Platts Solar Module Price Assessments

Jul 8, 2024 · Platts, part of S&P Global Commodity Insights, has observed strong interest in transparent solar module pricing following the exponential growth in the manufacture, trade

Fall 2024 Solar Industry Update

Jan 14, 2025 · In Q3 2024, module prices rose 1% but stayed near record lows, around $0.10/Wdc, as substantial module overcapacity continues to depress prices. Global polysilicon

Fall 2023 Solar Industry Update

Dec 4, 2023 · Global Manufacturing According to Infolink (formerly PV Infolink), the top 10 module manufacturers were responsible for 160 GW (+57% y/y) in H1 2023 and the top 5 cell

Winter 2025 Solar Industry Update

Feb 4, 2025 · PV System and Component Pricing Global module spot prices fell 22% in 2024, reaching $0.09/Wdc in December. In 2024, global spot prices fell 43% for wafers and 27% for

Chinese PV Industry Brief: China adds 268 GW of renewables,

Aug 1, 2025 · China installed 268 GW of new renewables capacity in the first half of 2025, nearly doubling year on year, with solar accounting for 212 GW of the total, says the nation''s energy

Solar module price increases to affect returns on

Jul 1, 2022 · Solar cell and module prices have increased by more than 40% over the last 18 months in India, driven by polysilicon prices. However, bid tariffs

Economic assessment of local solar module assembly in a

Feb 16, 2022 · The initial analysis focuses on the economic viability of photovoltaic (PV) module assembly at different scales in Australia and then generalizes to include the global supply

Too many confusing solar terms? Here''s a quick

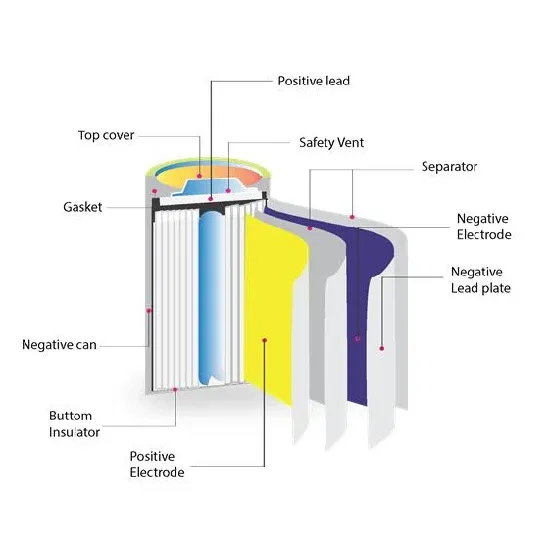

Dec 6, 2023 · Solar cells: Semiconductors typically made of silicon that generate electricity when exposed to photons (aka particles of light) via the photovoltaic

Company presentation January 2024

Feb 5, 2025 · Comparison with Current Cost Structures In 2024, the average CAPEX for utility-scale solar PV in Europe decreased by 28% due to record-low module prices This significant

Global average price for solar PV modules 2024| Statista

Jul 14, 2025 · Average spot price for solar photovoltaic modules worldwide from 2016 to 2024 (in U.S. dollars per watt-peak) You need a Statista Account for unlimited access Immediate

Waaree Energies bags order to supply 1 GW solar PV module

Dec 9, 2024 · Waaree Energies has secured a 1 GW solar PV module supply order from an Indian renewable energy company. The modules will be delivered during FY 2024-25 and FY 2025

Chinese Solar Giants Raise Panel Prices as Demand Picks Up

Feb 26, 2025 · A Chinese solar module manufacturer among the world''s 10 largest by shipments told Yicai that it recently raised the prices of products sold to Chinese distributors by about 2

Prices rising across China''s PV supply chain, says

Mar 20, 2025 · Taiwan-based research firm EnergyTrend says market optimism in China has driven up solar module prices, while production of modules, cells,

Photovoltaics Report

Jun 6, 2025 · Wafer size increased. Keeping the same number of cells, larger PV module sizes are realized, allowing a power range of over 700 W per module. In 2024, Europe''s contribution

Global Solar Module Capacity to Reach 1.8 TW by 2025:

Aug 7, 2025 · Solar module capacity is set to hit 1.8 TW by 2025, driven by global demand and major expansions. Explore key trends and growth forecasts—read the full report now!

6 FAQs about [PV module price per GW]

How much does a photovoltaic module cost?

Mainstream Modules: Average price of €0.11/Wp, stable compared to September but 21.4% lower than January 2024. Low-Cost Modules: Average price of €0.065/Wp, a 7.1% decrease from September and 27.8% from January 2024. These trends are exerting mounting pressure on the photovoltaic sector.

How much will PV modules cost in 2025?

International PV module prices, driven by Chinese averages, will likely rise from $0.08/W to $0.10/W today to $0.11/W by the end of 2025 and potentially $0.13/W by 2027, says Clean Energy Associates (CEA), noting that heterojunction and back-contact technologies now make up 12% of global module capacity.

How much does a photovoltaic panel cost?

Mainstream Photovoltaic Panels: Average price of €0.10/Wp, down 9.1% month-on-month. Low-Cost Photovoltaic Modules: Average price of €0.060/Wp, a decrease of 7.7% compared to the previous month. These figures underscore the significant pressures in the photovoltaic market, as price reductions strain margins to unprecedented levels.

How much does a module cost in 2024?

High-Efficiency Modules: Average price of €0.14/Wp, down 6.7% from September 2024 and 39.1% from January 2024. Mainstream Modules: Average price of €0.11/Wp, stable compared to September but 21.4% lower than January 2024. Low-Cost Modules: Average price of €0.065/Wp, a 7.1% decrease from September and 27.8% from January 2024.

How much will solar modules cost in 2025?

CEA has predicted that solar module prices may increase from around $0.8/W to $10/W currently to $0.11/W by the end of 2025 and likely up to $0.13/W by 2027.

Why are solar module prices so volatile in 2023?

Importation duties, oversupply, and supply chain costs have led to significant solar module pricing volatility, particularly since the start of 2023. New technology is rapidly evolving improving efficiencies with the market seeking more clarity around the changing prices of solar modules.

Update Information

- Global PV Module Prices in Pakistan

- Supercapacitor module price in Croatia

- Buenos Aires Glass PV Module Sales

- EU export PV module prices

- Kosovo PV Flexible Module Project

- Burkina Faso photovoltaic p-type module price

- 570 Photovoltaic Module Price

- Bangladesh 30kW PV inverter price

- Pvlnfolink photovoltaic module price

- Kyrgyzstan downgrades PV module exports

- Warsaw solar energy storage module price

- N-type 580wp crystalline silicon photovoltaic module price

- Tunisia double glass photovoltaic module price

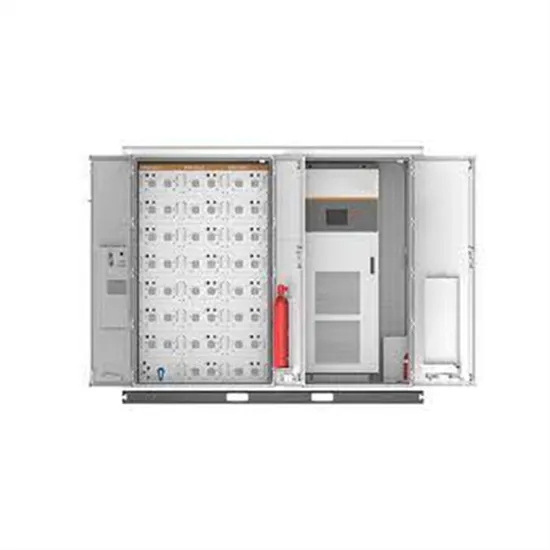

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

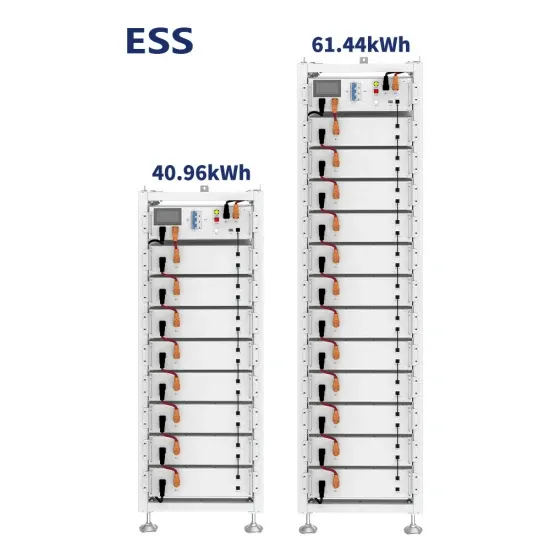

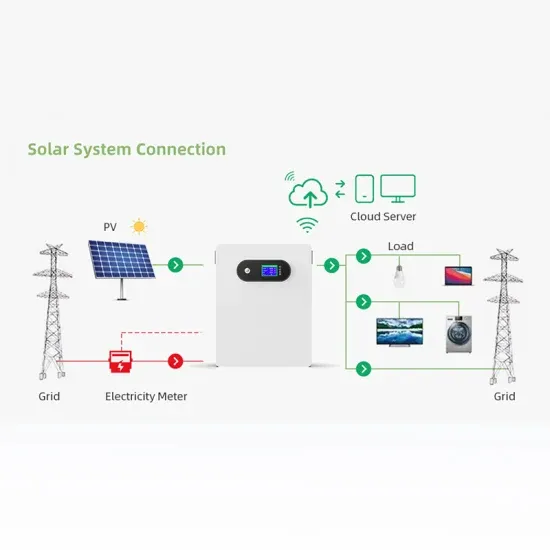

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.