An introduction: Revenue streams for battery storage

Sep 16, 2020 · In comparison, make-whole revenue requirements can range from £60/kW-year to £85/kW-year for 30-minute batteries, with substantial cost savings projected in coming years.

How much profit does an energy storage power station make?

May 31, 2024 · 1. Profit generation for an energy storage power station can vary significantly based on multiple factors, including geographical location, market conditions, technology used,

How much profit does energy storage project construction make?

Jun 15, 2024 · Based on the intricate dynamics of the energy storage sector, 1. profitability significantly varies depending on project scale and region, 2. market demand and technology

Battery Energy Storage Key Drivers of Growth

Dec 1, 2022 · Today, much of the revenue for batteries comes from ancillary services but the need for these services is limited, so optimisers and their technology must be capable of

How much profit does energy storage bring? | NenPower

Feb 17, 2024 · The technology behind energy storage encompasses several variants, including lithium-ion batteries, pumped hydro storage, and compressed air energy storage. Each type

How much profit does energy storage power generation have?

Jul 18, 2024 · 1. Profits from energy storage power generation can be substantial, ranging from 15% to 50% internal rate of return (IRR), 2. Factors influencing profitability

How about profit sharing of energy storage power station

Oct 2, 2024 · The profit sharing of energy storage power stations can be examined through several key aspects: 1. Revenue Generation Mechanisms, 2. Stakeholder Involvement, 3

How to generate revenue from battery storage in 2021

Oct 19, 2023 · Low carbon generators, such as solar and wind, are increasingly forming part of the energy mix. So too are interconnectors, which enable renewable energy to flow between

What Investors Want to Know: Project-Financed Battery Energy Storage

Jun 20, 2023 · Battery energy storage systems (BESS) store electricity and flexibly dispatch it on the grid. They can stack revenue streams offering arbitrage, capacity and ancillary services

How much is the actual profit of energy storage power station?

Feb 12, 2024 · Such regulatory evolution will potentially unlock new revenue streams and profit models for savvy energy storage entrepreneurs, positioning them at the forefront of future

How much profit does energy storage power supply have

Jun 4, 2024 · Understanding the mechanics of energy storage requires familiarity with various technologies deployed in this domain, including lithium-ion batteries, pumped hydro storage,

How is Energy Storage Profitable? Unlocking the Billion

Nov 19, 2023 · In 2023, the global market hit $50 billion, and experts predict it''ll double by 2030. So, how do companies turn giant batteries into cash machines? Grab your hard hats – we''re

In-depth explainer on energy storage revenue and effects

Apr 17, 2025 · Energy storage business salary typically ranges between $50K and $150K per year, varying by scale, location, and specialization. Keep reading to understand how factors

How much profit can be gained from exporting energy storage

Jan 21, 2024 · Exporting energy storage equipment presents a lucrative opportunity, driven by the increasing global demand for sustainable energy solutions. 1. Potential profit margins vary

How much profit does an energy storage foreign trade company make

Aug 23, 2024 · 1. Profit margins for an energy storage foreign trade company generally range between 10% and 30%, influenced by various market factors. 2. This sector shows high

How much profit does an energy storage power station have?

Oct 8, 2024 · 1. An energy storage power station typically generates profit through various avenues, which can vary widely based on market conditions, location, and size. 2.

How much profit does energy storage power generation have?

Jul 18, 2024 · The profitability of energy storage power generation can be influenced by several actors and factors. To thoroughly analyze how much profit these systems can generate,

Strategic energy storage investments: A case study of the

Nov 1, 2022 · Energy storage can provide a range of revenue streams for investors in electricity markets. However, as their deployments continue to rise, storage wi

Profit Analysis in the Energy Storage Sector: Trends,

Apr 17, 2022 · While global installations grew 45% year-over-year in 2024, 80% of companies saw profits shrink faster than ice cream melts in Texas summer [2] [5]. The sector''s caught

How much is the net profit of the energy storage plant?

Feb 10, 2024 · The net profit of an energy storage plant depends on several factors, including operational efficiency, capacity, market demand for energy, regulatory incentives, and the

How much profit can energy storage cabinet export make?

Aug 24, 2024 · These cabinets not only store excess energy generated from renewable sources but also ensure a consistent energy supply when demand fluctuates. The potential for profit in

How much profit can 2Gwh of energy storage bring?

Aug 22, 2024 · The profitability stemming from 2GWh energy storage can be quite significant, encompassing several critical factors. 1. Revenue generation from ancillary services, such as

6 FAQs about [How much profit do energy storage projects usually make ]

What is the 'value stack' in energy storage?

Owners of batteries, including storage facilities that are co-located with solar or wind projects, derive revenue under multiple contracts and generate multiple layers of revenue or 'value stack.' Developers then seek financing based on anticipated cash flows from all or a portion of the components of this value stack.

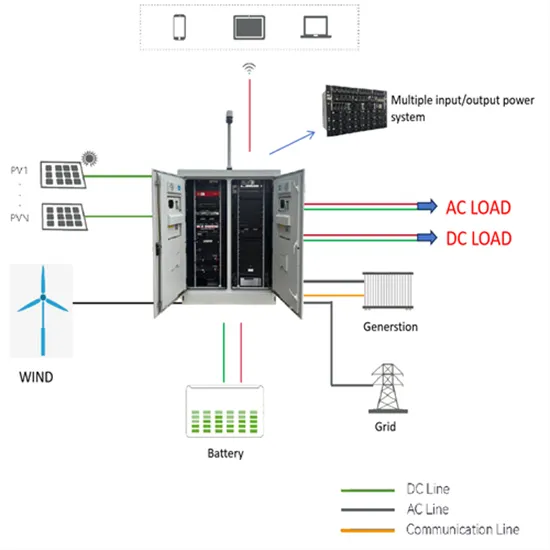

What is a battery energy storage project?

A battery energy storage project is a system that serves a variety of purposes for utilities and other consumers of electricity, including backup power, frequency regulation, and balancing electricity supply with demand.

How do solar and wind projects generate revenue?

In many locations, owners of batteries co-located with solar or wind projects derive revenue under multiple contracts and generate multiple layers of revenue or “value stack.” Developers then seek financing based on anticipated cash flows from all or a portion of the components of this value stack.

What is the source of revenue for many power projects?

For many power projects, a single power purchase agreement provides the source of all revenue for the project. Fixed-price contracts allow a project to generate a relatively predictable and stable amount of revenue, subject to the project meeting technical operating assumptions.

Should a storage project be paired with a solar or wind power project?

Pairing a storage project with a solar or wind power generation project can be beneficial. It allows projects to charge the storage system rather than deliver power to the grid when market prices for electricity are low (or negative) or when electricity would otherwise be curtailed.

Can energy storage projects sell ancillary services?

In many regions, energy storage projects may be able to sell “ancillary services” in addition to energy or capacity either to transmission owners or to regional grid operators. For example, Swinerton’s Mira Loma, California, energy storage project.

Update Information

- How much does an energy storage container usually cost

- How many companies in Suriname make energy storage batteries

- How much does high-tech home energy storage usually cost

- How many volts are small energy storage batteries usually

- How much does the Majuro energy storage system usually cost

- How much space does the liquid-cooled energy storage cabinet have

- Lilongwe and its energy storage projects include

- How much does energy storage equipment cost in Hamburg Germany

- How much does the Turkish energy storage equipment box cost

- How much does a square meter of container energy storage cost in Minsk

- How much does a 300 kWh energy storage battery cost

- How is China s energy storage container solar energy

- How much is the cost of energy storage operation and maintenance calculated

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.