Global Communication Base Station Battery Trends: Region

Mar 31, 2025 · The Communication Base Station Battery market is experiencing robust growth, driven by the expanding deployment of 5G and 4G networks globally. The increasing demand

Lithium-ion Battery For Communication Energy Storage System

Aug 11, 2023 · If so, let''s get to know the right LiFePO4 manufacturers? Specialist Suppliers - We keep comprehensive stocks across the range and and offer excellent technical back-up,

Global Communication Base Station Battery Trends: Region

Mar 31, 2025 · Lithium-ion batteries, particularly Lithium Iron Phosphate (LiFePO4) batteries, dominate the market due to their superior energy density, longer lifespan, and improved safety

Environmental feasibility of secondary use of electric vehicle lithium

May 1, 2020 · Abstract Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles

Lithium-ion Battery Safety

Jan 13, 2025 · Lithium-ion Battery Safety Lithium-ion batteries are one type of rechargeable battery technology (other examples include sodium ion and solid state) that supplies power to

Lithium-ion batteries – Current state of the art and

Dec 15, 2020 · Indication of future research directions towards further improved Li-ion batteries. Proposal of key performance indicators for the mid- & long-term future development. Abstract

Battery technology for communication base stations

In order to ensure the reliability of communication, 5G base stations are usually equipped with lithium iron phosphate cascade batteries with high energy density and high charge and

How many tons of energy storage batteries are

Apr 11, 2024 · For example, fielding a lithium-ion battery, which is prevalent in current installations, a standard configuration could approach 300 kg to 3,000

Carbon emission assessment of lithium iron phosphate batteries

Nov 1, 2024 · The demand for lithium-ion batteries has been rapidly increasing with the development of new energy vehicles. The cascaded utilization of lithium iron phosphate (LFP)

Use of Batteries in the Telecommunications Industry

Mar 18, 2025 · Large telecom offices and cell sites with dedicated generators have 3 to 4 hours of battery reserve time A large telecom office may have over 400 cells and 8000 gallons of

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries. To maximize overall

【MANLY Battery】Lithium batteries for communication base

Mar 6, 2021 · In general, as the demand for 5G communication base stations continues to increase, there will be considerable market space for lithium battery energy storage in the

Lithium-Ion Batteries: How Many Types Exist? A Guide To

Jan 17, 2025 · There are six main types of lithium-ion batteries: NMC (Nickel Manganese Cobalt), NCA (Nickel Cobalt Aluminum Oxide), LFP (Lithium Iron Phosphate), LCO (Lithium Cobalt

The majority of lithium batteries used in communication base

Feb 24, 2025 · At present, most of the lithium-ion batteries used in the field of communication standby power supply are lithium iron phosphate batteries, and a few are ternary lithium-ion

Update Information

- How many batteries are there in a 3 kW communication base station

- Is it okay to build a communication base station with lithium-ion batteries on the roof of a building

- How many energy storage batteries are there in a communication base station

- How much is the contract price for communication base station batteries

- Which communication base station lithium-ion batteries have UPS

- How is the Monrovia communication base station inverter

- How is the wind power of communication base station set up

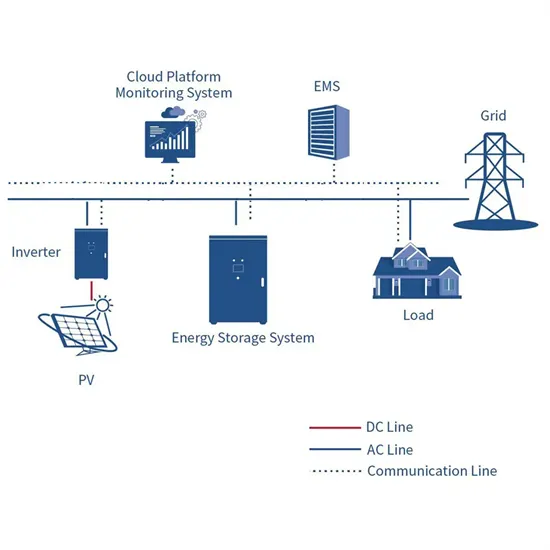

- Communication base station batteries have photovoltaic

- How to build a wind-solar hybrid outdoor power station for communication base stations

- How heavy is the 4G outdoor communication base station battery energy storage system cabinet

- How many nanometers does it take for a communication base station to complement solar power

- How to install photovoltaic power supply for communication base station

- How many communication base station flywheel energy storage companies are there in China

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.