Economic benefit evaluation model of distributed energy storage

Jan 5, 2023 · Firstly, based on the four-quadrant operation characteristics of the energy storage converter, the control methods and revenue models of distributed energy storage system to

Energy storage peak and valley profit

What are the benefits of energy storage power stations? Energy storage stations have different benefits in different scenarios. In scenario 1, energy storage stations achieve profits through

Optimal scheduling strategies for electrochemical

Oct 1, 2024 · This paper constructs a revenue model for an independent electrochemical energy storage (EES) power station with the aim of analyzing its full life-cycle economic benefits under

Several profit models of energy storage stations

The CES business model allows multiple renewable power plants to share energy storage resources located in different places based on the transportability of the power grid. the

Energy storage peak and valley profit

Energy storage stations have different benefits in different scenarios. In scenario 1, energy storage stations achieve profits through peak shaving and frequency modulation, auxiliary

The profit model of independent energy storage power stations

These facilities play a crucial role in modern power grids by storing electrical energy for later use. The guide covers the construction, operation, management, and functionalities of these power

6 Emerging Revenue Models for BESS: A 2025 Profitability

Mar 31, 2025 · From "peak-valley arbitrage" to "carbon credit monetization," the profit models of commercial and industrial energy storage are becoming increasingly diversified. These new

How is the profit of Shandong energy storage power station?

Sep 24, 2024 · The Shandong energy storage power station, leveraging advanced technologies, maximizes revenue generation through energy arbitrage, peak shaving, and ancillary

The profit model of independent energy storage power stations

This article provides a comprehensive guide on battery storage power station (also known as energy storage power stations). These facilities play a crucial role in modern power grids by

How is the profit of Hunan energy storage power station?

Feb 20, 2024 · To maximize profits, energy storage operators strategically strategize when to discharge energy onto the grid. When prices are low, storage facilities charge up by absorbing

Study on profit model and operation strategy optimization of energy

Sep 25, 2023 · With the acceleration of China''s energy structure transformation, energy storage, as a new form of operation, plays a key role in improving power quality, absor

How is the profit model of energy storage power station

Jan 27, 2024 · 1. The profit model of energy storage power stations operates primarily through: 1) frequency regulation, 2) capacity arbitrage, 3) ancillary market services, and 4) participation in

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Profit model of industrial park energy storage power station

Configuration optimization and benefit allocation model of multi-park The goal of "carbon peak and carbon neutrality" has accelerated the pace of developing a new power system based on

summary of the analysis report on the profit model of energy storage

This paper studies the optimal operation strategy of energy storage power station participating in the power market, and analyzes the feasibility of energy storage

Configuration optimization and benefit allocation model of

Feb 15, 2022 · Configuration optimization and benefit allocation model of multi-park integrated energy systems considering electric vehicle charging station to assist services of shared

Profit model and application prospects of energy

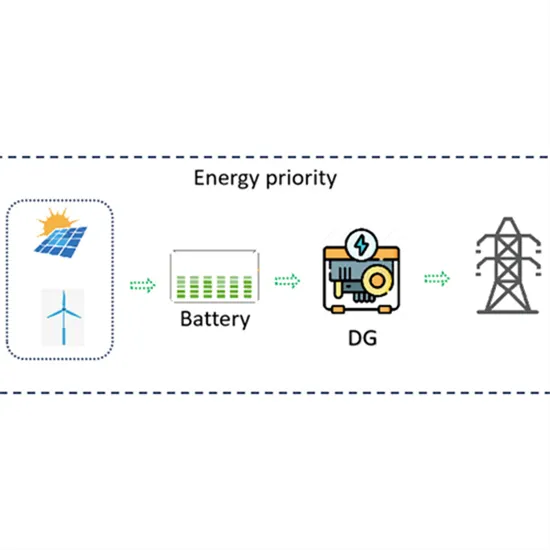

The upper-layer energy management strategy based on the energy storage power station can achieve the complementary power generation of wind and solar power, thereby achieving the

How is the profit of Henan energy storage power station?

Aug 26, 2024 · The profit of Henan energy storage power station is influenced by several critical factors. 1. Revenue generation stems primarily from energy arbitrage, where energy is

Bidding model of pumped-storage power plants

Jul 31, 2024 · This paper first introduces the current situation of pumped storage power plants (PSPP) participating in the electricity markets. Then, the bidding models for PSPP in the

Profit model of overseas energy storage power stations

Therefore, this article analyzes three common profit models that are identified when EES participates in peak-valley arbitrage, peak-shaving, and demand response. On

Photovoltaic energy storage power station profit model 1

2 Profit model of energy storage power station According to statistics, there are 73 electrochemical energy storage projects put into operation from January to April 2023, with an

How about profit sharing of energy storage power station

Oct 2, 2024 · 1. REVENUE GENERATION MECHANISMS Energy storage power stations operate on several diverse revenue generation mechanisms essential for their economic viability.

Energy storage station profit

Keywords: electricity spot market, electrochemical energy storage, profit model, energy arbitrage, economic end of life. Citation: Li Y, Zhang S, Yang L, Gong Q, Li X and Fan B (2024) Optimal

6 Emerging Revenue Models for BESS: A 2025 Profitability

Mar 31, 2025 · Explore 6 practical revenue streams for C&I BESS, including peak shaving, demand response, and carbon credit strategies. Optimize your energy storage ROI now.

Capacity configuration of a hybrid energy storage system for

The evaluated annual revenue model for energy storage stations includes: Mode 1: a profit model of participating in the electricity market as an independent energy storage with 100 % capacity;

Capacity investment decisions of energy storage power stations

Sep 12, 2023 · Design/methodology/approach Based on the research framework of time-of-use pricing, this paper constructs a profit-maximizing electricity price and capacity investment

How much profit does an energy storage power station have?

Oct 8, 2024 · Energy storage power stations derive profit from several key revenue streams, which reinforce their financial sustainability. These streams largely depend on the operational

Profit model and application prospects of energy

In December 2021, the Haiyang 101 MW/202MWh energy storage power station project putted into operation, and energy storage participated in the market model of peak regulation

Hierarchical game optimization of independent shared energy storage

Apr 15, 2025 · The numerical results demonstrate that the proposed penalty mechanism increases the independent shared energy storage operator''s revenue by 35.6 %, while the

Operation strategy and capacity configuration of digital

Aug 15, 2024 · Sensitivity analysis was conducted to assess the impact of variations in both the rated power and maximum continuous energy storage duration of the BESS. Base on the

Competitive model of pumped storage power plants

Aug 1, 2021 · The calculation example analysis shows that compared with the traditional model, the "three-stage" model can bring better benefits to the pumped storage power station, and

6 FAQs about [Profit model of peak energy storage power station]

What is a profit model for energy storage?

Operational Models: From "peak-valley arbitrage" to "carbon credit monetization," the profit models of commercial and industrial energy storage are becoming increasingly diversified. These new models not only provide investors and users with more choices and opportunities but also drive the continuous development of energy storage technology.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

What is a power storage facility?

In the first three applications (i.e., provide frequency containment, short-/long-term frequency restoration, and voltage control), a storage facility would provide either power supply or power demand for certain periods of time to support the stable operation of the power grid.

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

Update Information

- Profit model of grid-side energy storage power station

- Practical operation of the profit model of energy storage power station

- Profit model of Laayoune grid-side energy storage power station

- Brazzaville Industrial Energy Storage Peak Shaving and Valley Filling Profit Model

- Energy storage peak load regulation power station investment

- Peak shaving energy storage power station type

- Wind power storage power station profit model

- Price structure of energy storage power station

- Maseru Energy Storage Power Station

- South African Energy Storage Power Station Manufacturing Plant

- Tunisia Industrial-grade Photovoltaic Energy Storage Power Station

- Vatican Distributed Photovoltaic Energy Storage Power Station

- Guatemala energy storage power station connected to the grid

Solar Storage Container Market Growth

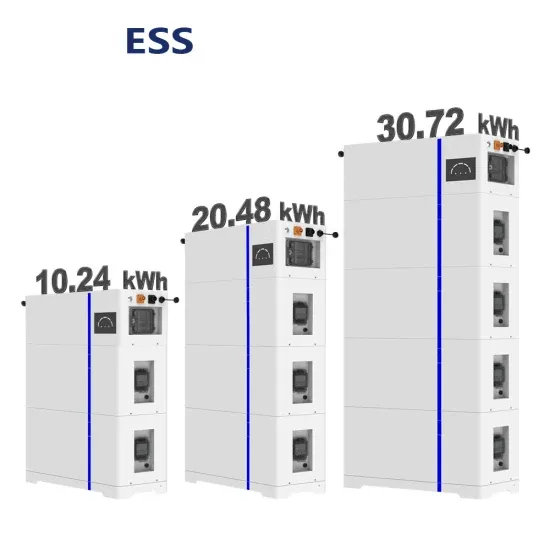

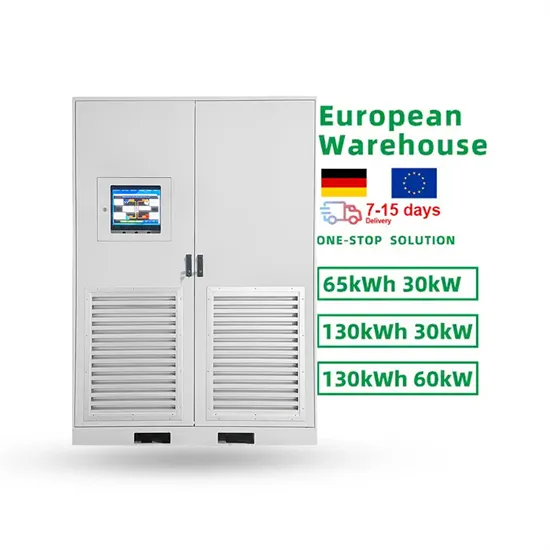

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.