EXPLORING THE POTENTIAL OF LITHIUM PRODUCTION IN SUDAN

This comprehensive article examines and ion batteries, lead-acid batteries, flow batteries, and sodium-ion batteries. energy storage needs. The article also includes a comparative analysis

Microvast battery plant Sudan

Microvast is a leader in the innovation and technology of lithium-ion (Li-ion) batteries. We design, develop, and manufacture premier battery cells, modules, and packs for transportation, heavy

Sudan lithium battery for energy storage

Lithium-ion batteries (LIBs) are widely regarded as established energy storage devices owing to their high energy density, extended cycling life, and rapid charging capabilities. Nevertheless,

MOTOMA case study

Mar 31, 2025 · MOTOMA recently completed a high-efficiency energy storage system installation in Sudan, providing users with a stable, safe, and sustainable energy solution. The inverter''s

Sudan Solar Energy and Battery Storage Market (2025-2031

Market Forecast By Type (On Grid, Off Grid, Hybrid, Grid Connected), By Battery Technology (Lithium ion, Lead Acid, Flow Battery, Solid State), By Application (Residential, Commercial,

Sudan lithium battery for energy storage

Lithium batteries are becoming increasingly important in the electrical energy storage industry as a result of their high specific energy and energy density. The literature provides a

Sudan Lithium-Ion Battery Energy Storage System Market

Historical Data and Forecast of Sudan Lithium-Ion Battery Energy Storage System Market Revenues & Volume By Industrial Energy Storage Systems for the Period 2021-2031

Sudan energy storage systems and components

Solar energy seems to be the future mainstream energy storage and here is the solar lithium battery pack that can help you store the solar energy. Solar Lithium Battery Packs & Energy

Exploring the Potential of Lithium Production in

Apr 20, 2023 · Battery Production and Other Industries Lithium carbonate is a critical component in lithium-ion batteries, which are used in electric vehicles

Sudan''s New Energy Storage Industry Project: Lighting Up

Enter Sudan''s new energy storage industry project, where solar panels meet cutting-edge batteries to rewrite the country''s energy script. With 59% electrification rates and heavy fossil

SOUTH SUDAN LITHIUM BATTERY ENERGY STORAGE

Are lithium ion batteries flammable? Lithium Ion Batteries Hazard and Use Assessment Phase IIB - Flammability Characterization of Li-ion Batteries for Storage Protection This report presents

Sudan lithium battery for energy storage

Closeup of battery modules at Moss Landing Energy Storage Facility. Image: Vistra Energy. An incident which caused batteries to short has taken offline Phase II of Moss Landing Energy

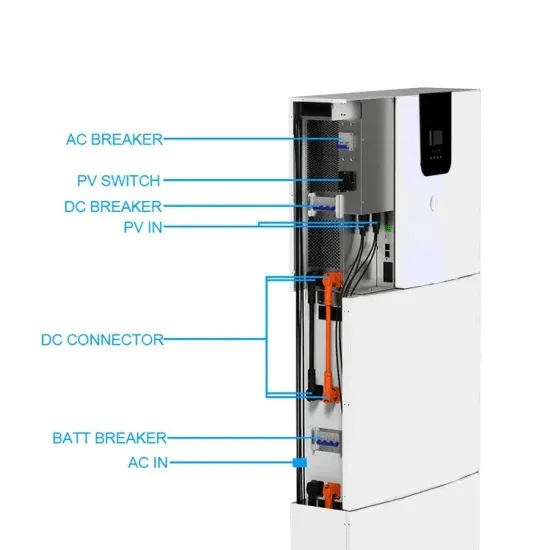

The 5KWH/10KWH lithium battery is a robust and high

Product Vertiv(TM) HPL Lithium-Ion Battery Energy Storage System. Designed by data center experts for data center users, the Vertiv(TM) HPL battery cabinet brings you cutting edge

Update Information

- Application of lithium battery energy storage battery in St Petersburg Russia

- South Korea s lithium battery energy storage demand trend

- Harare lithium battery energy storage container project

- Mali New Energy Lithium Battery Energy Storage Project

- Nicaragua Energy Storage Lithium Battery Export Company

- 1gw energy storage lithium battery investment

- Evaluation of energy storage cabinet lithium battery

- Ouagadougou liquid-cooled energy storage cabinet system lithium battery pack

- Use of lithium battery for energy storage

- Price of container energy storage lithium battery

- Ma Lithium Battery Energy Storage System Solution

- Togo Energy Storage System Lithium Battery Module

- Colombian lithium battery energy storage prices

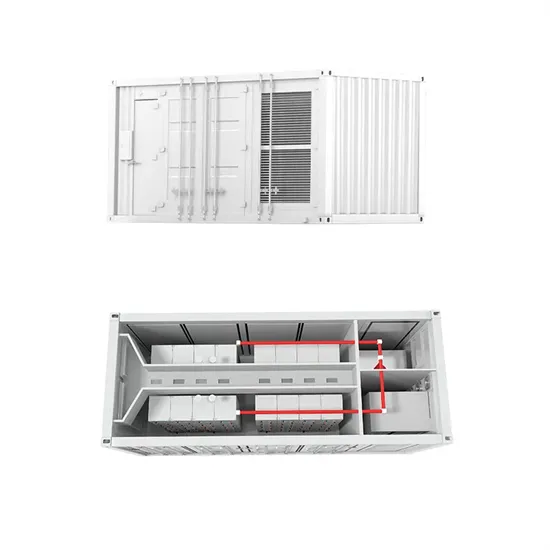

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.