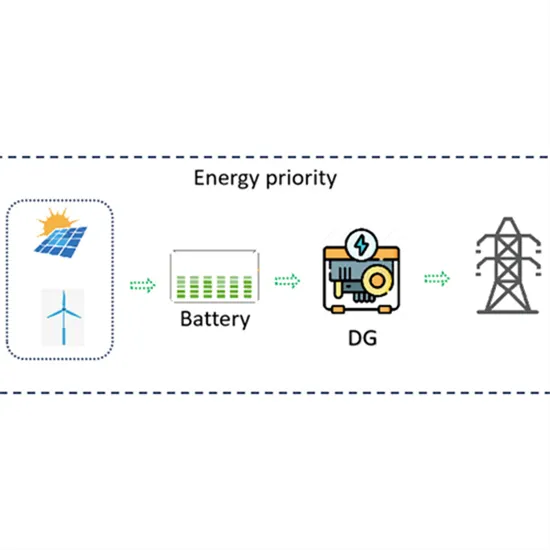

Integration of energy storage system and renewable energy

Aug 1, 2021 · First, we introduce the different types of energy storage technologies and applications, e.g. for utility-based power generation, transportation, heating, and cooling.

Powering Ahead: 2024 Projections for Growth in the European Energy

Feb 20, 2024 · With over 10 ways for Energy Storage Systems (ESS) to generate revenue, ranging from the high-value FM service market and standby market to the lower-value energy

Minimization of total costs for distribution systems with

May 17, 2025 · In this work, the optimal integration for distributed generation units, including photovoltaic farms, wind turbine farms, and battery energy storage systems in IEEE 123-bus

How is the profit of energy storage battery industry?

Feb 15, 2024 · Furthermore, regulatory support and diverse revenue mechanisms fortify the financial sustainability of energy storage solutions. With the electrification of transport and a

Gross profit of energy storage system integration

The framework for categorizing BESS integrations in this section is illustrated in Fig. 6 and the applications of energy storage integration are summarized in Table 2, including standalone

Gross profit margin of energy storage system integration

By interacting with our online customer service, you''ll gain a deep understanding of the various Gross profit margin of energy storage system integration companies featured in our extensive

Integration of energy storage systems | Energy Storage for Power Systems

Jul 3, 2024 · The main objectives of introducing energy storage to a power utility are to improve the system load factor, achieve peak shaving, provide system reserve and effectively minimise

Energy Storage Sector Profit Margin: Riding the

Sep 10, 2024 · 1. The "Lithium Limbo" – How Low Can Prices Go? 2024''s lithium price crash created a golden window for storage manufacturers. CATL cleverly rode this wave, boosting

LG Home Energy Storage Gross Profit: The Backbone of

1. The $33 Billion Elephant in the Room: Energy Storage''s Profit Potential The global energy storage market, valued at $33 billion [1], isn''t just about Tesla Powerwalls anymore. LG''s

Trina Solar Reports Strong Q1 Gross Margin and Promising

May 27, 2025 · In 2024, energy storage revenues reached 2.335 billion yuan (up 19.1% year-on-year), with system shipments of 4.3 GWh (up 115%) and a gross margin of 12.95% (down 3.07

Profit maximization for large-scale energy storage systems

Nov 15, 2022 · Large-scale integration of battery energy storage systems (BESS) in distribution networks has the potential to enhance the utilization of photovoltaic

C&I Energy Storage Market Trends | Size Report [2034]

Aug 19, 2025 · Global C&I Energy Storage Market size is estimated at USD 6.81 billion in 2025, set to expand to USD 27.15 billion by 2034, growing at a CAGR of 16.61%.

Analysis of energy storage companies with promising

In China, generation-side and grid-side energy storage dominate, making up 97% of newly deployed energy storage capacity in 2023. 2023 was a breakthrough year for industrial and

Energy Storage System Integration Market Research Report

According to our latest research, the global Energy Storage System Integration market size reached USD 23.7 billion in 2024, reflecting the sector''s robust expansion in response to the

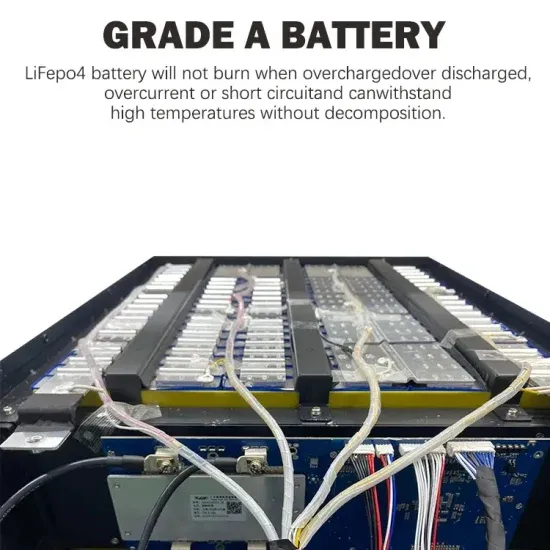

White paper BATTERY ENERGY STORAGE SYSTEMS

Jun 24, 2024 · The majority of newly installed large-scale electricity storage systems in recent years utilise lithium-ion chemistries for increased grid resiliency and sustainability. The

Profits of the Energy Storage Industry: A Rollercoaster Ride

Why the Energy Storage Sector Feels Like a Financial Gymnasium Let''s face it – 2024 has been the year when energy storage profits decided to play extreme sports. While the global energy

Profit of Energy Storage Industry: A Rollercoaster Ride in

Oct 22, 2022 · Why the Energy Storage Market Feels Like a High-Stakes Poker Game If 2024 were a poker tournament, the energy storage industry would be the table where players keep

Energy storage system integrator profit

The global Battery Energy Storage Systems (BESS) integrator market has grown increasingly competitive in 2022, with the top five global system integrators accounting for 62% of overall

LG Home Energy Storage Gross Profit: The Backbone of

Ever wondered how a battery can boost both your home''s energy resilience and a company''s bottom line? Let''s crack open LG''s playbook on energy storage profits—where kilowatt-hours

Profit analysis of battery energy storage

Grid-connected battery energy storage system: a review on application and integration. Two-level profit-maximizing strategy, state invariant strategy for SOC control: 5: 0: 5: 5 [132] cost

Unlocking Energy Storage: Revenue Streams and Regulations

Nov 4, 2024 · The global energy storage market is experiencing rapid growth, driven by the increased demand for renewable energy integration and grid stabilisation. By 2030, the global

Profits of energy storage system

While existing literature focuses on how strategic storage operation by a profit-seeking firm can increase profits by increasing energy prices [19], [22], [23], our system-wide approach reveals

Energy storage system gross profit ihs

What happens if energy storage fails to be integrated? If energy storage fails to be integrated across the energy system,clean energy goals will not be met. The global energy storage

Battery Energy Storage Market revenue to hit USD 212.8

Dec 5, 2023 · Battery energy storage systems contribute to reduced greenhouse gas emissions by enabling greater integration of renewable energy sources and reducing the need for fossil

Ensuring Profitability of Energy Storage

May 4, 2016 · This method aims to simultaneously reduce the system-wide operating cost and the cost of investments in ES while ensuring that merchant storage devices collect sufficient profits

Global Energy Storage System Integrator Market Insights,

Apr 10, 2024 · At present, pumped storage accounts for 94% of the energy storage market in Europe, with Spain and Germany having the largest capacity. According to BNEF data,

Energy storage gross profit

The gross profit margin of energy storage is a critical determinant of financial health in the sector, revealing the potential profitability of energy storage operations. 1. The average gross profit

Optimal integration of energy storage in distribution networks

Jun 28, 2009 · Energy storage, traditionally well established in the form of large scale pumped-hydro systems, is finding increased attraction in medium and smaller scale systems. Such

Profitability of lithium battery energy storage

Aug 18, 2025 · So, what is the profit margin of lithium battery energy storage products? We might as well analyze the real profits of lithium battery energy

6 FAQs about [Gross profit of energy storage system integration]

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Is energy storage a'renewable integration' or 'generation firming'?

The literature on energy storage frequently includes “renewable integration” or “generation firming” as applications for storage (Eyer and Corey, 2010; Zafirakis et al., 2013; Pellow et al., 2020).

Does storage capacity improve investment conditions?

Recent deployments of storage capacity confirm the trend for improved investment conditions (U.S. Department of Energy, 2020). For instance, the Imperial Irrigation District in El Centro, California, installed 30 MW of battery storage for Frequency containment, Schedule flexibility, and Black start energy in 2017.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

Update Information

- Profit model of peak energy storage power station

- Niue Energy Storage Integration Project

- Nigeria Energy Storage System Integration

- Lithium battery energy storage integration

- Photovoltaic energy storage and solar energy storage integration

- Photovoltaic energy storage profit point

- Lithium-ion electronic energy storage system integration

- Brazzaville Industrial Energy Storage Peak Shaving and Valley Filling Profit Model

- Profit model of Laayoune grid-side energy storage power station

- Energy storage lithium battery profit

- Profit from selling energy storage cabinets

- How much profit do energy storage projects usually make

- Khartoum container energy storage manufacturer

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.