Associated Battery Manufacturers East Africa

ABM (Associated Battery Manufacturers) is a leading manufacturer in East and Central Africa, specializing in the production of storage batteries, including automotive lead-acid batteries,

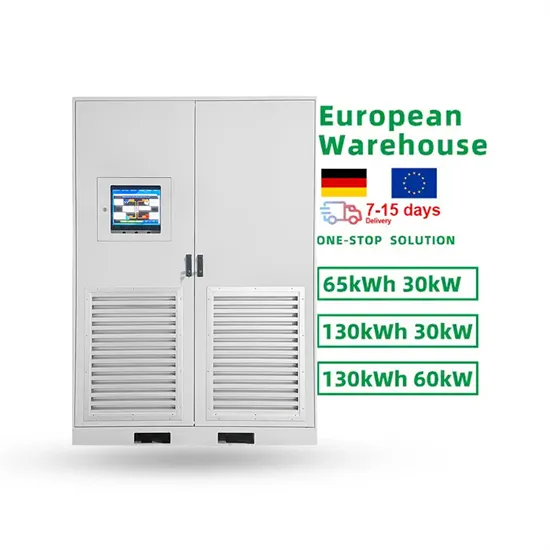

African Energy Storage Systems from Londian manufacture

Aug 1, 2025 · Londian is an innovative energy technology company specializing in the design and manufacturing of tailored energy storage solutions for the rapidly growing markets of Asia,

Energy Storage Manufacturers in Africa

Several local and international companies are leading Africa''s energy storage revolution. Below are some of the key players: 1. SolarAfrica (South Africa) Specializes in solar-plus-storage

Challenges Facing the Battery Industry in Africa

Jun 25, 2022 · Africa enjoys about 12 hours of daylight on average, which means that, where off-grid solar energy systems are deployed, batteries are crucial

Africa Lead Acid Battery Market Size with Top Companies

Atlas Battery is a leading manufacturer of lead acid batteries for automotive and industrial applications. The company is recognized for its commitment to quality and innovation. Atlas

East Africa Battery Market 2025-2034 | Size,Share, Growth

Jul 28, 2025 · Increasing Demand for Energy Storage: The need for efficient energy storage systems to address power outages and fluctuations is driving the demand for batteries in East

East African power giant ventures into solar manufacturing

Kenya''s leading power producer, KenGen, is set to start manufacturing solar panels, inverters and batteries after receiving government approval. The company aims to diversify revenues,

5 African Startups Advancing Battery Recycling

Jan 17, 2025 · Africa generates 2.9 megatons of e-waste annually, with only 20% recycled globally. This includes lithium-ion batteries, which are costly to produce but can be recycled to

West african lithium battery energy storage battery

What is revov battery & how does it work in South Africa? offering second-life lithium iron phosphate (LiFePO4) batteries. These batteries are repurposed from electric vehicle (EV)

Middle East And Africa Battery Market

Major players in the Middle East and Africa battery market include C&D Technologies Inc., East Penn Manufacturing Co. Inc., Exide Industries Ltd, First National Battery Pty Ltd, Middle East

Lithium Battery Energy Storage | LondianESS Manufactured

Africa is undergoing an energy transformation, with lithium battery storage systems at its core. As of 2025, over 600 million Africans still lack reliable electricity access (IEA, 2025), creating an

East Africa Battery Companies

This report lists the top East Africa Battery companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research and identified these

Africa''s growing energy storage capacity is key to energy self

Mar 18, 2025 · Africa''s energy goals are closely tied to advancements in battery storage technology – not only in the generation of electricity but also in its efficient storage and

Top 10 Energy Storage Companies in Africa | PF Nexus

Jul 14, 2025 · Battery Energy Storage Systems (BESS) are highly versatile, with applications ranging from short-to-medium-term utility-scale grid support to behind-the-meter commercial

GSL ENERGY''s Experience in African Battery Energy Storage

5 days ago · GSL ENERGY''s Deployment of Energy Storage Batteries in Africa As a global leader in the energy storage manufacturing sector, GSL ENERGY has been deeply rooted in the

Top 3 Battery Manufacturers in Kenya in 2024

In Kenya, the demand for reliable energy storage solutions continues to rise with the proliferation of renewable energy systems, electric vehicles, and the need for uninterrupted power supply.

East Africa Battery Market 2025-2034 | Size,Share, Growth

Jul 28, 2025 · Market Overview The East Africa battery market has witnessed significant growth and evolution in recent years, driven by various factors such as increasing industrialization,

Middle East African Battery Market 2025-2034 | Size,Share,

Aug 19, 2025 · Conclusion The Middle East & African battery market is at a transformative moment—fueled by compelling energy transition goals, expanding electrification needs, and

Update Information

- East African Energy Storage Backup Power Company

- East Timor Manufacturing Energy Storage Container Company

- Caracas Energy Storage Battery Intelligent Manufacturing Company

- African new energy battery cabinet manufacturing company

- Energy storage battery manufacturing in Haiti

- Guyana battery energy storage box direct sales company

- Does the company s energy storage battery need to be replaced

- Harare Energy Storage Lithium Iron Phosphate Battery Company

- South African energy storage container customization company

- Czech lithium battery energy storage company

- Estonian energy storage battery customization company

- Battery Energy Storage Company in Saint Petersburg Russia

- Lithium battery grid-connected energy storage and off-grid energy storage company

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.