Top 11 Reliable Power Generator Stores in Ho Chi Minh City

Jul 22, 2025 · Võ Gia Trading and Services Co., Ltd. – Proud to be the leading company in Vietnam in the field of power generator consultation, supply, rental, and maintenance. Võ Gia

Generator in Ho Chi Minh | Best Generator from Ho Chi Minh

Discover a wide selection of high-quality Generator in Ho Chi Minh from trusted suppliers. Explore our range of Best Generator from Ho Chi Minh and find the perfect fit for your needs.

generators in vietnam | Find generators manufacturers,

Vinagenset is the leading importer and distributor of generators in Vietnam. We provide OEM services and represent well-known generator brands in the world such as: Cummins, Doosan,

List of Generators Companies in Vietnam

LEVIS MANUFACTURER - Global Power Solution<br/>We are one of the leading manufacturers generator sets in Vietnam. With over 15 year experience solution, making generator, set as

Port of Ho Chi Minh City Container Tracking

The Port of Ho Chi Minh City, located in Vietnam, is a critical hub for Southeast Asian trade. Handling a wide variety of cargo types, the port connects regional and global markets

Vietnam Generators, Manufacturers & Suppliers in Vietnam

Get comprehensive list of Generators suppliers in Vietnam. Registered manufacturers, suppliers & exporters are capable to fulfill the demand of all kind of Generators & related products. Add

generators suppliers and distributors in ho chi minh city, vietnam

Suppliers and Distributors of Generators imported from famous brands such as: CUMMINS, KOHLER, CATERPILLAR, PERKINS, YANMAR, FG WILLSON, etc. Representative

List of Water Generator companies in Vietnam

Dakao Vietnam is a professional supplier of gasoline generator, diesel water pump, brush cutter, knapsack sprayer, electric motor and equipments. The products we produce or co-produced

List of Generators Companies in Ho Chi Minh, Vietnam

Dakao Vietnam is a professional supplier of gasoline generator, diesel water pump, brush cutter, knapsack sprayer, electric motor and equipments. The products we produce or co-produced

List of Food Container companies in Vietnam

NEXUS PRODUCTION Vietnam is located in Ho Chi Minh City which the largest city of - one fastest growing economies & manufacturing centre world. We are privately owned enterprise

Update Information

- Inverter manufacturer in Ho Chi Minh Vietnam

- Vietnam Ho Chi Minh rooftop photovoltaic panel manufacturer

- Vietnam Ho Chi Minh Energy Storage Flywheel

- Vietnam Ho Chi Minh outdoor UPS uninterruptible power supply

- How much does a mobile energy storage system cost in Ho Chi Minh City Vietnam

- Uninterruptible power supply for the Ho Chi Minh computer room in Vietnam

- Niger generator container manufacturer

- Finland container generator manufacturer

- Barbados container energy storage manufacturer price

- The role of the generator container

- Ouagadougou electric energy storage container manufacturer

- South America Container Generator

- European Generator Equipment Container

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

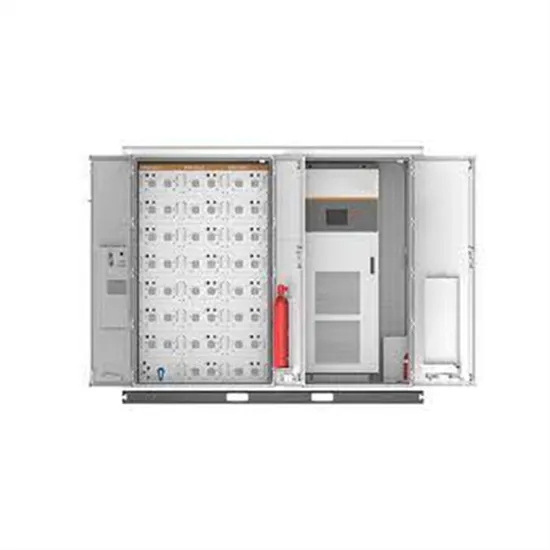

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.