Europe Solar PV Glass Market Price, Share, Growth Insights

Europe Solar PV Glass Market installed and glass consumed volume accounted for 842.3 million Sq. mts in 2024 and projected to grow at 1,500.6 millon Sq. mts in 2031 to reach CAGR 8.6%

PV Glass Price is Expected to Rise Driven by the Strong

published:2023-08-14 18:03 Edit As of 4th August, the mainstream price of domestic 2.0mm coated photovoltaic glass is 17.5 yuan/㎡, an increase compared with last week; the

Solar Photovoltaic Glass Market Size, Share Analysis

Mar 12, 2024 · Overall, the glass industry is expected to see a reduction in costs due to the decline in soda ash prices and the expansion of the scale of individual lines. Therefore, the

solar mounting systems | B2B companies and suppliers

DEGTECH - Photovoltaic Wholesale Your wholesale supplier for PV modules, inverters, energy storage systems, charging stations, and accessories from market leaders at the best prices.

Recent Facts about Photovoltaics in Germany

Jun 23, 2025 · These include PV panels and PV tiles for pitched roofs, lightweight PV systems for roofs with low load-bearing capacity, PV systems for green roofs, PV modules for cold façades

Germany Solar PV Glass Market (2025-2031) | Outlook & Share

Germany Solar PV Glass Market (2024-2030) | Outlook, Share, Industry, Analysis, Trends, Companies, Forecast, Segmentation, Competitive Landscape, Size & Revenue, Value, Growth

Photovoltaics Report

Jun 6, 2025 · In addition to building-integrated (roof or building facades) and ground-mounted systems, more and more PV systems are being installed on agricultural land (agrivoltaics) and

German Solar Panels Price Guide 2025: What You Need to

As of 2025, entry-level polycrystalline panels start around €45 per unit for basic 50W models, while premium 400W monocrystalline options reach €240+ for residential installation.

Germany Solar Photovoltaic (PV) Power Market Outlook

Aug 19, 2025 · /LONDON, March 21, 2024, 10:00 GMT, RENEWABLE MARKET WATCHTM/ This market report offers an incisive and reliable overview of the photovoltaic sector of the country

Europe Solar Photovoltaic Glass Market Size & Competitors

The Europe Solar Photovoltaic Glass Market is projected to witness market growth of 27.3% CAGR during the forecast period (2024-2031). The Germany market dominated the Europe

The Photovoltaic Market in Germany

THE BATTERY AGE Situated at the heart of Europe, Germany is Europe''s leading PV market. It converts more solar en-ergy into electricity than any other country. Grid parity was achieved in

Germany Hamburg Solar Photovoltaic Tile Company

German solar company Paxos Solar has unveiled a glass-glass photovoltaic tile that can be installed on roofs and connected to a heat pump, reducing energy demand by as much as 20

Germany Rooftop Solar Country Profile

Apr 15, 2024 · Scoring System This country profile highlights the good and the bad policies and practices of solar rooftop PV development within Germany. It examines and scores six key

Germany Hamburg Port Delivery 440W 450W Double Glass

May 18, 2024 · Germany Hamburg Port Delivery 440W 450W Double Glass Solar Panel Trina Vertex S+ Mono PV Module 430W 425W Neg9r. 28 US $0.11-0.13 / watt Min. Order: 17,000

Prices for PV, storage systems and heat pumps rise sharply

Mar 10, 2025 · After prices for photovoltaic modules, electricity storage systems, and heat pumps dropped by up to 30 percent since 2022, consumers must now prepare for higher purchase

6 FAQs about [Germany Hamburg photovoltaic glass price]

How big is the Solar Photovoltaic Glass market?

The Market Size and Forecasts for the Solar Photovoltaic Market are Provided in Terms of Volume (tons) for all the Above Segments. The Solar Photovoltaic Glass Market size is estimated at 27.11 Million tons in 2024, and is expected to reach 63.13 Million tons by 2029, growing at a CAGR of 18.42% during the forecast period (2024-2029).

Where are solar photovoltaic glasses made?

The largest producers of solar photovoltaic glasses are in the Asia-Pacific region. Some of the leading companies in the production of solar photovoltaic glasses are Jinko Solar, Mitsubishi Electric Corporation, Onyx Solar Group LLC, JA Solar Co. Ltd, and Infini Co. Ltd. China is the world’s largest solar photovoltaic glass manufacturer.

What is Solar Photovoltaic Glass?

Solar photovoltaic glass is a technology that enables the conversion of light into electricity. The glass is incorporated with transparent semiconductor-based photovoltaic cells, also known as solar cells. These cells are sandwiched between two sheets of glass, which enables them to capture these solar rays and convert them into electricity.

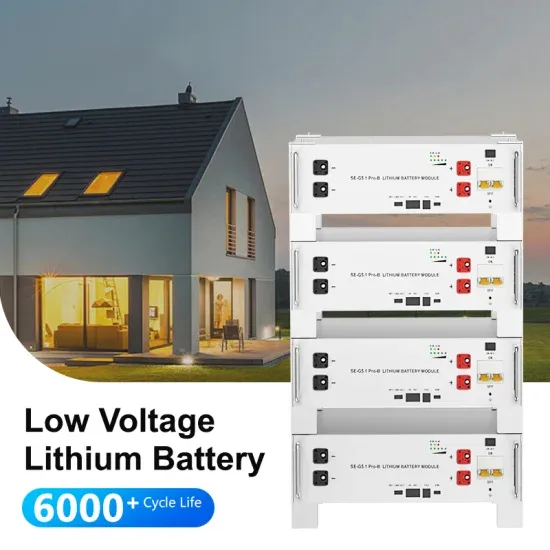

What is the German solar battery storage price monitoring?

The German Solar Battery Storage Price Monitoring summarizes price data of the most important battery storage market segments. To that end, EuPD Research interviews 80 solar installation companies and summarizes developments in a price index. In addition, the following data is gathered in the German Solar Battery Storage Price Monitoring:

Which region will dominate the Solar Photovoltaic Glass market?

The Asia-Pacific region is expected to dominate the solar photovoltaic glass market. In developing countries like China, India, and Japan, the crisis in electricity supply has resulted in increasing the scope for self-producing electricity using solar photovoltaic glass.

What data is gathered in the German PV price monitoring?

The data stems from interviews with solar installation companies and an evaluation of offers made to end consumers on online portals. The following data is gathered in the German PV Price Monitoring: Split of turn key costs of < 30 kWp rooftop systems in different cost components.

Update Information

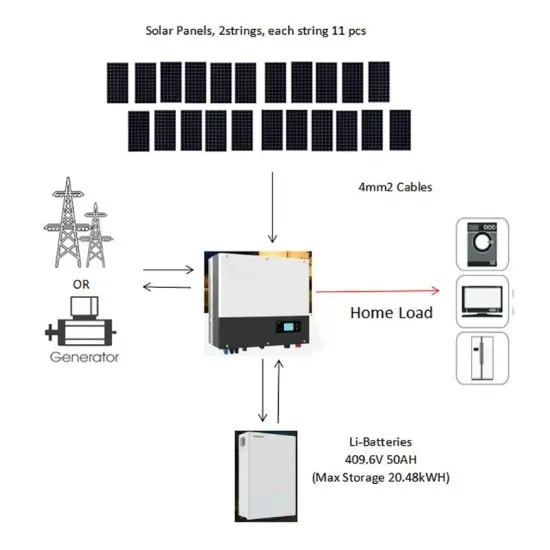

- Germany Hamburg photovoltaic glass price

- Germany Hamburg photovoltaic module inverter company

- Price of photovoltaic double-sided glass

- Photovoltaic energy storage in Hamburg Germany

- Summer photovoltaic energy storage power generation in Hamburg Germany

- What is the current price of single crystal double glass photovoltaic panels

- Current price of photovoltaic glass

- Tunisia double glass photovoltaic module price

- Jamaica Photovoltaic Glass Price

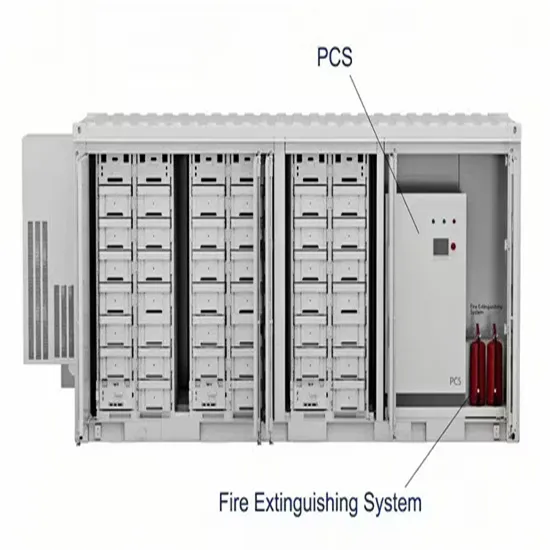

- Price of energy storage container in Hamburg Germany

- Manama single glass photovoltaic curtain wall price

- How much is the price of single glass photovoltaic curtain wall in Cameroon

- What is the manufacturer of 4v photovoltaic panels in Hamburg Germany

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.