Impact of US trade barriers on solar PV supply chain:

Apr 10, 2025 · Therefore, even with Trump''s new tariff hikes targeting China, the impact on Chinese PV companies remains limited. PV supply chain and market outlook In summary,

World stuck in major solar panel ''supply glut''; module prices

Jan 13, 2024 · The organization said some 90 GW of modules were sitting in warehouses in the European Union at the end of 2023 with a further 45 GW in the US, though some

Navigating Changing Dynamics in U.S. Module Supply

Nov 24, 2024 · Scope Geography Timeline Crystalline silicon PV cells •Cambodia, Malaysia, Thailand, (whether or not assembled into Vietnam modules) DoC initiation decision (May 14)

Oversupply in China Weighs on Prices across the Solar Value

Mar 8, 2024 · Module production exceeded 499GW, up 69.3% from 2022, with exports in 2023 totaling 211.7GW, an increase of 37.8% year-on-year. The Global Polysilicon Marker, the

India PV Module Intelligence Brief | Q2 2024

Sep 17, 2024 · Recent reports India PV Module Intelligence Brief | Q1 2025 This report encapsulates quarterly trends in module demand and supply, import and domestic production

Non-stop solar innovation despite module oversupply – pv

Aug 4, 2025 · Non-stop solar innovation despite module oversupply It''s no secret that prices throughout the solar supply chain have been at rock bottom over the past 18 months.

Policy and supply chain factors slow global PV demand

Oct 29, 2024 · The Section 201 tariff on imported cells and modules removed the exemption for bifacial modules, and then raised the tariff rate quota (TRQ) for cells. Meanwhile, the Section

Mastering U.S. Solar Market Dynamics: Strategies for Module

Apr 26, 2024 · The U.S. solar market has been experiencing an oversupply of PV modules, accompanied by rapidly falling prices. However, the threat of a new solar AD/CVD case could

Is China''s $7 billion plan to reduce polysilicon overcapacity

Aug 11, 2025 · OPIS, Wood Mackenzie, and Bernreuter Research have spoken with pv magazine about China''s alleged $7 billion plan to reduce polysilicon oversupply and restore a

Limiting Generation, Prices, Production, and Sales: How Can

Dec 9, 2024 · Excess supply of silicon materials, wafers, cells, modules, and auxiliary materials has plagued the Chinese PV industry in 2024. The immediate outcomes include insufficient

Solar industry faces collapse amid surplus and plunging prices – pv

Aug 28, 2024 · The global photovoltaic (PV) market is facing a crisis of oversupply, plunging prices, and mounting losses across the entire supply chain, from polysilicon to modules.

''Oversupply is still there'' – pv magazine

Jan 23, 2025 · According to their analysis, overcapacity remains difficult to be kept in control, which makes an increase in solar module prices very unlikely,

Supply of photovoltaic cells exceeds demand

The PV module supply chain is undergoing transformation in 2024, marked by oversupply, policy uncertainty, and low prices affecting manufacturing capacity expansion and factory utilization

Understanding the Latest Trends in Photovoltaic

Jul 10, 2024 · The photovoltaic (PV) industry has witnessed a noticeable decline in module prices, influenced by several key factors. Here, we distill the primary

Analysis Of Photovoltaic Module Price Trends And Industry

Dec 31, 2024 · However, as the primary cost component of photovoltaic modules, the price of solar cells plays a decisive role in module pricing. Due to the oversupply of polysilicon in

''Indian solar manufacturers cannot merely catch

Apr 10, 2025 · Suhas Donthi, CEO of Emmvee, speaks with <b>pv magazine</b> about India''s evolving role in the global solar supply chain, the risks of

PV outlook 2024: Market to benefit from falling prices but

Nov 14, 2023 · For new cell and module players, it''s not likely to wean themselves off Chinese supply chain completely within two to three years of time. Overall, the solar industry will

China''s photovoltaic industry will remain bearish in 2025

Feb 7, 2025 · Overcapacity and low prices in the PV sector have already resulted in polysilicon production cuts among major producers such as Tongwei and Daqo New Energy, to alleviate

6 FAQs about [Oversupply of photovoltaic cell modules]

Is the PV module supply chain undergoing transformation in 2024?

The PV module supply chain is undergoing transformation in 2024, marked by oversupply, policy uncertainty, and low prices affecting manufacturing capacity expansion and factory utilization rates. Oversupply has been central to the solar supply chain since the second quarter of 2023 but there are signs the trend is shifting.

Is the solar supply chain oversupply shifting in 2024?

Oversupply has been central to the solar supply chain since the second quarter of 2023 but there are signs the trend is shifting. In 2024, the supply chain has experienced a slowdown. Rationalization efforts in China aim to control the expansion of companies and increase industry barriers to entry.

How will China's solar expansion affect global solar supply chains?

After investing over US$130 billion into the solar industry in 2023, China will hold more than 80% of the world’s polysilicon, wafer, cell, and module manufacturing capacity from 2023 to 2026, according to a recent report by Wood Mackenzie titled “How will China’s expansion affect global solar module supply chains?”.

How many GW of solar modules are there in 2023?

The organization said some 90 GW of modules were sitting in warehouses in the European Union at the end of 2023 with a further 45 GW in the US, though some manufacturers have disputed the scale of the stockpiling. Nevertheless, the ongoing oversupply led to module spot prices dropping roughly 50% between January and December 2023, the IEA added.

Are solar panels cost-competitive?

Strong government policies in overseas markets have started to increase local solar manufacturing, but they are still not cost-competitive compared to Chinese supply. A module made in China is 50% cheaper than that produced in Europe and 65% cheaper than the US, according to the report.

Why is the global PV manufacturing capacity reducing in 2024?

Since the first quarter of 2024, however, there has been a noticeable decrease in the utilization rates of global PV manufacturing capacity. Lower utilization is attributed to limited demand growth and high inventory levels, leading to a market surplus.

Update Information

- Equatorial Guinea photovoltaic cell modules

- Profits of photovoltaic cell modules

- Requirements for exporting photovoltaic modules to Nigeria

- Polycrystalline 280w photovoltaic cell module unit price

- Degradation rate of photovoltaic monocrystalline silicon modules

- Efficiency comparison between double-glass and single-glass photovoltaic modules

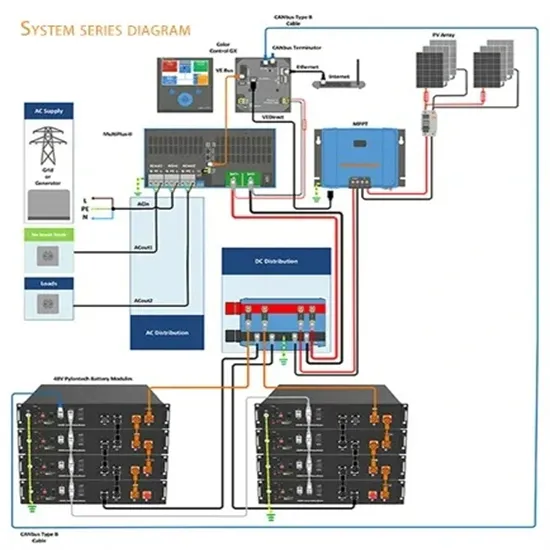

- Photovoltaic modules on communication base station inverter

- Latest price of n-type photovoltaic modules

- What are battery modules and photovoltaic modules

- Photovoltaic cell module layout

- Poor quality of exported photovoltaic modules

- Prices of photovoltaic modules in Cote d Ivoire

- Total photovoltaic panel cell area

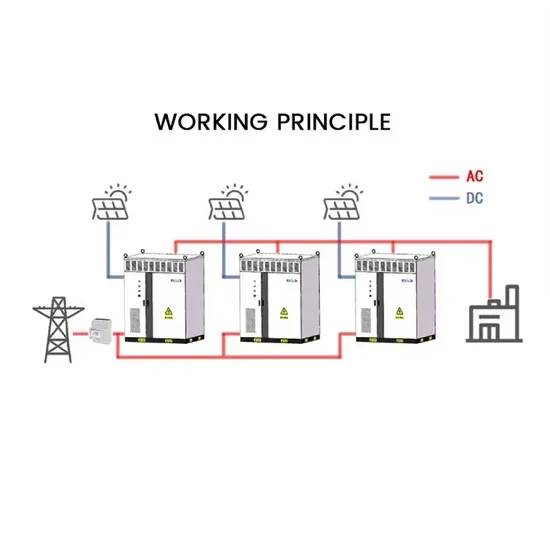

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.