or solar projects, for example, depending on the weather or the time of day, and does not always correlate with demand. Energy can be

SALT and Battery: Taxes on Energy Storage

Jul 31, 2023 · The IRA expanded the investment tax credit by eliminating the requirement that a storage system be charged by solar and including stand-alone energy storage systems placed

Understanding VAT Implications for Energy Storage Systems

The Current VAT Landscape Most jurisdictions apply standard VAT rates to energy storage systems, but exceptions are emerging: Germany''s 7% VAT for residential battery systems

Global Electrochemical Energy Storage Project List

Global Electrochemical Energy Storage Project List The DOE Global Energy Storage Database provides research-grade information on grid-connected energy storage projects and relevant

Energy Storage Technology Service Tax Rates: What

When you bundle generation, storage and sales like in 光储充一体化 (solar-storage-charging integration) projects, China''s tax authorities treat it like a full-course dinner – complete with

The Levelized Cost of Storage of Electrochemical

Jun 2, 2022 · The International Installed Capacity of Energy Storage and EES The cumulative installed capacity of global energy storage in 2014–2020 is

Zero VAT on energy storage in the UK possible soon

Jun 22, 2023 · The UK government is consulting on reducing the VAT rate to zero for households that install a photovoltaic installation with energy storage. A government consultation is

UK Government Unveils VAT Relief for Domestic Energy Storage

Dec 15, 2023 · The UK government has announced plans to offer VAT relief on installing Battery Energy Storage Systems (BESS), including retrofitted BESS, which will become exempt from

VAT on Energy Storage: Policies, Impacts, and What You

Oct 12, 2021 · Countries are scrambling to adjust VAT rates for energy storage systems (ESS) to meet climate goals. Here''s the lowdown: Germany: Slashed VAT from 19% to 0% for

China s energy storage technology innovation

Should China invest in energy storage technology? Subsidies of at least 0.169 yuan/kWh to trigger energy storage technology investment. Energy storage technology is one of the critical

Virginia Reforms Local Tax Treatment of Energy Storage

Mar 29, 2021 · The tax reforms provide a less burdensome, simpler, and more transparent local tax regime for energy storage projects as Virginia pursues development of large-scale energy

Tax and Energy Series : China

Jun 3, 2024 · By the end of 2023, the cumulative installed capacity of newly built and operational storage projects nationwide reached 31.39 million kilowatts/66.87 million kilowatt-hours, with

VAT hike squeezes energy sector

Mar 24, 2025 · VAT increase and project costs Instead of the originally anticipated two-percentage-point hike, the budget speech proposes raising the value-added tax (VAT) rate in

The Levelized Cost of Storage of Electrochemical

Jun 2, 2022 · Large-scale electrochemical energy storage (EES) can contribute to renewable energy adoption and ensure the stability of electricity systems

Energy Storage Technology Service Tax Rates: What

1. The "We Do Everything" Package (13% VAT) Think of this as the储能行业 (energy storage industry) equivalent of a combo meal. When you bundle generation, storage and sales like in

5 FAQs about [VAT rate for chemical energy storage projects]

What is the VAT rate for energy saving materials?

The Government maintains a reduced rate of VAT of 5 per cent on the installation of many Energy Saving Materials, such as ground source and air source heat pumps, subject to certain conditions.

What is the VAT rate on energy?

Gareth Kloet of Go Compare replies: The VAT rate on energy for domestic customers is 5 per cent - lower than the 20 per cent rate that is applied to other products and services - and is collected on behalf of the Government by the suppliers.

What is a standard VAT rate?

The standard VAT rate is the primary rate of VAT applied to goods and services within a country, covering most items except for certain specific goods and services that may qualify for a reduced rate. Some exceptions include essential items or goods and services that meet certain criteria outlined below. China applies 3 standard VAT rates.

What is the standard VAT rate in China?

Standard VAT rates in China typically vary between 6% and 13% (China has standard VAT rates of 6%, 9% and 13%), although certain goods and services may qualify for reduced rates or exemptions.

How does China's VAT system work?

China’s VAT system is invoice-driven, requiring businesses to issue special VAT invoices (fapiao) for tax compliance and credit claims, with strict regulatory oversight. If you wish to get quickly informed about all basic and reduced VAT rates in Europe or VAT rates in the World you can view our dedicated page by clicking on the respective title.

Update Information

- Energy storage power station projects put into operation

- Commercial energy storage projects in Venezuela

- How much profit do energy storage projects usually make

- Government Energy Storage Projects

- Gravity Energy Storage Facilities and Projects

- Energy storage projects connected to the grid

- Three grid-side energy storage projects

- Huawei Energy Storage Beneficiary Projects

- Energy storage projects in Thimphu

- SPB in energy storage projects

- In-Stock Projects Energy Storage Power Station

- Energy storage configuration for Australian photovoltaic projects

- Are there any energy storage projects being developed in Ljubljana

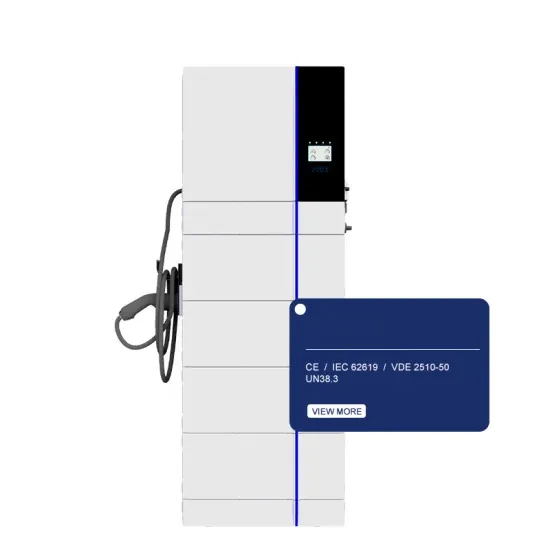

Solar Storage Container Market Growth

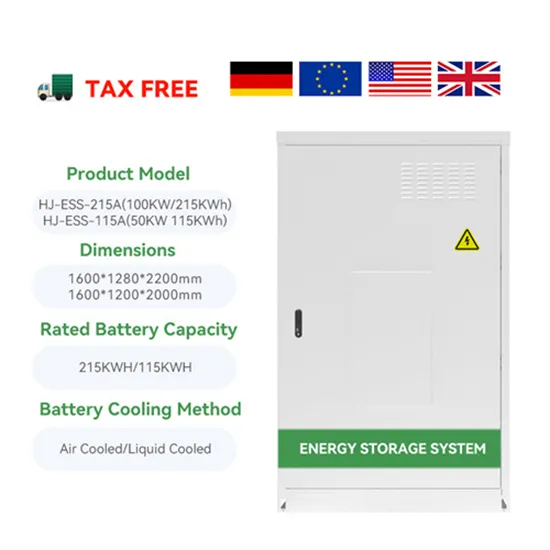

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

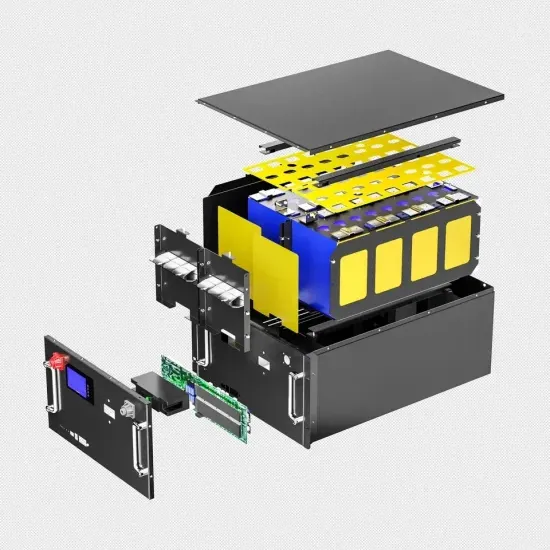

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.