福莱特玻璃集团股份有限公司|太阳能光伏玻璃|浮法玻璃|工程

Feb 16, 2021 · 浮法玻璃 节能玻璃 家居玻璃 光伏电站 VIEW MORE 1 专业的玻璃解决方案 Professional Glass Solution Available

Top 10 Solar Powered Glass Manufacturers in

Oct 21, 2024 · This article will list out top 10 photovoltaic glass manufacturers in China to help further understand the development of these manufacturers in

Anhui Xinyi Photovoltaic Glass Co., Ltd.:Company Profile

Discovery Company profile page for Anhui Xinyi Photovoltaic Glass Co., Ltd. including technical research,competitor monitor,market trends,company profile& stock symbol

Top Ten Photovoltaic Glass Brands in China for 2024

Sep 16, 2024 · Southern Glass is a well-established brand in the glass industry, with a strong focus on photovoltaic glass production. The company''s products are known for their excellent

Top 10 Photovoltaic Glass (PV Glass) Supplier in

Apr 8, 2025 · The company is a prominent player in the photovoltaic glass market, offering ultra-clear rolled glass and TCO glass essential for solar energy

Top Ten Photovoltaic Glass Brands in China for 2024

As of August 19, 2024, the list of the top ten photovoltaic (PV) glass brands in China has been officially released. This ranking is based on professional evaluations that consider market

Solar Glass Manufacturers in India | Solar Panel

Feb 23, 2025 · Elevate your solar panels with our anti-reflective coated solar glass. Connect with leading solar glass manufacturers in India for detailed

Solar Photovoltaic Glass Companies, Top Industry

Jun 19, 2024 · Solar Photovoltaic Glass Companies: The research insight on solar photovoltaic glass market highlights the growth strategies of the companies. Know the future scenario,

Top 10 Photovoltaic Glass Brand & Manufacturers

Jul 22, 2025 · This section provides a list of the top 10 Photovoltaic Glass manufacturers, Website links, company profile, locations is provided for each company. Also provides a detailed

集团简介_关于福莱特_福莱特玻璃集团股份有限公司

公司于2015年11月在香港联交所上市,2019年2月在上海证券交易所主板上市,成为嘉兴市第一家A+H两地上市企业,目前公司光伏玻璃市占率约30%。福莱特

Top 10 Photovoltaic Glass (PV Glass) Supplier in

Apr 8, 2025 · Here is an overview of the top 10 photovoltaic glass suppliers in China for 2024. 1. XINYI SOLAR. Established: 2009. Location: Wuxi, China.

China Glass Manufacturers, OEM/ODM Glass Deep

Jiangsu Chunge Glass Co., Ltd is a professional OEM/ODM glass manufacturers and glass deep processing factory, We specialize in custom glass, involving photovoltaic solar cell glass, new

Global and China Photovoltaic Glass

May 21, 2019 · Abstract In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total.

福莱特玻璃集团股份有限公司|太阳能光伏玻璃|浮法玻璃|工程

PV Glass Float Glass Architectural Glass Household Glass Solar Power Station VIEW MORE 1 专业的玻璃解决方案 Professional Glass Solution Available

Top 10 Leading Solar Glass Manufacturers In

Nov 14, 2023 · As a leader in the glass industry, Sisecam has also established itself as a global player in producing automotive glasses, flat glass, glass fiber,

TOP 10 SOLAR PHOTOVOLTAIC GLASS MANUFACTURERS

We began our search for the best solar power stocks by compiling a list of 25 public companies that are major players in the solar industry. This included companies that have a business

6 FAQs about [Photovoltaic glass company]

Who makes solar Photovoltaic Glass?

As a leading solar photovoltaic glass manufacturer, it is a holding business for investments that produces and sells photovoltaic glass goods. IRICO Group is widely recognized as one of the world's top solar photovoltaic glass manufacturers. It was founded in 1984 and is currently headquartered in Beijing, China.

Who is the best solar photovoltaic glass manufacturer?

IRICO Group is widely recognized as one of the world's top solar photovoltaic glass manufacturers. It was founded in 1984 and is currently headquartered in Beijing, China. They offer innovative photovoltaic solar modules that can be used to manufacture solar cell panels. Flat Glass Group was set up in 1971.

What is Solar Photovoltaic Glass?

Photovoltaic solar cell glass, also known as solar photovoltaic glass or solar panel glass, is a special glass material used to manufacture solar photovoltaic cell modules. It has transparency and optical properties that allow light to pass through and be absorbed by solar cells to produce electricity.

What makes Acht a top Photovoltaic Glass manufacturer?

The company is a prominent player in the photovoltaic glass market, offering ultra-clear rolled glass and TCO glass essential for solar energy applications. ACHT’s advanced technology, R&D system, and extensive corporate culture have solidified its position as a top photovoltaic glass manufacturer.

Who is Luoyang Glass in top 10 Photovoltaic Glass Manufacturers?

Luoyang Glass in top 10 photovoltaic glass manufacturers belongs to the non-metallic mineral products industry, mainly engaged in the development, production and sales of new energy glass, functional glass photoelectric materials and their deep-processed products and components.

What is Photovoltaic Glass business?

The photovoltaic glass business is mainly engaged in the production and sales of photovoltaic glass. The wholly-owned subsidiary operates a 900t/d photovoltaic glass production line, with a designed annual output of about 39 million square meters of photovoltaic glass deep-processed products.

Update Information

- Southern Europe Double Glass Photovoltaic Module Company

- Kyrgyzstan Photovoltaic Glass Panel Company

- Photovoltaic glass production company in Valparaiso Chile

- Cuban photovoltaic glass company

- Philippine Photovoltaic Glass Company

- Photovoltaic glass substrate

- Brussels photovoltaic glass custom manufacturer

- Belarusian glass photovoltaic power generation

- Are there any photovoltaic glass manufacturers in Cape Verde

- How much is the price of single glass photovoltaic curtain wall in Cameroon

- Photovoltaic glass panel spherical

- Bulgarian thin film photovoltaic module glass

- Nanya Photovoltaic Glass R

Solar Storage Container Market Growth

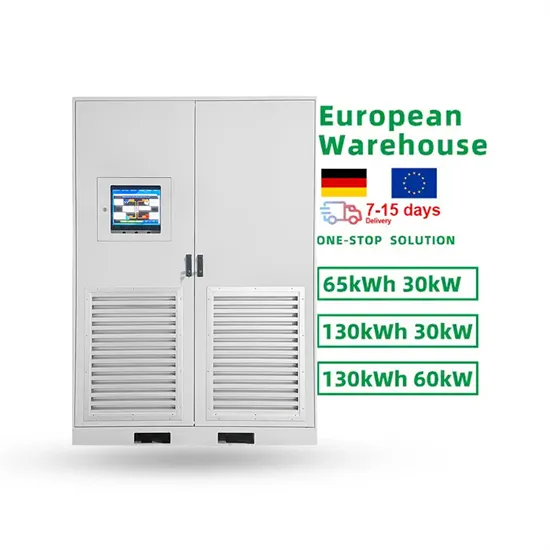

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.