Schneider Electric UPS Solutions

In today''s digital and automated world, ensuring stable and uninterrupted power supply is critical to protecting IT systems, industrial operations, and vital data. Understanding this need,

Vietnam UPS Systems Market | Grow at 7.6% CAGR till 2030

Vietnam UPS System Market Synopsis Vietnam UPS system market witnessed remarkable growth from 2020 to 2023, driven by the nation''s digital transformation and economic

Vietnam UPS Systems Market Forecast Report 2023-2024

Dec 31, 2024 · Vietnam Uninterruptible Power Supply (UPS) System Market Forecast Historical Data and Forecast of Vietnam Uninterruptible Power Supply (UPS) System Market Revenues

Chuyên cung cấp UPS chính hãng giá rẻ tại TPHCM

UPS là từ viết tắt của Uninterruptible Power Supply (dịch ra là bộ cấp nguồn điện liên tục), ở Việt Nam còn có tên gọi là bộ lưu điện. Bộ lưu điện UPS hoạt động

Vietnam UPS Systems Market 2014-2017 & 2018-2024:

Jul 11, 2025 · Vietnam Uninterruptible Power Supply (UPS) Systems Market is projected to grow at a CAGR of 4.7% during 2018-24. UPS systems are witnessing mounting adoption by

Uninterruptible power supply Import Data of Vietnam to Ho chi minh

Get detailed Customs Import data of Uninterruptible power supply based on shipping bills to Ho chi minh port with HS codes, countries, port, price, date, and quantity at Exim Trade Data.

Vietnam Data Center Uninterruptable Power Supply (UPS)

Aug 17, 2025 · Vietnam''s Data Center Uninterruptible Power Supply (UPS) market is driven by regional growth, particularly in Southeast and Northern Vietnam, where urbanization and

Eaton joins hands with Digiworld to distribute UPS

Apr 12, 2025 · Within the framework of the cooperation, Digiworld will become the official distributor of Eaton UPS products in Vietnam. Eaton''s single-phase UPS solutions provide

Import Data of Uninterruptible power supply under HS Code

Find the latest Import data of Uninterruptible power supply under HS code 85049020 based on shipping details from Vietnam to Singapore at Ho chi minh with importers, buyers, quantity,

Uninterruptible power supply equipment for power distribution in Ho Chi

Therefore, using UPS for Data center is the optimal solution to help ensure continuous and uninterrupted power supply 24/7, avoiding sudden power outages, voltage surges, electric

Vietnam UPS Systems Market Forecast By KVA Ratings,

Jan 2, 2025 · Vietnam Uninterruptible Power Supply (UPS) System Market Revenue Ranking, by Companies, 2023 Competitive Benchmarking Company Profiles Eaton Corporation Plc

Import Data of Uninterruptible power supply under HS Code

Find the latest Import data of Uninterruptible power supply under HS code 85044011 based on shipping details from Vietnam to Taiwan at Ho chi minh with importers, buyers, quantity, and

uninterruptible power supply (ups) in ho chi minh city, vietnam

Viet Linh Company Limited Last updated: 18/8/2023 83/24 Bach Dang St., Ward 2, Tan Binh Dist., Ho Chi Minh City, Vietnam +84 28 38955408, 38486750, +84 913615662

Buy UPS uninterruptible power supply in Ho Chi Minh Vietnam

Get latest Vietnam Import Data of Uninterruptible power supply under HS Code 85044011 from Taiwan to Ho chi minh port. Discover year wise import value for Uninterruptible power supply

Import Data of Uninterruptible power supply under HS Code

Find the latest Import data of Uninterruptible power supply under HS code 85049020 based on shipping details from Vietnam to Italy at Ho chi minh with importers, buyers, quantity, and date

Vietnam UPS Systems Market Forecast Report 2023-2024

Dec 31, 2024 · The country''s push towards establishing a $45 billion digital economy by 2025 fueled IT adoption and investments in high-tech hubs like Ho Chi Minh City. This surge in

uninterruptible power supply (ups) in ho chi minh city, vietnam

32/4A8 Tan Thoi Hiep 7, Tan Thoi Hiep Ward, District 12, Ho Chi Minh City, Vietnam +84 28 62509902 BY YELLOW PAGES CATEGORY: Uninterruptible power supply (UPS) in ho chi

6 FAQs about [Vietnam Ho Chi Minh outdoor UPS uninterruptible power supply]

What is Vietnam uninterruptible power supply (UPS) systems market?

Vietnam Uninterruptible Power Supply (UPS) Systems Market is projected to grow at a CAGR of 4.7% during 2018-24. UPS systems are witnessing mounting adoption by different end-user applications ranging from residential households, small commercial offices to large industrial enterprises.

What drives Vietnam's data center uninterruptible power supply market?

Vietnam’s Data Center Uninterruptible Power Supply (UPS) market is driven by regional growth, particularly in Southeast and Northern Vietnam, where urbanization and digital infrastructure development are rapidly expanding.

What projects are driving demand for ups in Ho Chi Minh city?

Notable projects driving demand included Ho Chi Minh City's iconic Landmark 81 skyscraper, the massive Vincom Mega Mall Royal City retail complex, and the new JW Marriott Hanoi luxury hotel fueling the demand for UPS in the country. Key Attractiveness of the Report

Who dominates the UPS market in Vietnam?

Major players such as Schneider Electric, , Siemens, Eaton, and General Electric dominate the market with advanced UPS technologies. Southeast and Northern Vietnam lead the market due to higher IT infrastructure investments and growing digital economy initiatives. Rising Concerns Over Power Reliability and Infrastructure Resilience

Why is Vietnam's UPS system market growing in 2023?

Vietnam UPS system market witnessed remarkable growth from 2020 to 2023, driven by the nation's digital transformation and economic development initiatives. The country's push towards establishing a $45 billion digital economy by 2025 fueled IT adoption and investments in high-tech hubs like Ho Chi Minh City.

Why did commercial projects acquire the highest revenue share in Vietnam's ups market?

Commercial projects acquired the highest revenue share in Vietnam's UPS system market in 2023 owing to the rapid expansion of office complexes, retail centers, and hospitality developments across major cities. These commercial endeavors necessitated reliable UPS solutions to safeguard critical operations against power disruptions.

Update Information

- Huawei Vietnam Ho Chi Minh Outdoor Power Supply Factory

- Outdoor power supply produced in Ho Chi Minh Vietnam

- Mogadishu substation UPS uninterruptible power supply

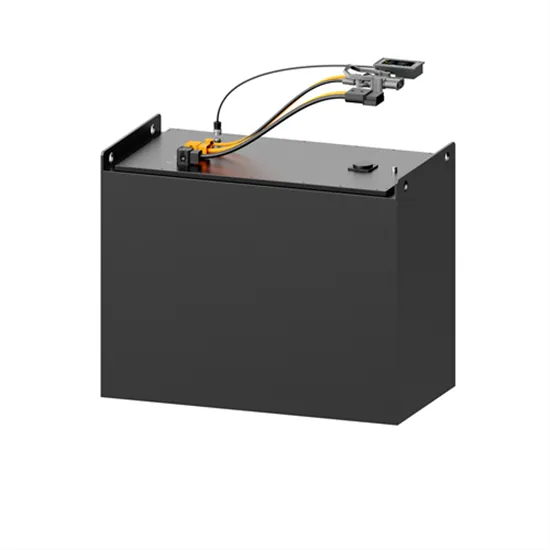

- ATa ups uninterruptible power supply

- Brazil processing UPS uninterruptible power supply wholesaler

- Fiji ups uninterruptible power supply price

- Which brand should I choose for UPS uninterruptible power supply equipment

- Which brand of UPS uninterruptible power supply is good in Haiti

- Modular UPS uninterruptible power supply in Alexandria Egypt

- Ups uninterruptible power supply backup battery

- How much does Sierra Leone medical UPS uninterruptible power supply cost

- Purchase of medical UPS uninterruptible power supply in Hanoi

- How much does a Japanese UPS uninterruptible power supply cost

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.