FREETOWN ENERGY LITHIUM BATTERY RANKING

Ranking of japanese energy storage lithium batteries MI Matrix analyzes the top 10 companies in Japan Lithium-ion Battery Market, revealing Panasonic Corporation, LG Energy Solution, GS

Freetown liquid-cooled energy storage lithium battery

On August 23, the CATL 5MWh EnerD series liquid-cooled energy storage prefabricated cabin system took lead in successfully realizing the world''''s first mass production delivery. As the

Freetown liquid-cooled energy storage lithium battery

As technology advances and economies of scale come into play, liquid-cooled energy storage battery systems are likely to become increasingly prevalent, reshaping the

Freetown New Energy Battery Brand | EK Solar Energy

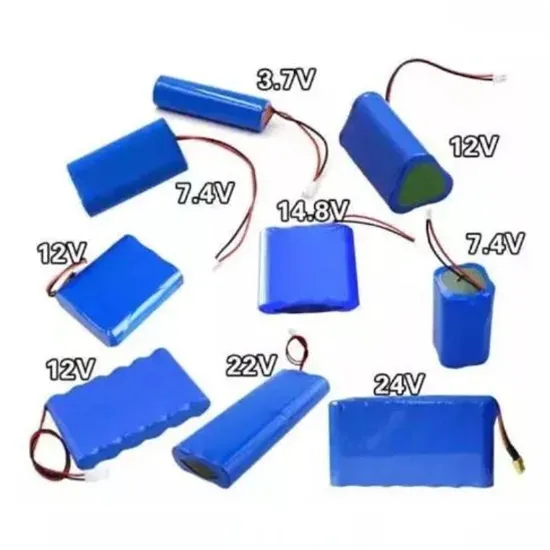

LEMAX lithium battery supplier is a technology-based manufacturer integrating research and development, production, sales and service of lithium battery products, providing

Top 15 Lithium-ion Battery Manufacturers: A Global Review

Jun 26, 2025 · Discover the top 15 lithium-ion battery manufacturers for 2025 in our global guide. We compare the best companies for EV, industrial, and custom lithium batteries to find your

Freetown New Energy Storage Technology: Powering the

Why Freetown''s Energy Storage Tech Is the Talk of the Town Ever wondered how cities will keep lights on when the sun isn''t shining or wind isn''t blowing? Enter Freetown new energy storage

Freetown Energy Storage Lithium Battery Assembly:

If you''re here, you''re probably wondering: "Why should I care about lithium battery assembly?" Well, whether you''re an energy storage project manager, a renewable energy enthusiast, or

1Q24 Energy-storage cell shipment ranking:

May 10, 2024 · The world shipped 38.82 GWh of energy-storage cells in the first quarter this year, with utility-scale and C&I projects accounting for 34.75 GWh

Haichen Energy Storage Freetown Project: Powering a

Let''s face it – the energy world is changing faster than a TikTok trend. Enter the Haichen Energy Storage Freetown Project, a $120 million battery storage initiative that''s turning heads from

Top 10 global energy storage battery cells by

2 days ago · This article will take you through the ranking of the top 10 global energy storage battery cells in terms of total shipments, provide you with a

Top 10 Global BESS Manufacturers – BESSfinder

May 19, 2025 · Our ranking is based on four key criteria: 1. CATL (Contemporary Amperex Technology Co. Limited) CATL leads through vertical integration, strong LFP battery

Ranking of Freetown Energy Storage Rental Companies

Top PV Manufacturers Financial Stability Ranking Report Q3 2024 Explore the top solar panel manufacturers globally with Sinovoltaics'''' Ranking Report Edition #3-2024. Gain free access to

Top 10 Global BESS Manufacturers – BESSfinder

May 19, 2025 · Introduction The Battery Energy Storage System (BESS) industry has experienced remarkable growth in recent years, driven by the global shift toward renewable energy and the

Ranking of Freetown Energy Storage Lithium Battery

Global energy storage cell, system shipment ranking 1H24 According to InfoLink''''s global lithium-ion battery supply chain database, energy storage cell shipment reached 114.5 GWh in the

6 FAQs about [Freetown Energy Storage Lithium Battery Brand Ranking]

What are the top 10 battery manufacturers in 2024?

Among the top 10 global battery manufacturers (power + energy storage) in 2024, six are Chinese companies: CATL, BYD, EVE Energy, CALB, Gotion High-Tech, and Sunwoda. Three South Korean companies—LG Energy Solution, Samsung SDI, and SK On—along with Japan’s Panasonic also made the list. Part 1. Breakdown of the Top 10 Battery Shipments in 2024

What are the best battery energy storage companies?

When it comes to the 10 Best Battery Energy Storage Companies, industry leaders like BYD, Tesla, MANLY Battery, and CATL set the benchmark with cutting-edge technology and global market dominance.

Who makes energy storage batteries?

Below are ten of the most influential energy storage battery manufacturers worldwide, covering a wide range of applications from residential to commercial and grid-level storage. The list is in no particular order: 1. CATL (Contemporary Amperex Technology Co., Limited) – China One of the largest manufacturers of lithium-ion batteries globally.

Which Chinese energy storage manufacturers are the best for 2023?

In a highly anticipated release, Black Hawk PV has disclosed the top ten rankings of Chinese energy storage manufacturers for 2023. Leading the pack is CATL with an impressive 38.50% market share and a robust shipment volume of 50 GWh.

What are the best battery companies in the world?

1. CATL (Contemporary Amperex Technology Co. Limited) CATL leads through vertical integration, strong LFP battery chemistry, and unmatched scale. 2. Tesla Energy Tesla’s Megapack offers turnkey energy storage with advanced software integration. 3. BYD (Build Your Dreams) BYD is known for its Blade Battery tech and vertical integration. 4. Fluence

What is the capacity of lithium power (energy storage) batteries in China?

Current statistics reveal that as of July this year, the capacity of the lithium power (energy storage) battery industry has reached nearly 1,900 GWh in China. However, the actual utilization rate of lithium power (energy storage) batteries is reported to be less than 50%.

Update Information

- Ranking of safe lithium battery energy storage cabinets

- Battery energy storage cabinet manufacturer brand ranking

- Copenhagen energy storage battery brand ranking

- Energy storage lithium iron phosphate battery life

- Cyprus energy storage low temperature lithium battery

- Latvian lithium-ion energy storage battery brand

- Cairo energy storage lithium battery energy storage cabinet manufacturer

- Price of lithium battery for photovoltaic energy storage in Mumbai India

- New Zealand high voltage energy storage lithium battery assembly

- Energy storage cabinet new energy lithium battery

- Roman Energy Storage Lithium Battery Which one is cheaper

- Energy storage lithium iron phosphate battery 48v

- Sudan lithium battery energy storage

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.