Communication Base Station Energy Storage Lithium Battery

Rising Demand for Backup Power Solutions: Communication base stations require dependable backup power systems to prevent downtime during grid failures or power outages, making

Carbon emission assessment of lithium iron phosphate batteries

Nov 1, 2024 · The demand for lithium-ion batteries has been rapidly increasing with the development of new energy vehicles. The cascaded utilization of lithium iron phosphate (LFP)

Emerging Markets for Communication Base Station Li-ion

Apr 1, 2025 · The Communication Base Station Li-ion Battery market is experiencing robust growth, driven by the increasing deployment of 5G and other advanced wireless

Communication Base Station Energy Storage Systems

Powering Connectivity in the 5G Era: A Silent Energy Crisis? As global 5G deployments surge to 1.3 million sites in 2023, have we underestimated the energy storage demands of modern

Lithium battery for communication base station

Battery groups are installed as backup power in most of the base stations in case of power outages due to severe weathers or human-driven accidents, particularly in remote areas. The

Analyzing Communication Base Station Li-ion Battery:

Mar 29, 2025 · The Communication Base Station Li-ion Battery market is experiencing robust growth, driven by the expanding global network infrastructure and the increasing demand for

Communication Base Station Energy Storage Lithium Battery

Apr 6, 2025 · The expanding 5G network rollout globally is a primary catalyst, necessitating higher energy capacity and stable power supply for base stations. Furthermore, the shift towards

5G communication iron phosphate battery -Lithium -|stacking

Apr 3, 2023 · At present, the world''s mainstream operators are actively preparing for 5G, 5G commercial base station to drive the demand for lithium iron phosphate cells. The trial of the

What are the characteristics of communication base stations and lithium

grid-side projects and the development of 5G base stations have brought changes and opportunities to the industry, and the communication energy storage market is regarded by

Can telecom lithium batteries be used in 5G telecom base stations?

Jul 1, 2025 · With fast - charging lithium batteries, the base station can return to full operation in a shorter period, ensuring seamless communication for users. Lithium batteries have a very low

Battery for Communication Base Stations Market | Size

One of the key trends shaping the communication base station battery market is the shift towards lithium-ion batteries from traditional lead-acid batteries. Lithium-ion batteries offer higher

Requirements of communication equipment and communication base stations

Sep 1, 2021 · Lithium iron phosphate batteries are suitable for efficient work in communication base stations in harsh environments with high ambient temperature, small computer room

Challenges to Overcome in Communication Base Station

Apr 20, 2025 · The Communication Base Station Energy Storage Lithium Battery market is experiencing robust growth, driven by the increasing demand for reliable and efficient power

Energy Storage in Telecom Base Stations: Innovations

With the relentless global expansion of 5G networks and the increasing demand for data, communication base stations face unprecedented challenges in ensuring uninterrupted power

What is the purpose of batteries at telecom base

Feb 10, 2025 · Telecom batteries refer to batteries that are used as a backup power source for wireless communications base stations. In the event that an

What are the characteristics of communication base stations and lithium

The construction of lithium batteries for communication base stations at home and abroad is in full swing. 1) The Asia-Pacific market in general has huge market potential, base station

Lithium battery is the magic weapon for

Jan 13, 2021 · Intelligent energy storage lithium battery can effectively protect the base station battery in the event of the accidental short circuit, lightning shock,

A critical review of recent progress on lithium ion batteries

May 1, 2025 · Abstract Li-based batteries are significantly advanced in both the commercial and research spheres during the past 30 years. The history of lithium-based batteries is rife with

【MANLY Battery】Lithium batteries for communication base stations

Mar 6, 2021 · In the future, especially after the 5G upgrade, lithium battery companies will no longer simply focus on communication base stations, but on how the communication network

Battery technology for communication base stations

Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles (EVs), yet

Communication Base Station Energy Storage | We Group

Fundamentally, the base station energy storage challenge stems from conflicting operational requirements. Lithium-ion batteries - while efficient - struggle with frequent partial state of

Challenges and opportunities toward long-life lithium-ion batteries

May 30, 2024 · Following this, the degradation modeling and advanced management strategies for achieving long-life batteries are elucidated. Lastly, facing the existing challenges and future

are communication base station energy storage batteries

Feasibility study of power demand response for 5G base station Abstract: In order to ensure the reliability of communication, 5G base stations are usually equipped with lithium iron phosphate

Lithium Battery Base Station: Revolutionizing Telecom

The recent breakthrough in sulfide-based solid-state batteries (Toyota, Jan 2024) promises to revolutionize base station energy storage. When implemented at scale, these innovations

Update Information

- How many lithium-ion batteries are there in a communication base station

- Buildings to build communication base station batteries

- Which communication base station lithium-ion batteries have UPS

- How many communication base station flow batteries are from Huawei

- Catching thieves from Addis Ababa communication base station batteries

- Malabo develops communication base station batteries

- Communication base station lithium-ion battery installation specifications

- The evolution of lithium-ion batteries for communication base stations

- How much is the contract price for communication base station batteries

- The green communication base station on the roof

- Communication base station supercapacitors installed on the roof

- How many energy storage batteries are there in a communication base station

- Do communication base station batteries need to be grounded

Solar Storage Container Market Growth

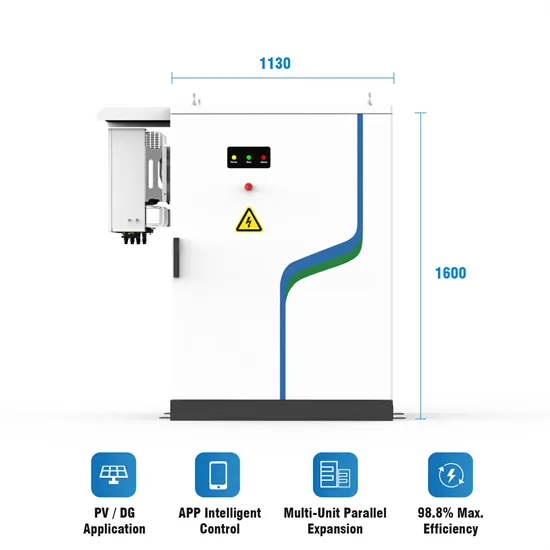

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.