Establishment of an EU level buy-out facility for

reduction in PV module prices, plummeting from 30¢/Wp to around 10¢/Wp. European manufacturers were forced to reduce their production in 2023 to only arou. d 2 GW of PV

Alarming rise in Chinese solar modules imported into the European

Sep 27, 2023 · The prices of photovoltaic (PV) modules have declined significantly in 2023. Particularly concerning is the closure of the US and Indian PV markets to Chinese imports,

Establishment of an EU level buy-out facility for

There is currently a surplus of imported PV modules in stock in EU ports and warehouses estimated in a range of 70–85 GW (equivalent to at least 140–170 million PV modules). The

PV Index July – prices ease as demand stays soft

Aug 14, 2025 · Polysilicon and wafer prices are recording upward corrections and there is a widespread consensus that the 9% export rebate will be phased out soon. If the first effects of

PV panel, battery production up to 45% more expensive in EU

Oct 31, 2024 · Producing solar PV modules, wind turbines and battery technologies costs on average up to 40% more in the United States, up to 45% more in the European Union and up

2025 Second-Half Outlook for the European Solar Industry

In the second half of 2025, the European solar market stands at a pivotal turning point where policy, pricing, and technology converge. Over the past 18 months, the global solar supply

Record-low solar PV prices risk EU''s open strategic autonomy

Sep 11, 2023 · With the support and recognition from the European Commission and national governments, we will see expedited market adoption of the SSI, enabling project developers to

Global solar module prices largely stabilize with

Feb 28, 2025 · In a new weekly update for <b>pv magazine</b>, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global

European PV Module Market Sees Price Rebound and

Mar 27, 2025 · The European PV module market has recently shown a trend of price rebound and demand recovery, driven by seasonal demand, rising supply chain costs, and policy support.

Record-low solar PV prices risk EU''s open strategic autonomy

Sep 11, 2023 · Module prices have hit the record-low of less than 0.15 EUR/W for low-cost products, now even submerging pre-Covid levels, making it extremely difficult for European

Solar energy in the EU

Oct 31, 2022 · EU measures to boost solar energy include making the installation of solar panels on the rooftops of new buildings obligatory within a specific timeframe, streamlining permitting

PV Index: Price upticks in April 2025 signal supply strains

May 6, 2025 · April saw nuanced but key price shifts in the European solar market, with module prices rising due to supply constraints, while inverter prices continued to decline. The PV

Solar module prices unaffected by tariff chaos

Apr 23, 2025 · Solar module prices in Europe rose slightly in April, but this only reflects a trend already expected and announced at the beginning of the year.

PV Index: Price upticks in April 2025 signal supply strains

May 6, 2025 · With a PMI of 70 and module supply under pressure, the European solar market faces a critical juncture. Price increases for N-type and bifacial modules signal ongoing stock

2025 Second-Half Outlook for the European Solar Industry

Introduction In the second half of 2025, the European solar market stands at a pivotal turning point where policy, pricing, and technology converge. Over the past 18 months, the global

Sliding solar module prices squeezing European manufacturers

Sep 29, 2023 · Plummeting module prices are weighing on European manufacturers, but the impact on wholesalers is differently, as warehouse conditions are showing signs of improvement.

Dominant PV Trade Flows In Europe 2022

The past reports6 traces the development over time, while this report focuses on the trade flows of 2022, distinguishing between PV cells and modules. Both of these two extra-European import

European PV Module Market Sees Price Rebound and

Mar 27, 2025 · After a prolonged decline, PV module prices in Europe have shown a noticeable rebound. Data indicates that N-type single-sided module prices have risen by 12%, while P

European Solar Market 2024-2025: Balancing Growth,

Jan 13, 2025 · Module prices are expected to rise slightly in 2025 due to key changes in Chinese production and export policies. In November 2024, the Chinese government reduced the

33GW! Europe imports PV modules from China

Jul 16, 2024 · In the first four months of 2024, Europe imported about 33GW of solar PV modules from China, accounting for 43% of China''s total module exports, according to Clean Energy

Global PV Module Market Analysis and 2025

Dec 11, 2024 · PV modules are the central component of the solar industry. This analysis reviews market conditions that affect solar panel pricing and availability.

6 FAQs about [EU export PV module prices]

How many PV modules are imported from China to the EU?

PV Module Shipments from China to the EU During January-October 2024, EU countries imported approximately 83 GW of PV modules from China, with total imports expected to be around 100 GW by the end of the year. These figures mostly align with 2023 levels, underscoring EU’s continued reliance on Chinese-manufactured modules.

Why is the PV market growing in the EU?

The PV market in the European Union (EU) has experienced remarkable growth, driven by the urgent need to transition to renewable energy and enhance energy security. Solar energy has emerged as a cornerstone of EU’s strategy to achieve its climate goals and reduce dependence on fossil fuel imports.

How will the EU solar market evolve in 2024-2025?

As the EU solar market evolves, trends in module shipments, inventory levels, and pricing are expected to influence its trajectory significantly. These factors underscore the delicate balance between fostering market expansion and addressing operational challenges, making 2024-2025 a critical period for the sector’s development.

Is the European solar market in motion?

Expert analysis: the solar market in motion With a PMI of 70 and tightening module supplies, the European solar market stands at a pivotal moment. Rising prices for P-type and Full Black modules, driven by diminishing inventories, suggest supply constraints will linger into Q3, especially as global demand intensifies.

How does pvxchange differentiate between the main technologies available on the market?

In doing so, we differentiate between the main technologies available on the market. Since 2009, pvXchange has provided a unique price index for the european market, which has become an invaluable industry tool. Today, it is hard to imagine the industry without our price index, trend data, and in-depth analysis and commentary.

How much does a photovoltaic module cost?

Mainstream Modules: Average price of €0.11/Wp, stable compared to September but 21.4% lower than January 2024. Low-Cost Modules: Average price of €0.065/Wp, a 7.1% decrease from September and 27.8% from January 2024. These trends are exerting mounting pressure on the photovoltaic sector.

Update Information

- Castries PV module wholesale prices

- Indian PV module selling prices

- Indian PV module prices

- Global PV Module Prices in Pakistan

- Latest photovoltaic module models and prices

- Bamako PV Energy Storage Prices

- Islamabad Photovoltaic Module Export

- What does the PV module EPC project refer to

- Namibia photovoltaic module export tariff

- Huawei Uruguay PV Module Project

- Photovoltaic module manufacturers inventory prices

- Buenos Aires Glass PV Module Sales

- Photovoltaic module export specifications

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

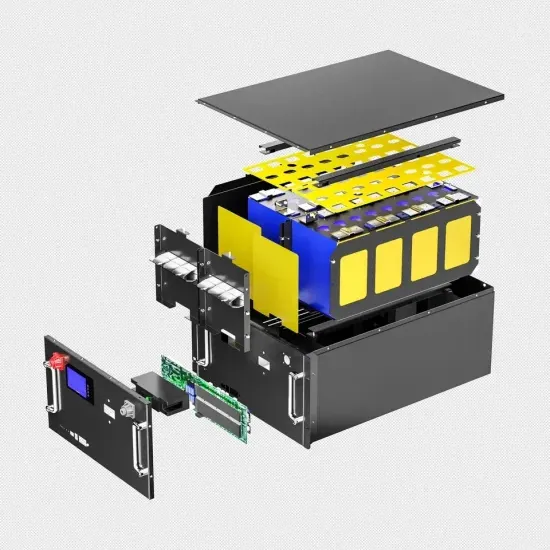

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.