Photovoltaic panels in Luxembourg: is it profitable?

May 3, 2021 · Luxembourg has an ambitious target to increase the share of energy from renewable sources to 25% by 2030. The development of photovoltaics is one of the solutions

Inauguration of the largest photovoltaic power plant in Luxembourg

Therefore, Enovos has partnered in recent years with many professional and industrial partners to significantly advance the energy transition through large-scale installations such as the

23,415 solar panels installed in Luxembourg''s largest solar park

Sep 10, 2019 · The solar park was created from a communal investment by RTL Group and Enovos, supported by the state''s first call for offers for photovoltaic power stations in February

Guardian Glass Manufacturing Plant, Luxembourg | DY Energy

📍 Guardian Glass Manufacturing Plant, Luxembourg DY Energy is thrilled to announce the completion of Luxembourg''s largest rooftop solar park! 🌞 As our first project in the country, this

Guardian Glass Europe: Float Glass Furnace Dedicated in

May 17, 2025 · Yesterday Guardian Glass marked a significant milestone with the official dedication of a new float glass furnace at the company''s Bascharage plant in Luxembourg.

Top 10 Photovoltaic Glass (PV Glass) Supplier in

Apr 8, 2025 · As the global demand for clean energy continues to rise, China has solidified its position as a leader in photovoltaic (PV) glass manufacturing. The

Luxembourg Photovoltaic Market (2024-2030) | Trends,

Historical Data and Forecast of Luxembourg Photovoltaic Market Revenues & Volume By Commercial & Industrial for the Period 2020-2030 Historical Data and Forecast of Luxembourg

free photovoltaic energy storage in luxembourg city

Free Full-Text | Optimal Integration of Hydrogen-Based Energy Storage Systems in Photovoltaic Microgrids: A Techno-Economic Assessment The feasibility and cost-effectiveness of

Enerdeal signs a contract with Guardian Glass for the

Aug 3, 2025 · ENERDEAL and Guardian Glass collaborate on a 5MWp solar project, reducing CO2 emissions by 1,400 tonnes annually. This partnership aligns with the EU''s emission goals

Luxembourg Photovoltaic Inverter Market (2024-2030)

Luxembourg Photovoltaic Inverter Industry Life Cycle Historical Data and Forecast of Luxembourg Photovoltaic Inverter Market Revenues & Volume By Application for the Period 2020- 2030

Photovoltaics in Luxembourg – Is It Still a Profitable

Feb 25, 2025 · In recent years, interest in photovoltaics in Luxembourg has increased significantly. More and more residents are choosing solar energy to lower their electricity bills.

Luxembourg Building Integrated Photovoltaic Skylights

Historical Data and Forecast of Luxembourg Building Integrated Photovoltaic Skylights Market Revenues & Volume By Transparent Solar Glass Skylights for the Period 2021-2031

Innovation in glass manufacturing Inside our plant in

Bascharage, Luxembourg, was chosen as the site for Guardian''s first float glass factory outside the US. In 1981, the strategic location opened doors to key regions, and the compact size of

Solar Photovoltaic Glass Companies: AGC Inc., Xinyi Solar

The report provides a comprehensive analysis of the Solar Photovoltaic Glass industry, emphasizing key competitors and their market positions. It offers an in-depth overview of

Advancements in Photovoltaic Glass Technology

Aug 19, 2025 · Implementing PV glass technology requires careful planning, financial investment, and a willingness to adapt to new ways of operating. It is through collaboration, knowledge

6 FAQs about [Luxembourg Photovoltaic Glass Industrial Park]

Is photovoltaic technology accelerating in Luxembourg?

It has been translated and edited for Delano. Photovoltaic technology has accelerated in recent years in Luxembourg. If small installations are plentiful, a new phenomenon is emerging: the installation of large power plants of more than 1 MW. Twenty or so have been installed in the last few years, and another ten or so should follow.

How many photovoltaic installations are there in Luxembourg?

However, these large installations have largely contributed to the acceleration of photovoltaic growth in Luxembourg, with almost 40 MW installed since 2020 (out of an overall increase of 117 MW). They now represent almost 14% of the country's installed capacity.

Why is Enovos installing a photovoltaic power plant in Luxembourg?

Enovos is installing numerous photovoltaic power plants in the country in response to a call for tenders issued by the State. In addition to the rooftop installations that we are all familiar with, other types of technologies are being developed in Luxembourg.

How much electricity does a solar power plant use in Luxembourg?

Based on the average number of sunny days in Luxembourg, the installation is expected to cover approximately 11% of the plant's total annual electricity consumption. Under optimal conditions, the production capacity is 5MWp, which is enough to power approximately 1,000 homes per year*.

How many photovoltaic panels does ArcelorMittal Luxembourg have?

8,600 photovoltaic panels on the roof of its European Logistic Center. - ArcelorMittal Luxembourg 8,600 photovoltaic panels on () 8,600 photovoltaic panels on the roof of its European Logistic Center.

Which photovoltaic power plant is installed in Differdange?

Installed by Enovos on the ArcelorMittal basin in Differdange, this photovoltaic power plant, which was inaugurated in 2021, represents more than 3 MW of installed power. It is one of 17 photovoltaic power plants of more than 1 MW in operation since 2020. (Photo: ArcelorMittal) Photovoltaic technology has accelerated in recent years in Luxembourg.

Update Information

- Vietnam Curtain Wall Photovoltaic Industrial Park

- Photovoltaic Glass Greenhouse Ecological Park

- Japan Osaka Photovoltaic Energy Storage Industrial Park

- Industrial plant photovoltaic glass

- Photovoltaic module double glass insulation

- Germany Hamburg photovoltaic glass price

- Solar Photovoltaic Glass Manufacturer in Cordoba Argentina

- Photovoltaic glass production plant in Mauritania

- Photovoltaic glass home power generation

- Cape Town Photovoltaic Glass Sales

- Is Guatemala Glass photovoltaic

- Dili rooftop photovoltaic glass

- Seasonal usage of photovoltaic glass

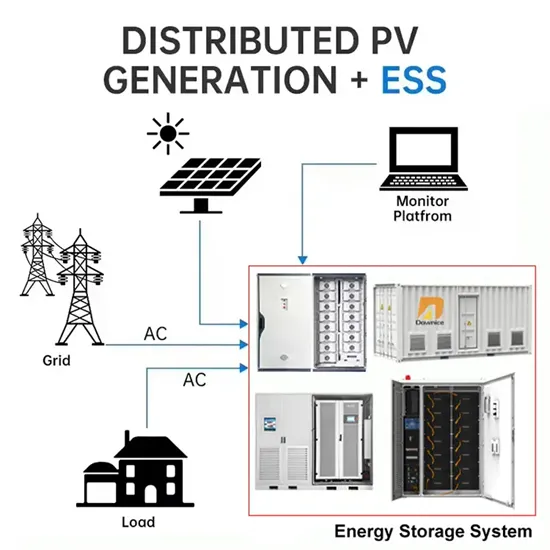

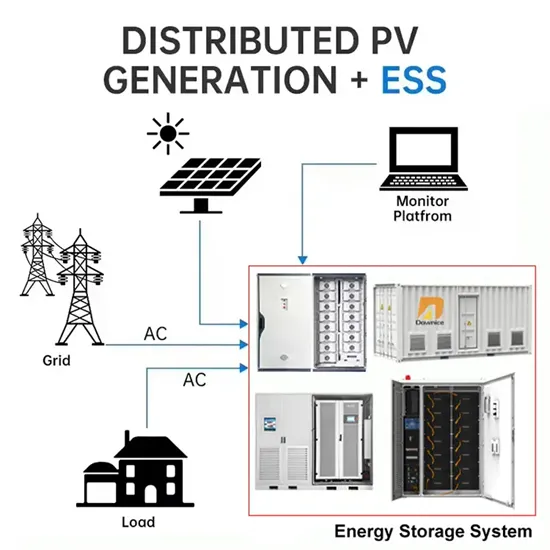

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

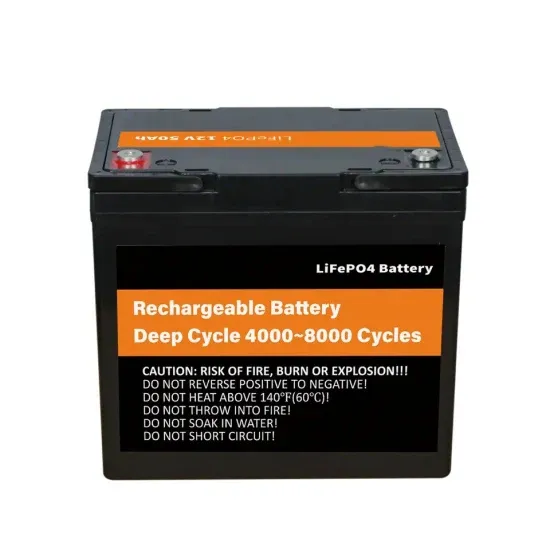

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.