Rising clamour! Photovoltaic component prices could meet

Solar photovoltaic (pv) net news: last week, the articles of wheat the component prices across the board increase, installer pressure!, caused the industry forward and anxiety, photovoltaic (pv)

Photovoltaic industry chain price differentiation, components

Mar 25, 2024 · authoritative advisory body InfoLink recently announced the latest week of photovoltaic industry chain prices, upstream and downstream prices continue to show a trend

Winter 2024 Solar Industry Update

Mar 5, 2024 · PV System and Component Pricing U.S. PV system and PPA prices have been flat or increased over the past 2 years. Global polysilicon spot prices fell 18% from mid-October

PV Price Forecasting Report (Q4

Feb 5, 2025 · The PV Price Forecasting Report provides independent market intelligence on changes in global supply chains and accurate forecasts for supply price scenarios based on

Global PV Module Market Analysis and 2025

Dec 11, 2024 · PV modules are the central component of the solar industry. This analysis reviews market conditions that affect solar panel pricing and availability.

Recent technical approaches for improving energy efficiency

Mar 1, 2023 · Recent progress on photovoltaic/thermal (PV/T) systems, sun-tracking mechanisms, bifacial PV configurations, floating and submerged PV systems is summarized, as well. Most

Advancements in photovoltaic technology: A comprehensive

Apr 1, 2025 · Abstract Photovoltaic (PV) technology has become a cornerstone in the global transition to renewable energy. This review provides a comprehensive analysis of recent

China''s Photovoltaic Module Market Price Differentiation

Mar 31, 2025 · According to the OPIS benchmark assessment, the FOB price of TOPCon modules rose by 1.14% for the fifth consecutive week, closing at US$0.089/W (approximately

Photovoltaic Module Opening Bid Prices All Increased

Dec 13, 2024 · The TOPCon bid section quoted a price of 0.62-0.76RMB/W, with an average price of 0.68RMB/W. All major photovoltaic companies quoted prices of 0.69RMB. /W or

PV Price Watch: Prices of China''s PV products stabilise, rebound

Jul 25, 2025 · Prices of products across various segments of China''s PV industry chain—polysilicon, wafers, cell and modules—have begun to rise recently. On July 23, the

Solar Manufacturing in Brazil: Local Sourcing vs. Import

1 day ago · Launching a solar factory in Brazil? This guide weighs the pros and cons of local sourcing vs. importing components to navigate Custo Brasil and secure incentives.

6 FAQs about [Latest photovoltaic component prices]

How much does a PV module cost in China?

According to price analysis firm InfoLink: “Since March, the spot price of n-type modules in China has soared from RMB0.7/W to RMB0.73/W. Quotes from leading manufacturers are approaching the RMB0.75/W mark.” The results of the China Datang Group’s 2025-2026 PV module framework. Image: Datang.

How much does a solar panel cost?

Average EXW prices from distributors for residential solar panels are reported between €0.125/W and €0.100/W, depending on the volumes. US DDP: The spot price for TOPCon utility-scale modules DDP US rose this week from 0.71% to $0.284/W.

How much will PV modules cost in 2025?

On 11 March 2025, the results of the China Datang Group’s 2025-2026 PV module framework purchase tender were announced, with the spot price of n-type modules increasing from RMB0.7/W (US$0.097/W) to RMB0.73/W (US$0.1/W), and some modules priced as high as RMB0.75/W (US$0.11/W).

How much are Chinese solar modules worth?

Prices for Chinese solar modules have reached record lows, according to the latest data from OPIS. The benchmark assessment for TOPCon modules from China has fallen to $0.100 per watt, a decline of $0.005 per watt compared to the previous week. Similarly, Mono PERC module prices have also dropped by $0.005 per watt, now standing at $0.090 per watt.

How much do Topcon solar modules cost in China?

The current tradable indications for TOPCon modules are being reported at $0.10 per watt Free-on-Board (FOB) China. As the market struggles with low demand, these new record low prices highlight the ongoing challenges faced by Chinese solar module makers.

What's happening in the solar photovoltaic industry?

On-Demand Webinar This in-depth webinar explores the dynamic transformations occurring within the global solar photovoltaic (PV) industry. As geopolitical factors, trade policies, and manufacturing strategies evolve, the landscape of solar PV production and distribution is undergoing significant change.

Update Information

- Latest Bangkok photovoltaic energy storage prices

- Latest photovoltaic module models and prices

- European Union Photovoltaic Power Generation Photovoltaic Panel Prices

- What to look for in photovoltaic panel prices

- Retail prices of photovoltaic panels in the Democratic Republic of Congo

- Future trend of photovoltaic panel prices

- Prices of photovoltaic modules in Cote d Ivoire

- Prices of photovoltaic panels in Shanghai

- Latest News on Photovoltaic Energy Storage

- Photovoltaic inverter bifacial component matching

- Latest solar energy prices on site

- Photovoltaic panel specifications and prices

- The best photovoltaic panel prices at the moment

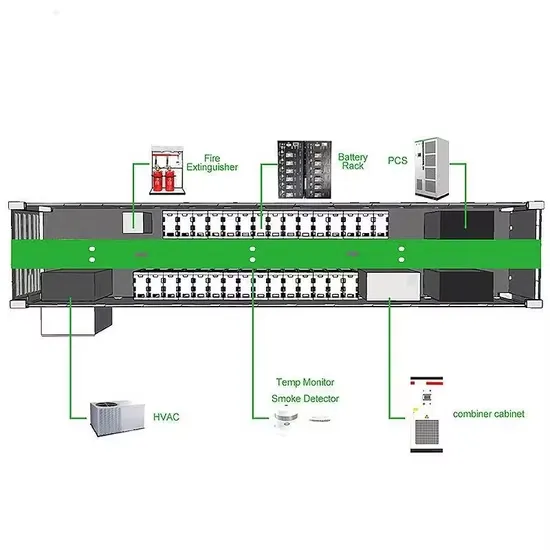

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

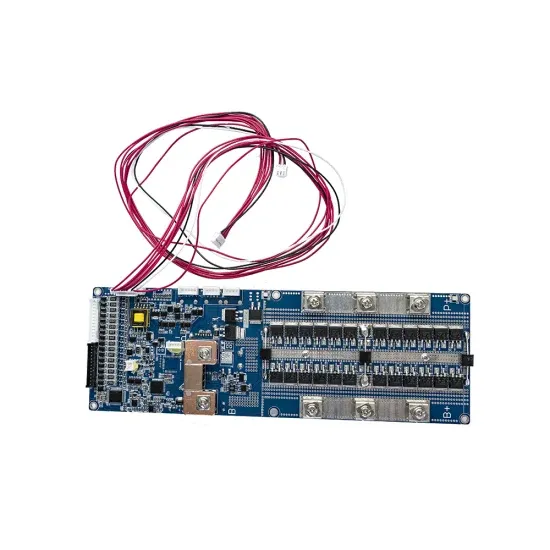

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.