Belgrade Energy Storage Battery Sales Powering a

From slashing energy bills to enabling renewable adoption, Belgrade energy storage battery sales are reshaping how the city consumes power. Whether you''re a factory manager or a

U.S. Battery Gigafactories [2025 List] | EV Supply Chain

An up-to-date list of all lithium battery gigafactories in the U.S. and the major ones worldwide. A large gigafactory can consume 2.4 GWh of electricity and 1 million gallons of water daily.

Tesla electric car factory evacuated after fire in ''battery pack

5 days ago · Tesla''s electric vehicle manufacturing plant in Germany has been evacuated following a fire in the battery pack manufacturing area. According to German newspaper

Europe''s first LFP battery factory opens its doors

Apr 24, 2023 · The opening of the Lithium Iron Phosphate (LFP) industrial facility was announced today by Serbian company ElevenEs and is touted as the first

belgrade lithium-ion battery energy storage container

48V100Ah Lithium Battery For Energy Storage And Power Back-up Gtech Power Group is a professional lithium battery manufacturer and power supply solution provider with our own

Assembly of Lithium Battery Packs in Belgrade A Growing

Belgrade is emerging as a strategic location for lithium battery pack assembly, driven by its skilled workforce, cost-effective manufacturing, and growing demand for renewable energy storage.

Belgrade Lithium Battery Pack

Belgrade energy storage battery customization The development time for a custom battery pack can vary significantly based on the project''''''''s. Chat online. Belrgade, Prishtina plan joint power

Tesla electric car factory evacuated after fire in

5 days ago · Tesla''s electric vehicle manufacturing plant in Germany has been evacuated following a fire in the battery pack manufacturing area. According to

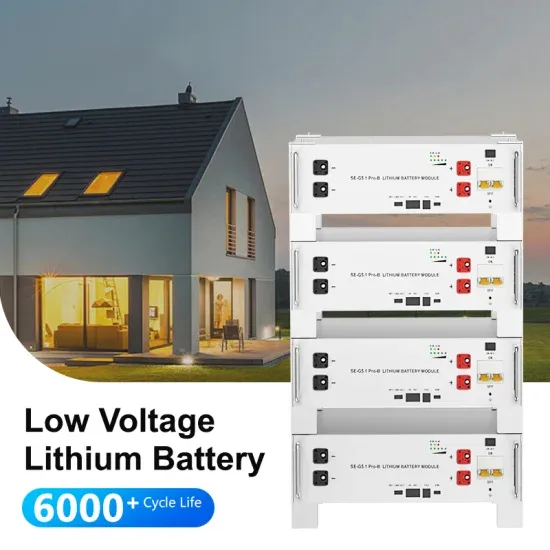

Belgrade Photovoltaic Energy Storage Lithium Battery

May 20, 2025 · Why Belgrade is Emerging as a Hub for Energy Storage Innovation As global demand for renewable energy solutions surges, Belgrade-based photovoltaic energy storage

The production of LFP batteries is developing in Serbia

Mar 28, 2023 · Top experts from their respective fields came to Belgrade, from battery ecology, engineering, chemistry, recycling and battery production, reports eKapija. "It became clear that

Energy storage battery production in Serbia

Belgrade and the European Union signed a deal on Friday to give the EU access to raw materials mined in Serbia and strengthen their ties on production of sustainable raw materials, battery

How To Establish A Battery Pack Manufacturing Factory

Feb 8, 2025 · Building a battery pack manufacturing factory is a strategic endeavor that requires meticulous planning, technical expertise, and a clear understanding of market demands.

Europe''s first LFP battery factory to be built in

Oct 21, 2021 · ElevenEs has developed its own lithium iron phosphate (LFP) technology for batteries for electric cars, buses, trucks, forklifts, other industrial

ElevenEs completes Europe''s first LFP battery cell

Apr 27, 2023 · It is the first lithium iron phosphate (LFP) battery cell factory in Europe, it added. In Serbia''s northernmost city of Subotica, a project is

Europe''s ''first'' LFP gigafactory opens in Serbia

Apr 25, 2023 · ElevenEs has opened a lithium iron phosphate (LFP) gigafactory in Serbia, which it claimed is the first in Europe. The facility in Subotica has opened with the aim of reaching

6 FAQs about [Belgrade battery pack factory]

Is there a battery Gigafactory in Serbia?

In Serbia’s northernmost city of Subotica, a project is underway for a battery gigafactory with an annual capacity of 8 GWh, set for launch in 2026, while 40 GWh is planned to be added by end-2027. The developer, ElevenEs, has just finished the cell manufacturing facility, as scheduled.

Will Europe's first battery factory be built in Subotica?

Backed by EU funds, it will build Europe’s first factory of the kind in Subotica, Serbia, aiming to reach a capacity of 16 GWh per year. By 2030, Europe will need 14 times more batteries than it produces today.

What is the first lithium phosphate battery factory in Europe?

It is the first lithium iron phosphate (LFP) battery cell factory in Europe, it added. In Serbia’s northernmost city of Subotica, a project is underway for a battery gigafactory with an annual capacity of 8 GWh, set for launch in 2026, while 40 GWh is planned to be added by end-2027.

Could Serbia be a technological leader in LFP battery production?

The Republic of Serbia could be a technological leader in LFP battery production in the whole world outside of China, because it has a chance to become the first in Europe to mass-produce this type of battery. The signed Memorandum with the European Union envisages a serious focus on the ecosystem of electric vehicles and battery production.

Where is the first LFP cell factory in Europe?

Battery storage startup ElevenEs said its manufacturing facility in Serbia is fully operational. It is the first LFP cell factory in Europe.

Is edge a cobalt & nickel-free battery cell?

The startup said its product, EDGE, is also the first cobalt and nickel-free battery cell on the continent and added the energy consumed in the process is 100% from renewable sources – a combination of hydro, wind and solar power. Earlier it revealed the initial capacity of the manufacturing facility would be 300 MWh.

Update Information

- Selling lithium battery pack factory

- Cambodia Lithium Battery PACK Factory Introduction

- Lithuania battery pack factory

- Qatar good lithium battery pack factory price

- 24v150 lithium battery pack

- Austria ups power lithium battery pack

- Factory price battery storage in Honduras

- Lithium iron phosphate battery pack press assembly

- BOSCH 18V 4A lithium battery pack

- European lithium titanate battery pack

- How much is the lithium iron phosphate battery pack

- Large capacity 26650 lithium battery pack

- Rabat Energy Storage Lead Acid Battery Factory

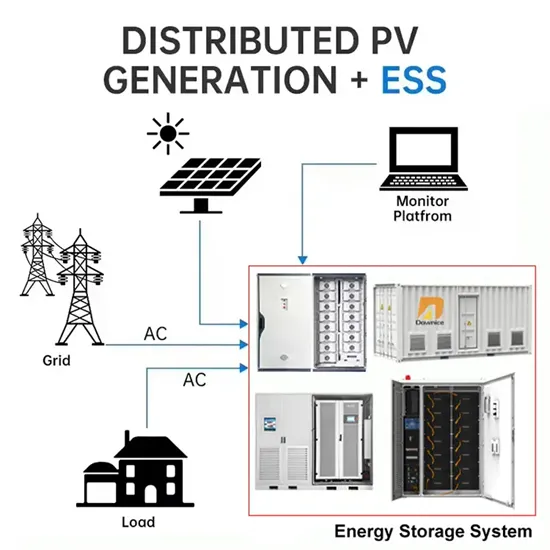

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.