apia containerized photovoltaic energy storage price list

Triple-layer optimization of distributed photovoltaic energy storage Subsequently, the energy storage system is configured according to user energy consumption patterns, PV power

Battery Energy Storage System Container | BESS

Aug 18, 2025 · Factory Direct Supply: We offer direct factory pricing for our containerized battery storage solutions. As a leading container energy storage system manufacturer, we ensure the

BESS Energy Container Tariff 2024: Trends, Challenges, and

Jan 26, 2025 · By 2024, a 20-foot DC container for BESS in the U.S. is expected to decline significantly by 18% to $148/kWh from $180/kWh in 2023. That is a nearly 50% fall from the

Apia energy storage power station

According to the dynamic distribution mode of the above energy storage power stations, when the system energy storage output power is stored, the energy storage power station that is in the

BESS (Battery Energy Storage Systems)

Boost energy storage with Industrial/Commercial & Home BESS, powered by lithium batteries. Ensure grid stability, savings, & backups. Plus, power base stations with We Energy

apia energy storage lithium battery project

These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable-energy generation, helping alternatives

Cost models for battery energy storage systems

Oct 8, 2018 · The study presents mean values on the levelized cost of storage (LCOS) metric based on several existing cost estimations and market data on energy storage regarding three

US-Made DC Containers to Compete with China by 2025

Jan 2, 2024 · CEA states that in 2023, a fully manufactured US DC BESS container will be priced at an average of $256/kWh for delivery in 2024/25. In comparison, a container manufactured in

BESS Prices in US Market to Fall a Further 18% in

Feb 9, 2024 · In this Energy Storage News article, CEA forecasts an 18% price decline for containerized Battery Energy Storage System (BESS) solutions in

6 FAQs about [Apia Energy Storage Station Container BESS Price]

What is a containerized battery energy storage system?

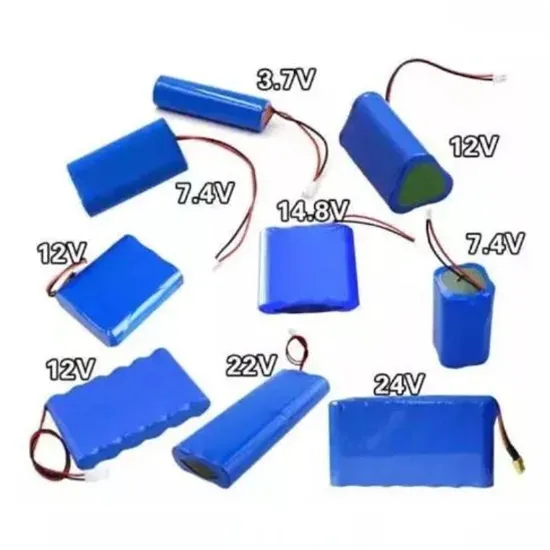

Containerized Battery Energy Storage Systems (BESS) are essentially large batteries housed within storage containers. These systems are designed to store energy from renewable sources or the grid and release it when required. This setup offers a modular and scalable solution to energy storage.

What is a battery energy storage system (BESS)?

The amount of renewable energy capacity added to energy systems around the world grew by 50% in 2023, reaching almost 510 gigawatts. In this rapidly evolving landscape, Battery Energy Storage Systems (BESS) have emerged as a pivotal technology, offering a reliable solution for storing energy and ensuring its availability when needed.

What is the Bess Price forecasting report?

The BESS Price Forecasting Report provides an in-depth four-year forecast for LFP and NMC battery systems, shedding light on market dynamics, supply, and demand. With detailed "all-in" pricing breakdowns tailored for key markets like Western Europe and the U.S., the report offers invaluable insights for stakeholders.

What is CEA's Bess Price forecasting report for Q3 2023?

Download the free report sample of CEA’s BESS Price Forecasting Report for Q3 2023 by completing the form on the right. The BESS Price Forecasting Report provides an in-depth four-year forecast for LFP and NMC battery systems, shedding light on market dynamics, supply, and demand.

What are the benefits of a Bess energy storage system?

• Flywheels: Store energy in the form of kinetic energy, suitable for short-term storage and high-power applications. BESS offer a range of benefits, from energy independence to cost-effectiveness, that make them integral to modern energy management strategies.

What is a containerized Bess?

Containerized BESS can easily be scaled up or down based on demand, making them suitable for both small-scale and large-scale applications, from powering a residential home, to storing energy at a wind farm.

Update Information

- Spanish energy storage container power station price

- Ecuador container energy storage BESS price

- Energy storage container power station price inquiry

- Stockholm container energy storage BESS price

- Small Energy Storage Power Station Container Price

- North Asia container energy storage cabinet factory price

- How much is the price of the Bahamas energy storage cabinet container

- Liquid Cooling Energy Storage Container Base Station

- Liquid Cooling Energy Storage Container Price in Cebu Philippines

- Havana Liquid Cooling Energy Storage Container Selling Price

- Ngerulmud sodium sulfur battery energy storage container price

- Energy storage battery container price trend

- Container energy storage function ESS power base station

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.