Colombian home energy storage battery production company

A detailed review of the most promising energy storage companies of 2025 and all you need to know for investors and technology enthusiasts. they are covering both residential and

Colombian lithium battery energy storage

The Cochrane Thermal Power - Lithium Ion Battery Energy Storage System is a 20,000kW energy storage project located in Mejillones, Antofagasta, Chile. SIN in Colombia; and SADI in

Colombia Battery Energy Storage Market (2025-2031) | Share

Key trends in the market include a rise in utility-scale battery storage projects to support grid stability and reduce reliance on fossil fuels, as well as a growing interest in behind-the-meter

Prices of Lithium Batteries: A Comprehensive Analysis

Apr 11, 2025 · Lithium battery prices fluctuate due to raw material costs (e.g., lithium, cobalt), manufacturing innovations, geopolitical factors, and demand surges from EVs and renewable

Lithium Prices Today, Lithium Price Charts • Carbon Credits

1 day ago · The OECD provides a comprehensive framework for determining the price of lithium. Here are the main factors that affect lithium price: Market Conditions and Demand: The surge

Colombian backup energy storage battery

In order to buy the best lithium battery in Canada, including lithium-ion batteries, 12V LiFePO4 batteries, and deep cycle solar batteries, which are the most common type of battery used in

BESS Costs Analysis: Understanding the True Costs of Battery Energy

Aug 29, 2024 · Exencell, as a leader in the high-end energy storage battery market, has always been committed to providing clean and green energy to our global partners, continuously

Colombia Energy Storage Lithium Battery Price: Trends,

May 10, 2025 · As of early 2025, lithium iron phosphate (LFP) battery cells for energy storage in Colombia hover around $90–$130 per kWh, while complete systems (including inverters and

Colombian household energy storage power supply

Fund Colombia »Canadian Solar wins 45 MW solar battery storage Located in the city of Barranquilla in northern Colombia, this project will consist of a 45 MWh lithium-ion battery

South America Energy Storage Battery Prices: What You

Jul 4, 2024 · Lithium carbonate prices did the cha-cha last year – from $70/kg to $25/kg and back up. But savvy buyers are now eyeing sodium-ion batteries. A Colombian wind farm recently

Energy Storage Prices in Medellin Trends Costs and Future

Current Energy Storage Price Trends in Medellin Over the past three years, energy storage prices in Medellin have dropped by approximately 22%, according to data from the Colombian

Lack of regulation slowing down BESS in Latin

Oct 17, 2024 · Image: Jonathan Touriño Jacobo / Energy-storage.news. A lack of regulation and policy regarding battery energy storage systems (BESS) is

colombian energy storage lithium battery company

Grid-Scale Battery Energy Storage for Arbitrage Purposes: A Colombian Case Colombian energy price difference between 19 May 2019 and 19 May 2020. Another point to consider is

Lithium Batteries in Colombia: Energy Revolution Ahead?

Colombia''s energy landscape is at a crossroads. With fossil fuels powering 70% of its grid and renewable integration stuck at 12%, the nation urgently needs scalable storage solutions.

Colombia lithium battery energy storage project

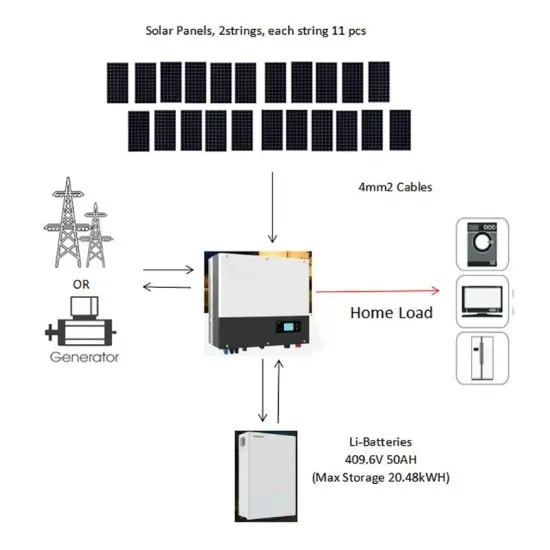

Containerized lithium-ion battery energy storage system (BESS) 22.5 acres of privately held land site location; Features metal storage containers that will house racks of battery modules

1MWh Battery Energy Storage System Prices

Jan 6, 2025 · The current market prices have shown a downward trend, with the average price of lithium-ion battery energy storage systems reaching new lows in 2024. However, future price

Lithium-Ion Battery Pack Prices See Largest Drop Since

Dec 10, 2024 · Lithium-ion battery pack prices dropped 20% from 2023 to a record low of $115 per kilowatt-hour, according to analysis by research provider BloombergNEF (BNEF). Factors

6 FAQs about [Colombian lithium battery energy storage prices]

How does the OECD determine the price of lithium?

The OECD provides a comprehensive framework for determining the price of lithium. Here are the main factors that affect lithium price: Market Conditions and Demand: The surge in demand from electric vehicles, portable electronic devices, and energy storage options significantly influences lithium demand.

Why is lithium a commodity in China?

China produces an estimated 80% of the entire world’s lithium-ion batteries each year, and about 60% of all electric vehicle batteries. As a result, Chinese prices for battery-grade lithium (i.e. lithium carbonate with over 99.5% purity) have become one of the foremost proxies for the price performance of lithium as a commodity.

Why did lithium-ion battery prices drop 20% from 2023?

Lithium-ion battery pack prices dropped 20% from 2023 to a record low of $115 per kilowatt-hour, according to analysis by research provider BloombergNEF (BNEF). Factors driving the decline include cell manufacturing overcapacity, economies of scale, low metal and component prices, adoption of lower-cost lithium-

Who provides the lithium commodity price?

We provide the lithium commodity price for the following: Fastmarkets’ mission is to meet the market’s data requirements honestly and independently, acting with integrity and care to ensure that the trust and confidence placed in the reliability of our pricing methodologies is maintained.

Why should you trade with Iosco-compliant lithium price data?

Trade with lithium price data that is unbiased, IOSCO-compliant and widely used across the energy commodity markets. Our lithium prices are market-reflective, assessing both the buy- and sell-side of transactions.

What is the demand for lithium-ion batteries in 2024?

That is more than 2.5 times annual demand for lithium-ion batteries in 2024, according to BNEF. While demand across all sectors saw year-on-year growth, the EV market – the biggest demand driver for batteries – grew more slowly than in recent years.

Update Information

- Lithium battery energy storage container prices and base stations

- Venezuela ups liquid cooled energy storage lithium battery EK

- Mali New Energy Lithium Battery Energy Storage Project

- Energy storage lithium iron phosphate and lead carbon battery

- Brazzaville base station lithium battery energy storage 100kw inverter

- Ranking of safe lithium battery energy storage cabinets

- Democratic Republic of Congo outdoor energy storage battery prices

- Which brand of energy storage lithium battery pack is good

- Energy storage lithium iron phosphate battery life

- What are the lithium battery energy storage power stations in Sri Lanka

- Charging time of energy storage lithium battery cabinet

- Banjul energy storage lithium battery manufacturer wholesale

- Sukhumi lithium battery energy storage

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.