European glass-glass PV modules particularly climate-friendly

Oct 1, 2021 · Electricity mix of countries has the greatest impact on the carbon footprint "If I want to install a photovoltaic system in a European location with average irradiation values, I have a

Solar glass buildings: Greatest achievable idea or

Apr 14, 2021 · How and what materials can include a photovoltaic cell? In reality, a transparent solar panel is essentially a counterintuitive idea because solar

EU''s Photovoltaic Modules Produce 40% Less Carbon – Report

Sep 24, 2021 · Glass-glass PV modules (b) do not require an aluminum frame and therefore have a lower carbon footprint than PV modules with backsheet (a). Although photovoltaic modules

Making solar a source of EU energy security

Aug 29, 2022 · A larger European PV manufacturing industry has the potential to provide lucrative employment and advance technological leadership. More importantly, in-house PV

Commission imposes provisional anti-dumping

Brussels, 4 June– The European Commission today announced a provisional tariff on imports of solar panels, cells and wafers from China. The measure comes following a nine-month

Meet the partners: PV glass recycling with MALTHA –

We completed our first task, the characterization of the glass after delamination. We are now scanning the demand and options of the market regarding PV panel glass. What does your

Europe Solar PV Glass Market Price, Share, Growth Insights

Europe solar pv glass market installed and glass consumed volume accounted for 842.3 million Sq. mts in 2024 and projected to grow at 1,500.6 millon Sq. mts in 2031 to reach CAGR 8.6%.

Europe Solar Photovoltaic Glass Market Size & Competitors

The Europe Solar Photovoltaic Glass Market is projected to witness market growth of 27.3% CAGR during the forecast period (2024-2031). The Germany market dominated the Europe

Ranking of EU Countries by Installed Solar PV

Feb 28, 2025 · The European Union (EU) is witnessing a significant expansion in solar photovoltaic (PV) energy as part of its renewable energy transition. By

AGC Glass Europe and photovoltaic recycling

Sep 24, 2024 · Saint Honoré, September 13, 2024 – AGC Glass Europe, part of the global AGC Group and a global leader in flat glass manufacturing, and

European Glass-Glass Photovoltaic Modules Are Particularly Climate

Sep 24, 2021 · In a new study, researchers at the Fraunhofer Institute for Solar Energy Systems ISE have calculated that silicon photovoltaic modules manufactured in the European Union

Europe BIPV Glass Market Size and Forecasts 2030

Apr 26, 2025 · The Europe Building-Integrated Photovoltaic (BIPV) Glass Market focuses on the integration of photovoltaic (PV) technology into building materials, particularly glass, enabling

Solar Photovoltaic Glass: Classification and

Jun 26, 2024 · Demand for solar photovoltaic glass has surged with the growing interest in green energy. This article explores ultra-thin, surface-coated, and

6 FAQs about [Does the EU have photovoltaic glass ]

Is glass for Europe a member of the European solar PV industry alliance?

website maker Glass for Europe is officially a member of the European Solar PV Industry Alliance, an initiative launched in December 2022 by the European Commission. The Alliance gathers key players in the value chain of the solar energy industry and aims at scaling up the production of solar PV panels and value chain components in Europe.

How can glass for Europe help re-build a European solar industry?

Glass for Europe represents almost 90 percent of flat glass production in the EU and its members can play a key role in re-building a European solar industry in the EU. The main goal of the European Solar PV Industry Alliance is to mobilise finance for European solar PV projects to increase the manufacturing capacity.

What is glass for Europe?

Glass for Europe is officially a member of the European Solar PV Industry Alliance, an initiative launched in December 2022 by the European Commission. The Alliance gathers key players in the value chain of the solar energy industry and aims at scaling up the production of solar PV panels and value chain components in Europe.

How does the EU support the European solar PV manufacturing sector?

Over the last years, the EU has taken initiatives to strengthen its support to the European solar PV manufacturing sector, which includes several globally competitive companies in several steps of the value chain.

How big is EU PV glass production?

Total EU PV glass production throughout the investigation period has been estimated at around 12 million square meters. The Chinese government initially participated in the first consultation phase of the review process, but later decided not to cooperate, the European Commission said.

Can a photovoltaic system be installed in a European location?

"If I want to install a photovoltaic system in a European location with average irradiation values, I have a great influence on its climate friendliness with the choice of my PV modules," explains Dr. Holger Neuhaus, Head of Department for Module Technology at Fraunhofer ISE.

Update Information

- EU brand new photovoltaic folding container wholesale

- Is the Ashgabat Photovoltaic Glass Factory good

- Photovoltaic glass frame loss

- Iron content of photovoltaic tempered glass

- Helsinki photovoltaic panel glass

- Photovoltaic tempered glass transportation standards

- Photovoltaic Glass Greenhouse Ecological Park

- Photovoltaic glass 900x400

- Is there a photovoltaic glass base in Austria

- Grenada double glass photovoltaic modules

- Personal work in photovoltaic glass

- There are several ways to produce photovoltaic glass

- Photovoltaic glass for 5G

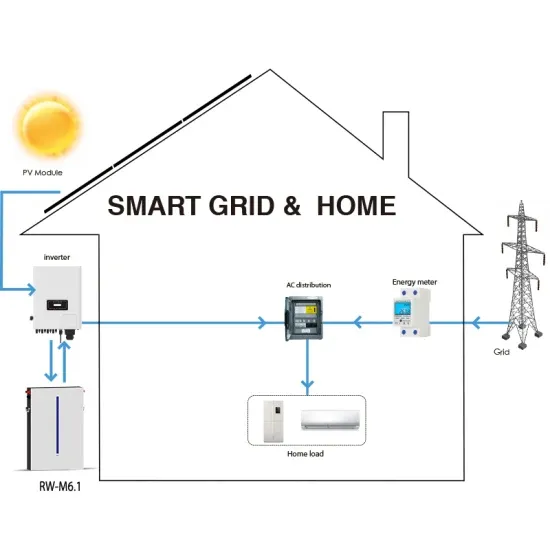

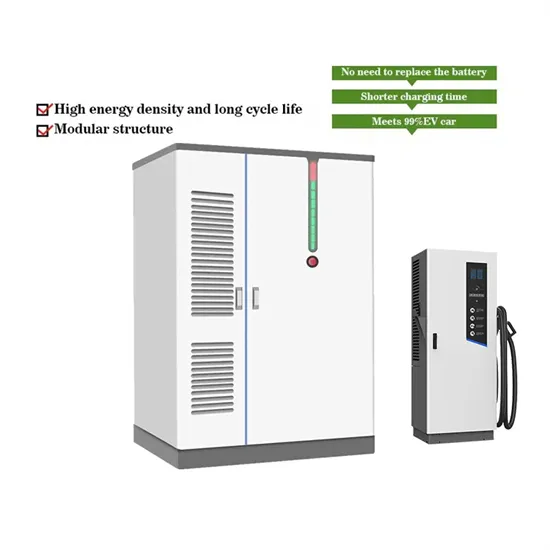

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.