Road to Renewables: Maldives transitions to a greener

Jun 6, 2022 · There is immense potential to create energy efficient fleets and a modern harbour infrastructure that utilises solar PV or wind energy. The public transport sector can also drive

Dominant PV Trade Flows In Europe 2022

The past reports6 traces the development over time, while this report focuses on the trade flows of 2022, distinguishing between PV cells and modules. Both of these two extra-European import

China''s Photovoltaic Module Exports to Asia-Pacific: A Look

Given Pakistan''s reduced demand for photovoltaic systems, it is expected that the volume of Chinese photovoltaic module imports will continue to decline in the fourth quarter of 2024. This

Maldives Solar Cell and Module Market (2025-2031)

Historical Data and Forecast of Maldives Solar Cell and Module Market Revenues & Volume By Industrial for the Period 2021-2031 Historical Data and Forecast of Maldives Solar Cell and

Solar module Imports in Maldives

Nov 16, 2021 · Create profitable strategy to import Solar module in Maldives with Top Solar module exporting importing countries, Top Solar module importers & exporters based on 3

Module imports to decrease in early 2024 after persisting

Jan 30, 2024 · Despite the removal of some modules from the ex-tariff list and the imposition of the 9.6% import tariff, the overall cost will not increase significantly, thanks to recently low

China''s PV module exports reach 39 GW in Jan–Feb 2025,

Mar 28, 2025 · InfoLink''s customs data shows that China exported 22.26 GW of modules in January 2025, up 2% YoY from 21.91 GW. However, exports in February dropped to 16.26

Chinese solar module exports down 12% MoM despite

Jan 7, 2025 · China''s module exports declined in November due to Europe''s off-season in Q4, India''s ALMM and focus on local capacity, and the nearing depletion of Brazil''s duty-free

China''s PV module exports see modest rebound in May after

Jul 3, 2025 · China''s total module exports from January to May 2025 reached 105.65 GW, down 4% YoY from 109.76 GW. In May 2025, the top five single-country markets importing Chinese

Operational Performance Assessment of Rooftop PV Systems in the Maldives

Jun 1, 2024 · In pursuit of the Maldives ambitious net-zero emissions target by 2030, the adoption of photovoltaic (PV) systems has surged as a leading renewable energy solution. Despite this

India Shines Brighter: Rising Solar Exports Amid Global Trade

Apr 21, 2025 · India''s solar exports surge amid global trade shifts, U.S. tariffs, and strong policy support boosting domestic manufacturing and international competitiveness.

Chinese module exports decline 11% MoM in July amid

Aug 28, 2024 · South Africa has imported around 2.1 GW of modules during the January-July period. Recently, foreign developers started to develop PV plants in South Africa, while the

Powered By The Sun: The Maldives Sustainable

Sep 26, 2023 · Better yet, the same 11-megawatt solar project, backed by private investments and supporting six population centers, is serving as a catalyst for

The Meteoric Rise of Indian PV Module Exports

Dec 9, 2024 · Indian PV module exports surged to $2B in 2024, driven by US tariffs on Chinese imports and global demand. Learn how India is reshaping the photovoltaic market.

India''s Solar Export Surge: Seizing Global Opportunities

Nov 30, 2024 · India''s solar export growth thrives as global shifts, including China''s subsidy cuts, create new opportunities for Indian manufacturers.

6 FAQs about [Maldives downgrades PV module exports]

Will a 5 MW solar installation make Maldives a popular destination?

Now, one of the first sights for any of the 1.7 million tourists visiting the Maldives will be that of the 5 MW solar installation on the highway linking the airport island to Male and its satellite town of Hulhumale.

How much does a solar project cost in Maldives?

In 2022, 63 investor expressed interest in the third 11 MW solar project in the remote islands of Maldives, and a record low price of 9.8 US cents was received. This is one of the lowest tariffs for any small island developing state (SIDS).

Should investors invest in sustainable solar projects in the Maldives?

In 2014, the first 1.5 MW solar project under ASPIRE only had four investors bids, and resulted in a high power purchase price (PPA) of 21 US cents per unit of electricity, indicating a lack of interest from investors in investing in sustainable projects in the Maldives.

Will Maldivian governments help achieve energy transformation goals?

The foresight and climate-proactivity of successive Maldivian governments, coupled with development financing from partners like the World Bank, will help the country achieve its ambitious energy transformation targets, showcasing best practices for other island states.

How will the Maldives' fuel subsidy project impact the economy?

This will reduce the Maldives’ import bill by approximately US$ 30 million annually, with a total project lifetime saving of US$ 750 million over 25 years. These projects are expected to significantly reduce the government’s fuel subsidy expenditure, thereby decreasing the nation's reliance on fossil fuels and the fiscal burden this creates.

Why is the Maldives economy vulnerable to external shocks?

However, the Maldives’ dependence on tourism and fossil fuel imports makes its economy particularly vulnerable to external shocks. Already, in 2020, the country’s real GDP contracted by at least 13 percent, 18.5 percentage points lower than the pre-COVID-19 baseline.

Update Information

- Kyrgyzstan downgrades PV module exports

- PV Module Perc

- Indian PV module prices

- Photovoltaic module exports rise

- Global PV Module Prices in Pakistan

- Maldives photovoltaic module inverter manufacturer

- Buenos Aires Glass PV Module Sales

- North Macedonia double glass module manufacturer

- Photovoltaic module panels produced in Thimphu

- Base station charging module to power supply

- 5g base station wind power module

- Double glass module standard

- Cape Verde energy storage battery module manufacturer

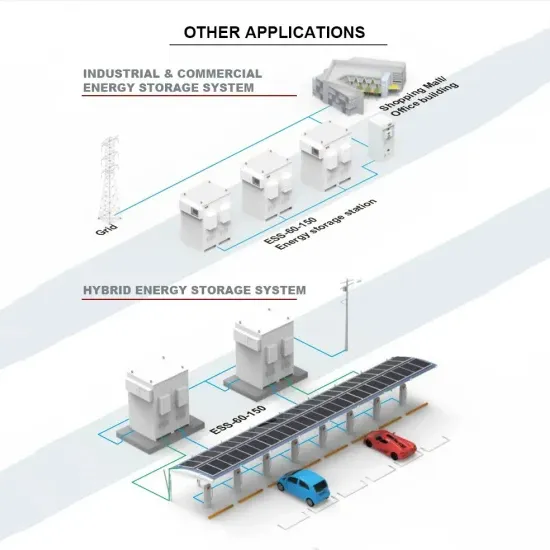

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.