Middle East cylindrical lithium battery structure

How many Li-ion cylindrical battery cells are there? This paper investigates 19 Li-ion cylindrical battery cells from four cell manufacturers in four formats (18650, 20700, 21700, and 4680). We

Statevolt''s push for a sustainable battery supply

Sep 3, 2024 · Lars Carlstrom shares insights on Statevolt Emirates'' mission to localise and innovate battery production in the Middle East. Inside Statevolt''s

Lithium-ion Battery Manufacturer | Ufine Battery

5 days ago · As a professional lithium ion battery supplier, Ufine leads the industry with a diverse range of lithium battery models, produces over 100,000

Middle-East and Africa Battery Cell Market 2025-2033

Feb 12, 2025 · February 2022: EV Metals group signed a Front-End Engineering Design Agreement to develop a lithium chemicals plant in Saudi Arabia. May 2022: Panasonic

Middle-East and Africa Battery Cell Market Market Trends

Jul 4, 2025 · The Middle East and Africa (MEA) battery cell market is experiencing robust growth, driven by the increasing adoption of electric vehicles (EVs), hybrid electric vehicles (HEVs),

Middle East and Africa Sodium-ion Battery Market Size and

Aug 11, 2025 · In Middle East and Africa Sodium-ion Battery Market, offering valuable insights, key market trends, competitive landscape, and future outlook to support strategic decision.

Saudi Aramco''s Lithium Push: Middle East''s New

Jan 15, 2025 · Saudi Aramco, the global oil giant, is making significant strides into lithium production, marking a strategic pivot in the Middle East''s resource

Middle East & Africa: Li-Ion battery projects by

May 23, 2025 · In 2022, the Middle Eastern and African (MEA) countries were mainly investing in lithium-nickel-manganese-cobalt-oxide batteries, as they

Comprehensive Middle East and Africa Lithium Ion Battery

Discover the latest trends, growth drivers, demand forecasts, and performance insights for the Middle East and Africa Lithium Ion Battery market. Explore key factors shaping the future of

HCC Ships Lithium Batteries for Middle East

On April 3, 2024, Beijing time, Topway Battery (HCC) completed the bulk shipment of lithium batteries to customers in the Middle East market as scheduled, including digital batteries, tool

Global Full Tab Cylindrical Battery Cell Market Outlook,

The global Full Tab Cylindrical Battery Cell market is projected to grow from US$ 24.43 million in 2024 to US$ 46.82 million by 2031, at a CAGR of 6.8% (2025-2031), driven by critical product

Cylindrical Lithium-Ion Battery Market size is set to grow by

Aug 12, 2024 · The global cylindrical lithium-ion battery market size is estimated to grow by USD 11.61 billion from 2024-2028, according to Technavio. The market is estimated to grow at a

Battery Production Flyer: Lithion Ion Cell Production

Feb 7, 2024 · Electrode manufacturing Cell assembly Cell finishing The manufacture of the lithium-ion battery cell comprises the three main process steps of electrode manufacturing, cell

EVE Energy Is Set to Build a Cylindrical Battery Production

PERAK, MALAYSIA, December 1, 2022 / EINPresswire / -- EVE Energy Co., Ltd. (EVE), a China-based lithium battery production company, through its subsidiary EVE Energy Malaysia

Latest List of Upcoming Lithium-ion Battery Manufacturing

Aug 1, 2025 · Search all the upcoming lithium-ion battery manufacturing plant projects, bids, RFPs, ICBs, tenders, government contracts, and awards in Middle East Region with our

Middle East and Africa Cylindrical Ternary Lithium Battery

Jul 4, 2025 · The cylindrical ternary lithium battery market in the Middle East and Africa (MEA) region is experiencing dynamic growth, driven by a blend of industrialization trends, rising

Global Cylindrical Lithium Ion Battery Market

Cylindrical Lithium Ion Battery is the most popular packaging style for primary and secondary batteries. The structure offers good mechanical stability and can withstand high internal

Cylindrical Lithium-Ion Battery Market

May 30, 2025 · The Cylindrical Lithium-Ion Battery Market was valued at USD 10.48 Billion in 2024 and is projected to reach USD 31.83 Billion by 2030, growing at a CAGR of 20.16%. This

Cylindrical Cell Assembly Line Market Size, Share and

4 days ago · Recent Developments In 2025, Xiamen Acey New Energy Technology launched the 32140 Battery Pack Assembly Line, supporting large-format cylindrical battery manufacturing.

Middle East Lithium Market Size, Share | Industry Report 2033

Aug 13, 2025 · The Middle East lithium market size was estimated at USD 84.3 million in 2024 and is expected to reach USD 747.9 million in 2033, growing at a CAGR of 16.0% from 2025

Cylindrical Lithium-Ion Batteries Market Report | Global

The global cylindrical lithium-ion batteries market size is projected to grow from USD 15.2 billion in 2023 to USD 36.8 billion by 2032, exhibiting a compound annual growth rate (CAGR) of

Global cylindrical lithium-ion battery market 2024-2028

Jun 11, 2024 · List of Tables The cylindrical lithium-ion battery market is forecasted to grow by USD 11613.1 mn during 2023-2028, accelerating at a CAGR of 6.59% during the forecast

Top 10 Companies in the Middle East Performance Lithium

Jun 10, 2025 · In this analysis, we profile the Top 10 Companies dominating the Middle East Performance Lithium Compounds Market —global lithium producers, regional chemical

Middle East and Africa Battery Test and Manufacturing

Jul 5, 2025 · The rapid acceleration in electric vehicle (EV) adoption and renewable energy projects across the Middle East and Africa (MEA) is significantly driving the demand for

Lithium-ion battery production process: middle

6 days ago · The middle-stage process of lithium battery manufacturing is the assembly section, and its production goal is to complete the manufacturing of

Middle East Lithium Ion Battery Market | Size & Volume 2031

Middle East Lithium-Ion Battery Market was valued at USD 2.4 billion and is expected to reach USD 5.5 billion, growing at a CAGR of around 5.1% from 2025 to 2031. This increase is driven

6 FAQs about [Middle East cylindrical lithium battery manufacturing]

What is the market size of lithium in Middle-East and Africa?

The market for Lithium in Middle-East and Africa is expected to grow at a CAGR of over 10% during the forecast period. Major factors driving the market studied are accelerating demand for electric vehicles and growing usage and demand from the portable consumer elctronics.

Who is Middle East Battery Company?

Middle East Battery Company has the latest and largest advanced technology plant in the region engaged in manufacturing automotive sealed maintenance free batteries for all types of cars.

Who are the key players in the Middle-East and Africa lithium market?

The Middle-East and Africa Lithium market is consolidated, with the top five players accounting for major share of the market. The key players in the market include, Albemarle Corporation, SQM S.A., Tianqi Lithium, Orocobre Limited Pty Ltd, and FMC Corporation.

Which country is expected to dominate the lithium market?

By application, battery segment is expected to account for the largest share owing to increasing usage of lithium for the production of lithium batteries. By Country, Saudi Arabia is expected to dominate the market during the forecast period. The Middle-East and Africa Lithium market report includes:

What is lithium used for?

Lithium is majorly used in battery applications for the production of lithium batteries. The battery application segment accounted for the largest share of the Middle-East and North Africa lithium market in 2019. Lithium batteries can be categorized into two segments, namely, disposable and rechargeable.

What are the opportunities for the lithium recycling market?

Recycling of lithium and its batteries is expected to offer various lucrative opportunities for the growth of market. By application, battery segment is expected to account for the largest share owing to increasing usage of lithium for the production of lithium batteries.

Update Information

- Middle East lithium battery portable energy storage manufacturer

- Middle East energy storage lithium battery manufacturer

- Middle East lithium battery bms maintenance

- Amsterdam EK34 cylindrical lithium battery

- Lg large cylindrical lithium battery

- 60300 cylindrical lithium battery

- Cylindrical lithium battery and square

- Honiara 10AH cylindrical lithium battery

- Cyprus cylindrical lithium battery sales

- Maximum temperature of cylindrical lithium battery

- Cylindrical lithium battery sales in Costa Rica

- Senegal lg lithium battery cylindrical

- Cylindrical lithium battery waterproof

Solar Storage Container Market Growth

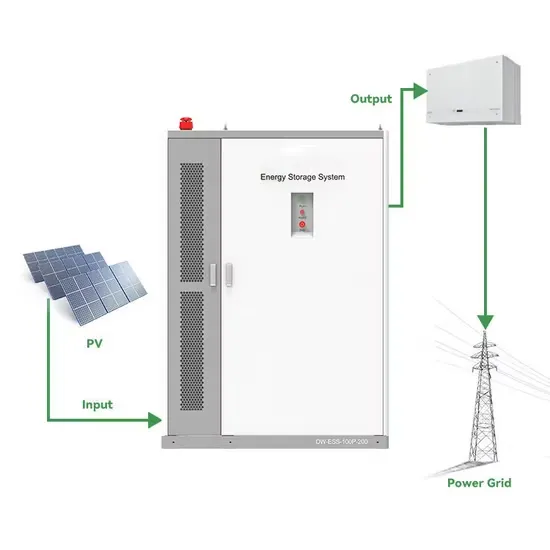

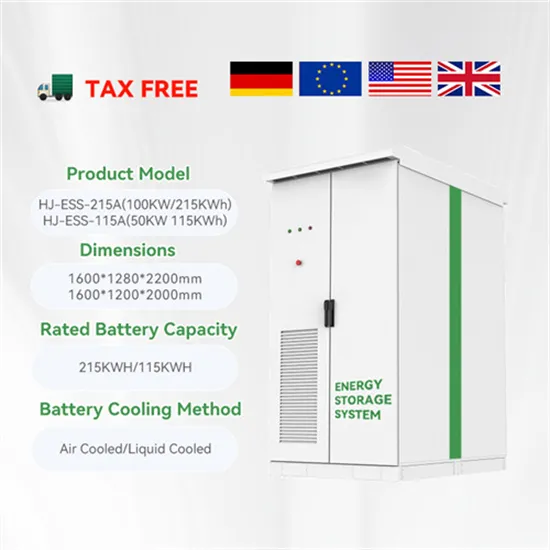

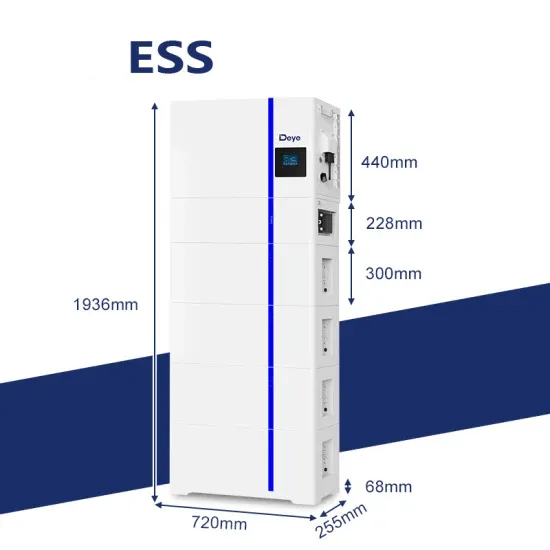

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.