Battery energy storage: the challenge of playing

Mar 13, 2024 · China is the leading country for the production of BESS, with a cumulative installed capacity of 10.4GW (2023), which is predicted to reach a

Large-scale battery storage fact sheet

Aug 20, 2024 · These include pumped hydroelectricity, compressed air, liquid air, rail potential energy, and large-scale battery storage. One important REAP initiative is to deploy large-scale

Energy storage in China: Development progress and

Nov 15, 2023 · Thus, this part needs to be summarized. Energy storage has entered the preliminary commercialization stage from the demonstration project stage in China. Therefore,

Energy storage systems: A review of its progress and

Nov 20, 2023 · The following part of the literature covers the paradigm shift and reasoning of energy storage adoption for both new and second-life energy storage (SLESS) among industry

BATTERY MANUFACTURING: THE EMERGING GLOBAL SCENARIO | Industry

Sep 12, 2024 · Consequently, the demand for batteries – the secondary, rechargeable type – is increasing. Though there are many different types of batteries, when it comes to electric

Battery Storage Industry Overview | Umbrex

Batteries store energy when supply exceeds demand and release it when demand exceeds supply, ensuring a reliable and consistent energy flow. This industry is crucial for integrating

What sector does energy storage battery belong to?

Apr 21, 2024 · Energy storage batteries primarily belong to the renewable energy sector, electricity storage industry, and clean technology domain. These batteries play a crucial role in

China Focus: New energy-storage industry booms amid

BEIJING, May 24 (Xinhua) -- U.S. carmaker Tesla broke ground on a mega factory in Shanghai on Thursday to produce its energy-storage batteries Megapack. The move coincided with

The Largest Batteries in the World

Nov 25, 2024 · 10. Notrees Energy Storage System Enter the largest battery in Texas, a 36 MW battery farm launched in 2012 by Duke Energy Renewables. Initially utilizing lead-acid

Global energy storage

Feb 27, 2025 · The global battery industry has been gaining momentum over the last few years, and investments in battery storage and power grids surpassed 450 billion U.S. dollars in 2024.

SelectUSA Industry Guide, State of the Advanced Battery

Mar 1, 2023 · Generally, lithium-ion batteries are the most widely utilized advanced battery, used in various growth sectors such as consumer electronics.3 Large format lithium-ion batteries

Battery Energy Storage System Market Size

Feb 27, 2025 · The global battery industry has been gaining momentum over the last few years, and investments in battery storage and power grids surpassed 450 billion U.S. dollars in 2024.

2025 Energy Storage Battery Market Trends: Which

According to market research, the global energy storage market size is projected to reach $136 billion by 2025, compared to $86 billion in 2023, reflecting a growth of over 58%. The installed

6 FAQs about [Which industry does large battery energy storage belong to ]

Who makes energy storage batteries?

Below are ten of the most influential energy storage battery manufacturers worldwide, covering a wide range of applications from residential to commercial and grid-level storage. The list is in no particular order: 1. CATL (Contemporary Amperex Technology Co., Limited) – China One of the largest manufacturers of lithium-ion batteries globally.

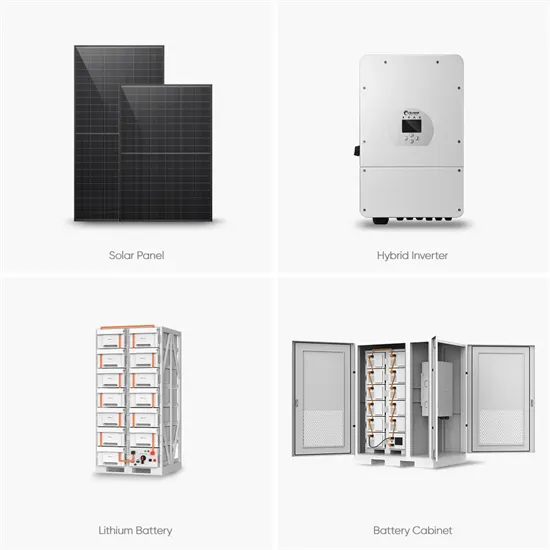

What is a battery energy storage system?

Battery energy storage systems (BESS) are rechargeable batteries that can store energy from different sources and discharge it when required. BESS consists of one or more batteries that can balance the electric grid, deliver backup power, and enhance grid stability.

What are the different types of energy storage technologies?

Pumped hydro, batteries, hydrogen, and thermal storage are a few of the technologies currently in the spotlight. The global battery industry has been gaining momentum over the last few years, and investments in battery storage and power grids surpassed 450 billion U.S. dollars in 2024. Find the latest statistics and facts on energy storage.

Who is the best battery storage company in the world?

Tesla – USA Known for Powerwall, Powerpack, and Megapack, Tesla leads in both residential and grid-scale storage with strong battery technology and system integration expertise. 4. LG Energy Solution – South Korea

What is the market share of battery energy storage systems in 2024?

By connection type, on-grid installations held a 78% share of the battery energy storage system market in 2024; off-grid applications are the fastest-growing segment at 18.5% CAGR. By component, battery packs, and racks represented 63% revenue share in 2024; energy-management software is advancing the fastest, at 20% CAGR.

Which companies offer energy storage solutions?

A joint venture of Siemens and AES, Fluence focuses on utility-scale energy storage with strong system integration and global deployment capabilities. 10. Huawei Digital Power – China Backed by ICT expertise, Huawei offers integrated PV+ESS+EV charging solutions with advanced smart control, widely used in commercial and large-scale energy projects.

Update Information

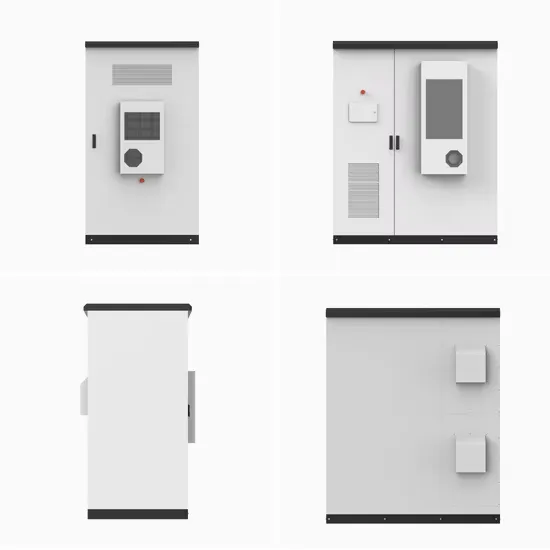

- Which type of energy storage battery cabinet is included

- Which battery companies distribute energy storage

- Which large energy storage cabinet in Colombia is the best to use

- Ukrainian large energy storage battery pump

- Which brand of energy storage lithium battery pack is good

- Large capacity energy storage battery in Cebu Philippines

- Introduction to the Energy Storage Lithium Battery Industry

- Mongolia Large Energy Storage Battery Company

- Which lithium battery for energy storage is cheaper in Hamburg Germany

- South African large capacity energy storage battery manufacturer

- American large capacity energy storage battery manufacturer

- The industry chain of energy storage battery packs

- Which type of energy storage battery is better in Port Vila

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.