Middle East Battery Energy Storage Systems Market Size and

Aug 7, 2025 · In Middle East Battery Energy Storage Systems Market is projected to grow from USD 3.1 billion in 2025 to USD 9.8 billion by 2031, at a CAGR of 21.5%

Energy Storage Outlook

May 25, 2025 · Global installed energy storage is on a steep upward trajectory. From just under 0.5 terawatts (TW) in 2024, total capacity is expected to rise ninefold to over 4 TW by 2040,

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Feb 4, 2022 · The pace of integration of energy storage systems in MENA is driven by three main factors: 1) the technical need associated with the accelerated deployment of renewables, 2)

Sungrow signs contract for world''s largest energy storage

Jul 16, 2024 · On July 15, Sungrow and Saudi Arabia''s AlGihaz successfully signed the world''s largest energy storage project with a capacity of up to 7.8GWh! The project is located in three

Saudi Arabia: PV + Storage''s next destination for overseas

Sep 29, 2024 · The Middle East has unique solar resource conditions.Under the development of global energy transformation, the demand for solar photovoltaics and energy storage

The Future of Battery Market in the Middle East & Africa

Jun 24, 2025 · From megaprojects to microgrids, the battery revolution is gaining serious ground across the Middle East and Africa. No longer just a supporting technology, battery storage is

Middle East: Energy Transition Unlocks Huge Market

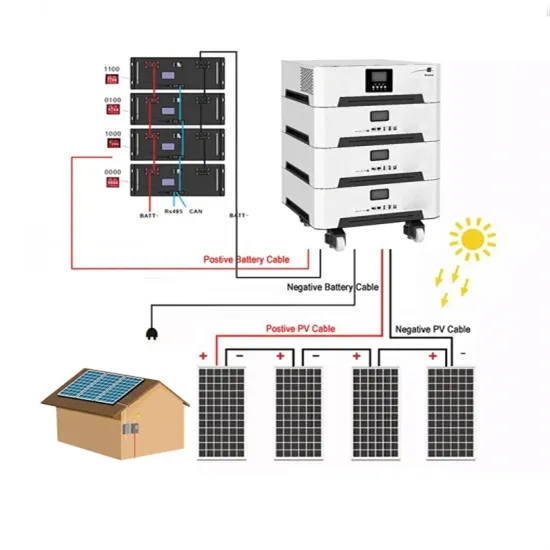

Dec 6, 2024 · SmartPropel Energy exports 10KWH rack-mounted lithium iron phosphate energy storage battery to Saudi Arabia. MENA national policies help transform the energy structure

Storage Projects in MENA Region | Synergy Consulting

The Middle East''s largest solar-plus storage project, Philadelphia Solar, reached financial close on a 12MWh lithium-ion battery based energy storage project in Jordan in 2018.

Battery Storage in the Middle East: Powering the Energy Shift

Jul 16, 2025 · According to The Future of Battery Market in the Middle East & Africa, Saudi Arabia plans to expand its battery storage capacity from 22 GWh to 48 GWh by 2030. The Saudi

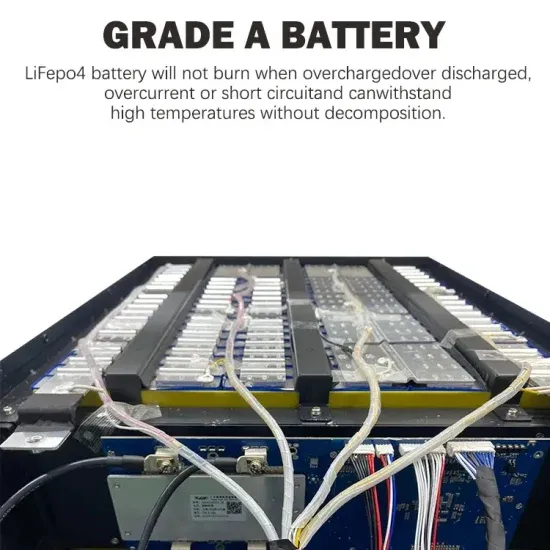

Saudi Arabia and UAE Drive Battery Market Expansion as LFP

Jul 15, 2025 · Saudi Arabia and the UAE are reshaping the region''s energy landscape, with Lithium Iron Phosphate (LFP) batteries emerging as a crucial enabler in the shift toward

Powering the Future: Energy Storage Solutions

Oct 14, 2023 · The horizon of energy storage in the Middle East is radiant with possibilities. Innovations in long-duration energy storage solutions, like those

Middle East Energy | Product Sector | Battery & Energy Storage

Aug 18, 2025 · With $19 billion in planned investments and over 8.5 GWh of battery storage capacity in development across the region, this sector offers unparalleled networking

First large-scale energy storage project advances

Feb 24, 2025 · It is set to be the first energy storage project of its kind in the Middle East based on CO2 battery energy storage technology. A site has been identified for the establishment for

How about energy storage batteries in the Middle East?

Jun 30, 2024 · Energy storage batteries in the Middle East present a compelling opportunity for transforming the region''s energy landscape. 1. Lithium-ion batteries are prevalent,

Implementation of large-scale Li-ion battery energy storage

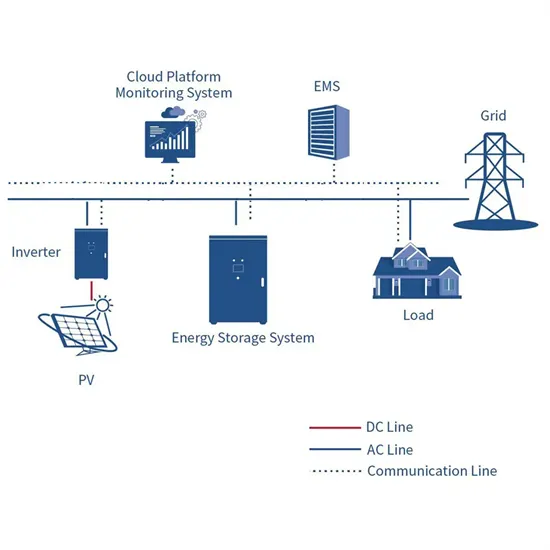

Feb 15, 2020 · Large-scale Lithium-ion Battery Energy Storage Systems (BESS) are gradually playing a very relevant role within electric networks in Europe, the Middle East and Africa

Energy Series Advancing Energy Storage in the MENA

Dec 11, 2024 · To date, the most popular way to store excess energy has been pumped storage hydropower plants, but battery energy storage systems (BESS) and thermal storage in the

Saudi Electricity Company Awards Multiple Contracts For

Jan 9, 2025 · Saudi Electricity Company (SEC) has taken a significant step in modernising the Kingdom''s energy infrastructure with the awarding of contracts for a large-scale Battery

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Feb 4, 2022 · Within the spectrum of energy storage technologies, the ranges of applications and captured revenue streams difer depending on the selected site, power system requirements,

Why battery storage investment is vital to the

Sep 28, 2023 · Investing in battery storage is crucial for a successful energy transition in the Middle East, as it enables the realisation of the full benefits of

Middle East and Africa Battery Energy Storage Systems

Aug 7, 2025 · In Middle East and Africa Battery Energy Storage Systems Market is projected to grow from USD 3.1 billion in 2025 to USD 9.8 billion by 2031, at a CAGR of 21.5%

Global energy storage market: review and outlook

Jan 24, 2025 · The global energy storage market added 175.4 GWh of installed capacity in 2024, with the three major regional markets—China, the Americas, and Europe—continuing to

6 FAQs about [Middle East large capacity energy storage battery]

Which is the largest energy storage project in the Middle East?

This facility stands as one of the largest energy storage projects in the Middle East and Africa. The Bisha BESS, owned by Saudi Electric Company , comprises 122 prefabricated storage units designed and supplied by China’s BYD.

Which country has the most battery storage capacity in MENA?

Currently, NaS battery technology dominates the battery storage capacity in operation in MENA, particularly in the UAE, with a total of 108 MW/648 MWh projects developed by the Abu Dhabi Water and Electricity Authority (ADWEA).

How many GWh of energy storage will Saudi Arabia have by 2025?

Projections indicate that Saudi Arabia aims to operate 8 GWh of energy storage projects by 2025 and 22 GWh by 2026, positioning the nation as the third-largest global market for energy storage, following China and the United States.

Which energy storage technology has the most installed capacity in MENA?

Pumped hydro storage (PHS) has the largest share of installed capacity in MENA at 55%, as compared to a global share of 90%. Pumped hydro storage is one of the oldest energy storage technologies, which explains its dominance in the global ESS market.

Why is Saudi Arabia investing in lithium?

This surge in energy storage capacity is complemented by Saudi Arabia’s strategic investments in the lithium supply chain, a critical component for battery production. Saudi Aramco, in partnership with state-owned mining company Ma’aden, plans to commence commercial lithium production by 2027.

Can energy storage be integrated in MENA?

Although the energy storage market in MENA is bound to grow, several barriers exist that hinder the integration of ESS and the ramping up of investments. Financial, regulatory, and market barriers need to be addressed via policy tools that lay the foundations for an evolved power market to integrate the deployed ESS.

Update Information

- Singapore large capacity energy storage battery customization

- Large capacity energy storage lead-carbon battery

- Middle East lithium battery portable energy storage manufacturer

- American large capacity energy storage battery manufacturer

- Middle East energy storage lithium battery manufacturer

- How much does a large energy storage cabinet cost in the Middle East

- Cameroon large capacity energy storage battery customization

- Large capacity energy storage battery in Cebu Philippines

- South African large capacity energy storage battery manufacturer

- Super large battery energy storage

- Battery capacity of general energy storage cabinet

- East African energy storage battery manufacturing company

- East Africa Energy Storage Battery Project

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.