Energy Storage Market Size, Growth, Share & Industry

Aug 12, 2025 · The Energy Storage Market Report is Segmented by Technology (Batteries, Pumped-Storage Hydroelectricity, Thermal Energy Storage, Compressed Air Energy Storage,

Battery Industry Strategy

May 20, 2022 · The battery supply chain : Importance of securing the manufacturing base Risks exist in the supply chain of mineral resources and materials which support battery cell

Energy Storage Industry Chain Segmentation: A Deep Dive

Mar 15, 2025 · Whether you''re an investor eyeing the next big thing, a tech geek obsessed with clean energy, or just someone who loves a good underdog story (spoiler: batteries are the new

energy storage battery application segmentation

Energy Storage Battery Inverter Market Size, Growth, And Industry Analysis By Market Segmentation The growth of the "Energy Storage Battery Inverter market" has been

Energy Storage System Market Size, Share Analysis, 2033

Aug 4, 2025 · The global energy storage system market was valued at USD 12.9 billion in 2024 and is projected to touch USD 58.2 billion by 2033, exhibiting a CAGR of 17.8%

Solar Energy Storage Market Size, Industry Share

Oct 18, 2022 · The global solar energy storage market size was valued at $9.8 billion in 2021, and is projected to reach $20.9 billion by 2031, growing at a

energy storage industry segmentation analysis and design plan

Here''s some videos on about energy storage industry segmentation analysis and design plan Energy Storage Management Webinar Series Nuvation Energy has created a 3-part

Market Positioning and Development Strategy of

Aug 31, 2017 · Analysis (advantage analysis):As the world''s leading lithium battery production and full solution provider, BYD has a strong technical advantage in the field of lithium battery, its

Energy storage industry put on fast track in China

Feb 14, 2024 · At an energy storage station in eastern Chinese city of Nanjing, a total of 88 white battery cartridges with a storage capacity of nearly 200,000 kilowatt-hours are transmitting

Li-ion Battery for Energy Storage Systems (ESS)''s Role in

Jan 3, 2025 · The global Li-ion battery market for energy storage systems is projected to reach $30,850 million by 2033, expanding at a CAGR of 10.8% from 2025 to 2033. The increasing

Battery Market Segmentation | SpringerLink

Feb 6, 2024 · It is hence not surprising that the battery market is highly fragmented into segments with different technological requirements and growth dynamics. This chapter provides an

Energy Storage Industry Chain Segmentation: A Deep Dive

Mar 15, 2025 · Buckle up—we''re dissecting the energy storage industry chain segmentation like a frog in high school biology, but way less messy. Think of the energy storage industry as a

Battery Market Size & Industry Growth 2030

Battery Market Size, Share, Trends & Competitive Analysis By Type: Lithium-ion Battery, Lead-acid Battery, Nickel-Metal Hydride Battery, Nickel-Cadmium Battery, Solid-State Battery, Flow

Energy Storage System Market Report Forecast & Growth 2032

The Energy Storage System market is projected to grow from USD 205.90 Billion in 2022 to USD 375.49 Billion by 2030, at a CAGR of 7.80% during the forecast period.

6 FAQs about [Energy storage battery field industry segmentation]

What is the segmentation of battery market?

Based on application, the market is segmented into automotive batteries, industrial batteries, and portable batteries. The industrial batteries segment emerged as the largest application globally, capturing over 35.0% of the market share in 2024.

What is the global battery market based on end use?

Based on end use, the market is segmented into automobiles, consumer electronics, grid-scale energy storage, telecom, power tools, military & defense, aerospace, and others. The automobile segment has emerged as the largest end use in the global battery industry, capturing over 31.0 % of the market share in 2024.

What is the market share of industrial batteries in 2024?

The industrial batteries segment emerged as the largest application globally, capturing over 35.0% of the market share in 2024. Industrial batteries are designed for heavy-duty applications such as backup power for data centers, grid energy storage, and powering equipment in sectors such as manufacturing, telecommunications, and logistics.

What is a stationary battery?

Stationary batteries are designed for fixed, non-mobile applications and are primarily used for energy storage and backup power. They are commonly employed in uninterruptible power supply (UPS) systems, renewable energy storage, telecommunications, and grid energy storage.

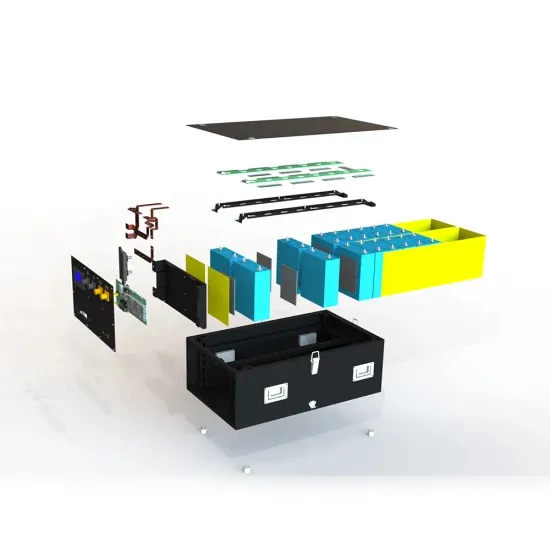

What is a battery energy storage system?

A Battery Energy Storage System (BESS) is a technology that stores electrical energy in batteries for later use. This system allows energy from sources like solar and wind to be saved and used when needed. It ensures a steady power supply even when these renewable sources are not producing electricity.

What are the key factors affecting China battery market growth?

The China battery market growth is attributed to a combination of government support, industrial policy, and technological innovation. Based on application, the market is segmented into automotive batteries, industrial batteries, and portable batteries. Based on type, the market is bifurcated into stationary and motive segments.

Update Information

- Huawei Sodium Battery Energy Storage Industry

- Energy Storage Cabinet Battery Industry Scale Analysis Report

- United Arab Emirates Energy Storage Battery Industry

- Which industry does large battery energy storage belong to

- The industry chain of energy storage battery packs

- New field energy storage battery

- Lithium battery energy storage field recommendations

- Battery energy storage cabinet industry standards and specifications

- Paraguay configures energy storage battery companies

- What is distributed battery energy storage

- Price trend of lithium battery energy storage cabinet in Djibouti

- Bahamas Energy Storage Battery Construction Project

- Czech Brno lithium iron phosphate energy storage battery

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.