Statement: European Parliament agrees on the EU Solar

Mar 12, 2024 · As the grid catches up to the energy transition, installing energy generation where we use energy will also help the grid, by keeping electricity local and empowering citizens with

Photovoltaic remuneration policies in the European Union

Apr 1, 2013 · The program most often used to encourage PV installations is FIT, a fixed-price contract for a specified period of time with procedural operating conditions. Recent experience

Evaluating solar photovoltaic power efficiency based on

Apr 1, 2023 · Due to the importance of the impact of solar PV generation in addressing climate change and achieving sustainable development, the vast majority of economies recognize the

Assessment of energy policies to promote photovoltaic generation

May 15, 2018 · Abstract Renewable energy is a focal point of discussion in the European Union, as clean production technologies contribute to all three aims of energy policy (security,

Europe: solar PPA price forecast by country| Statista

Jun 26, 2025 · It is forecast that the price for solar PV power purchase agreements between 2025 and 2034 in Europe will range from an average of roughly *** euros per megawatt hour in

Photovoltaic (PV) Solar Panel Energy Generation data

Jul 27, 2013 · Explore photovoltaic solar panel energy generation data on this platform, offering insights into renewable energy trends and statistics in Europe.

Guide to PV Europe: Costs, Considerations, and

Dec 29, 2024 · Explore the insights of PV Europe! Learn about solar benefits, costs, and factors before installation. Find out if solar energy is worth it in the EU.

5 things you should know about solar energy

Jun 20, 2025 · Solar energy is one of the world''s most abundant and easily accessible sources of renewable power. But how well do you know it? Several distinct technologies harness the

Energy decarbonisation in the European Union: Assessment

Jun 1, 2022 · This work considers the targets set by each of the EU-27 countries to implement, in particular, solar photovoltaic (PV) modules to cover their energy needs. Then, the future PV

Agrivoltaics alone could surpass EU photovoltaic

Oct 12, 2023 · Combining farming and solar photovoltaic electricity production – known as agrivoltaics - on a mere 1% of EU utilised agricultural area (UAA)

Cost Maps for Unsubsidised Photovoltaic Electricity

Jan 1, 2015 · Updated maps have been generated comparing the levelised cost of PV electricity with residential prices in European countries. The analysis assumes that full and free net

A high-resolution geospatial assessment of the rooftop solar

Oct 1, 2019 · To do this, it combines satellite-based and statistical data sources with machine learning to provide a reliable assessment of the technical potential for rooftop PV electricity

eu-market-outlook-for-solar-power-2024-2028

Dec 17, 2024 · The EU Market Outlook for Solar Power 2024-2028 is SolarPower Europe''s comprehensive annual report that outlines the current status and forecasts the trajectory of the

6 FAQs about [European Union Photovoltaic Power Generation Photovoltaic Panel Prices]

How much does solar PV cost in Europe?

The account requires an annual contract and will renew after one year to the regular list price. It is forecast that the price for solar PV power purchase agreements between 2025 and 2034 in Europe will range from an average of roughly 141 euros per megawatt hour in Sweden to 57 euros per megawatt hour in Italy.

Why is the PV market growing in the EU?

The PV market in the European Union (EU) has experienced remarkable growth, driven by the urgent need to transition to renewable energy and enhance energy security. Solar energy has emerged as a cornerstone of EU’s strategy to achieve its climate goals and reduce dependence on fossil fuel imports.

How will the EU solar market evolve in 2024-2025?

As the EU solar market evolves, trends in module shipments, inventory levels, and pricing are expected to influence its trajectory significantly. These factors underscore the delicate balance between fostering market expansion and addressing operational challenges, making 2024-2025 a critical period for the sector’s development.

How big is the EU PV market in 2024?

Trends in EU PV Installations (2024-2025) The EU PV market demonstrated steady yet modest growth in 2024, with an estimated 64 to 65 GWdc of new PV capacity installed – a slight increase of ~5% compared to the 61.9 GWdc installed in 2023, according to EUPD Research calculations.

Are PV electricity prices competitive?

Updated maps have been generated comparing the levelised cost of PV electricity with residential prices in European countries. The analysis assumes that full and free net metering but does not include any feed-in tariff or subsidy scheme. The results highlight the increasing competitiveness of PV.

How will the EU Impact PV installations in 2024?

In 2024, the EU set a new growth benchmark for PV installations, fueled by rising energy demand and increased investments in renewable infrastructure. Ambitious climate targets and supportive frameworks, such as national energy plans and EU-led incentives, have accelerated adoption.

Update Information

- Venezuela solar panel photovoltaic power generation prices

- European Union Photovoltaic Power Generation Cell Components

- EK SOLAR7v photovoltaic panel power generation

- 1w photovoltaic panel power generation per day

- 5kw photovoltaic panel power generation

- St George Photovoltaic Panel Power Generation Company

- Is the price of photovoltaic panel power generation a function of temperature difference

- The brand with the highest photovoltaic panel power generation

- 15v photovoltaic panel power generation

- Huawei EK SOLAR solar photovoltaic panel power generation

- Photovoltaic panel power generation rate under direct sunlight

- Liechtenstein solar panel accessories photovoltaic power generation installation

- Africa 1kw photovoltaic panel power generation in the first year

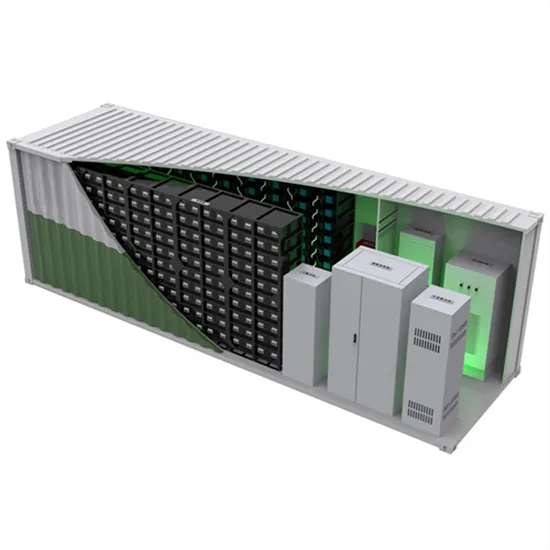

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.