Cuba Photovoltaic Glass Curtain Wall Merging Sustainability

Why Cuba Needs Smart Solar Solutions Now Imagine a building that generates electricity while blocking tropical heat. That''s exactly what photovoltaic (PV) glass curtain walls offer to Cuba -

Cuban Government Set to Launch New Solar Park in Ciego

Mar 6, 2025 · The Cuban regime is preparing to unveil the Ciego Norte Photovoltaic Solar Park in Ciego de Ávila province, boasting a generation capacity of 21.87 me

Onyx Solar: the Most Awarded Photovoltaic Glass Company

Onyx Solar is the global leading manufacturer of photovoltaic glass for buildings. The company is based in Ávila, Spain, and has offices in the United States and China. Since 2009, we have

Cuba: The "Fine Print" of the Photovoltaic Solar

May 17, 2025 · The $1.5 billion Cuba is investing in importing equipment for its future photovoltaic parks should guarantee a stable energy supply—but it

NGA updates resource on glass properties for photovoltaic

Apr 1, 2025 · website maker The National Glass Association (NGA) has published an updated Glass Technical Paper (GTP), FB39-25 Glass Properties Pertaining to Photovoltaic

Photovoltaic solar parks in Cuba: a project based on science

Oct 15, 2024 · "There are 26 photovoltaic solar parks that are currently in different phases of construction in all the provinces, which means an enormous constructive effort for the

Our Mariel Solar Park is producing power for use across Cuba

Mar 20, 2025 · Cuba received donated equipment from China to install solar photovoltaic parks in several provinces, aiming to alleviate the energy crisis

cartera oportunidades en inglés 27-10-14

Dec 8, 2014 · Since sugarcane was introduced to Cuba, the sugar industry sector has always been the most important one for Cuban agro-industrial production. ZERUS S.A. is the

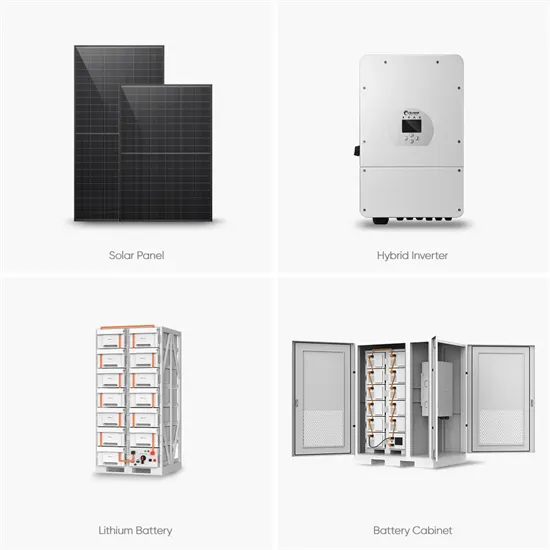

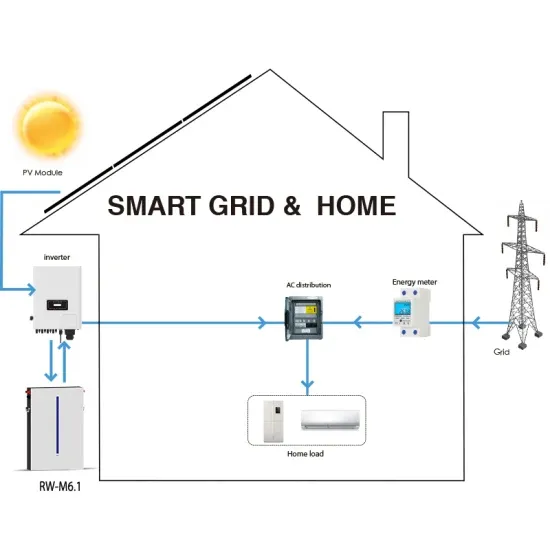

Cuban photovoltaic energy storage device company

From pv magazine LatAm. NTPC Ltd., an energy company under India''''s Ministry of Energy, has been selected by the ISA as a consultant to launch an auction in Cuba for 60 MW of PV

Top Ten Photovoltaic Glass Brands in China for 2024

Sep 16, 2024 · Southern Glass is a well-established brand in the glass industry, with a strong focus on photovoltaic glass production. The company''s products are known for their excellent

福莱特玻璃集团股份有限公司|太阳能光伏玻璃|浮法玻璃|工程

PV Glass Float Glass Architectural Glass Household Glass Solar Power Station VIEW MORE 1 专业的玻璃解决方案 Professional Glass Solution Available

POWER PLANT PROFILE NTPC CUBA SOLAR PV PARK CUBA

Can Cuba build a solar power plant? The loan should partly help finance four 10 MW solar power plants. Beyond that, the Cuban government has a long way to go if it is to build the planned

Update Information

- Southern Europe Double Glass Photovoltaic Module Company

- Kyrgyzstan Photovoltaic Glass Panel Company

- Morocco double glass photovoltaic curtain wall customization company

- Photovoltaic glass company

- Philippine Photovoltaic Glass Company

- Photovoltaic glass production company in Valparaiso Chile

- Photovoltaic glass edge rubbing

- Photovoltaic water pump inverter company

- Photovoltaic glass installation in Dominican sun room

- How many millimeters does photovoltaic glass use

- Top terrace photovoltaic glass sun room

- Mongolia photovoltaic glass enterprises

- Double-width polysilicon photovoltaic glass

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.