Warsaw off-grid energy storage system

Why should Poland invest in energy storage facilities? Investments in energy storage facilities are key to Poland''s energy transition. They increase the flexibility of the energy system and

BESS wins big in Poland capacity market auction

Dec 18, 2024 · The closing price was PLN 264.90/kW/year (US$65.3), similar to the PLN 244.90/kW seen in last year''s, both of which are a big drop on 2022''s

Solmix Photovoltaic wholesaler | Solar Panels and Inverters

2 days ago · In our offer, you will find photovoltaic modules, solar inverters, optimisers and energy storage from renowned global manufacturers, as well as electrical equipment, a full range of

Poland''s New Energy Storage Prices: Trends, Projects, and

With solar prices dropping faster than a smartphone battery in winter (from $0.238/W in Jan 2023 to $0.13/W by December) [1], the country is racing to pair renewables with storage solutions.

Poland: GoldenPeaks buys 216MWh of BESS, R.Power

Aug 6, 2025 · The news comes as our publisher Solar Media prepares to host the third Energy Storage Summit Central and Eastern Europe in Warsaw, Poland, on 23-24 September.

Poland''s PV Market: Opportunities and Trends

Jan 24, 2025 · Poland will reach an installed photovoltaic capacity of 20 gigawatts by the end of this year. Thanks to additional government subsidies for small

SOLAR PV ANALYSIS OF WARSAW POLAND

Price per watt: The average cost of solar panels in Poland is around $2.96 per watt (as of May 2024).. The cost of installing such an installation depends on the current power consumption

Warsaw Photovoltaic Energy Storage

During the event, investors interested in investing capital in renewable energy sources could learn about the offers of leading producers and distributors of, among others, solar panels and

Poland''s $1 billion energy storage subsidy scheme opens for

Apr 4, 2025 · The call for applications for the Electricity Storage and Related Infrastructure Programme, aimed at enhancing the stability of the Polish power grid, will remain open until

Energy storage: increasing interest in Poland –

Sep 14, 2016 · New regulations, funding programs and rising electricity prices are drivers for a increasing interest in energy storage in Poland. Coming 6th

PLN 12 million in subsidies for energy storage in Warsaw

Jan 24, 2025 · The funding is part of the Zero-Emission Energy System program, which supports the use of storage systems and other devices for grid stabilization. The energy storage

Poland relaunches residential solar, storage rebate scheme

Sep 5, 2024 · The sixth edition of the Polish government''s residential solar and storage rebate scheme is now open, with a total budget of PLN 400 million ($103.2 million). Applications will

6 FAQs about [Warsaw solar energy storage module price]

Why is energy storage a growing interest in Poland?

There is a rising interest in energy storage in Poland. New regulations, funding programs and rising electricity prices are drivers for a increasing interest in energy storage in Poland. Coming 6th Renexpo Poland, that takes place 19-21 October in Warsaw, provides a good opportunity to follow the new trends and make new business contacts.

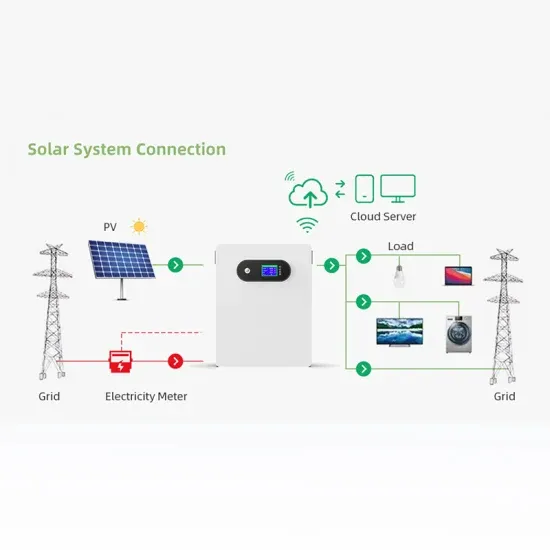

Why do we need energy storage facilities in Warsaw?

In summary, the construction of energy storage facilities in Warsaw is a significant step towards enhancing the city’s energy infrastructure, supporting the integration of RES, and ensuring a stable and secure power supply for its residents. This article was prepared by Institute of Fluid-Flow Machinery Polish Academy of Sciences.

Will Warsaw benefit from the construction of ten electricity storage facilities?

Warsaw is going to benefit from the construction of ten electricity storage facilities, thanks to a funding boost of over PLN 12 million from the National Fund for Environmental Protection and Water Management (NFOŚiGW).

What are the driving factors for energy storage in Poland?

Driving factors for energy storage in Poland are besides continuous feeding programs for renewable energy rising electricity prices and the poor condition of the grid. A “Strategy for sustainable development” is currently under consultation.

How many people attended this year's solar event in Warsaw?

More than 300 people attended this year’s event in Warsaw, Poland. Image: Solar Media.

How much solar capacity does Poland have?

Image: Solar Media. In terms of sheer capacity deployed, the Eastern European solar sector has gone from strength to strength in recent years; market leader Poland has seen its cumulative installed capacity jump from 12.4GW at the end of 2022 to 17GW at the end of 2023, and this has now grown to around 20GW.

Update Information

- Warsaw energy storage module price

- Energy storage container solar photovoltaic module factory photothermal equipment

- Berlin energy storage module price

- China Photovoltaic Energy Storage Cabinet Solar Installation Price

- Solar energy storage cabinet China price and price

- China Photovoltaic Energy Storage Cabinet Solar Power Supply System Price

- Price of energy storage cabinet converted to solar power supply

- Vatican solar energy storage cabinet control panel price

- Price of greenhouse solar energy storage cabinet

- Bolivia energy storage module equipment price

- Low voltage distribution cabinet GGD variable frequency solar energy storage cabinet price

- Tehran solar power generation and energy storage unit price

- Warsaw New Energy Storage Price

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.