BATTERY ENERGY STORAGE SYSTEM CONTAINER, BESS

Apr 8, 2024 · TLS OFFSHORE CONTAINERS /TLS ENERGY Battery Energy Storage System (BESS) is a containerized solution that is designed to store and manage energy generated

1MW Battery Energy Storage System

4 days ago · MEGATRONS 1MW Battery Energy Storage System is the ideal fit for AC coupled grid and commercial applications. Utilizing Tier 1 280Ah LFP battery cells, each BESS is

Battery Energy Storage System Container | BESS

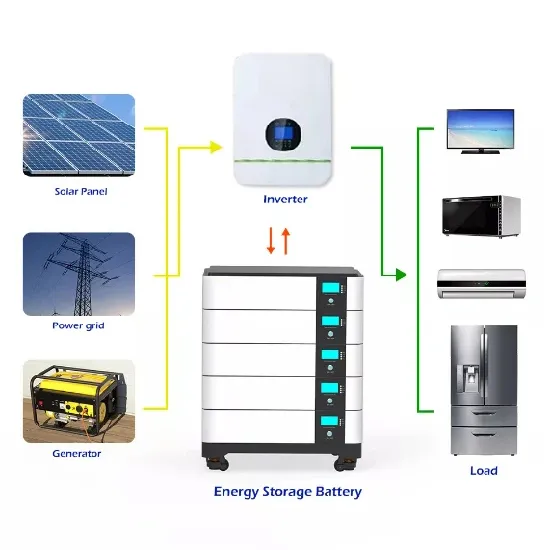

Aug 18, 2025 · A containerized energy storage system (often referred to as BESS container or battery storage container) is a modular unit that houses lithium-ion batteries and related

Europe grid-scale energy storage pricing 2024

Jul 17, 2024 · This report analyses the cost of lithium-ion battery energy storage systems (BESS) within Europe''s grid-scale energy storage segment, providing a 10-year price forecast by both

500kW Battery Energy Storage System

4 days ago · MEGATRONS 500kW Battery Energy Storage Solution is the ideal fit for commercial applications. Utilizing Tier 1 LFP battery cells, each commercial BESS is designed for a install

BESS Prices in US Market to Fall a Further 18% in

Feb 9, 2024 · In this Energy Storage News article, CEA forecasts an 18% price decline for containerized Battery Energy Storage System (BESS) solutions in

Gotion unveils 7MWh BESS as energy density race continues

Mar 6, 2025 · Gotion exhibiting a smaller model of its 7MWh BESS container at an expo in Japan. Image: Gotion. China-based lithium-ion OEM Gotion has launched a 7MWh BESS DC block

BESS Energy Container Tariff 2024: Trends, Challenges, and

Jan 26, 2025 · By 2024, a 20-foot DC container for BESS in the U.S. is expected to decline significantly by 18% to $148/kWh from $180/kWh in 2023. That is a nearly 50% fall from the

BESS Energy Container Tariff 2024: Trends, Challenges, and

Jan 26, 2025 · 2024 Evolution in Pricing of BESS The role of Battery Energy Storage Systems (BESS) is very important in the integration of renewable energy sources into the grid and

The developing BESS market 2024

Jul 29, 2024 · The developing BESS market 2024 Battery energy storage systems (BESS) are playing an increasingly integral role in the transition to a lower-carbon global economy. Below,

Some key takeaways from BloombergNEF''s Energy Storage

Aug 6, 2025 · Some key takeaways from BloombergNEF''s Energy Storage System Cost Survey 2024: 📉 Turnkey energy storage system prices fell 40% year-on-year to a global average of

Battery Energy Storage Systems Container (BESS Container)

Feb 20, 2025 · The **utility-scale renewable energy integration sector** is the largest addressable market for Battery Energy Storage Systems (BESS) container deployments, driven by the

Swedish container energy storage is affordable

14large-scale battery storage systems (BESS) have come online in Sweden to deploy 211 MW /211 MWh into the region. Developer and optimiser Ingrid Capacity and energy storage owner

6 FAQs about [Stockholm container energy storage BESS price]

How much storage capacity does a Bess container have?

Driven by bigger cells sizes and other technology advances, the industry is also increasingly seeing 20-foot BESS containers with 5MWh storage capacity from system integrators and vertically integrated battery manufacturers. Some are even exceeding that capacity, such as CATL with its 6.25MWh Tener solution.

Why are battery energy storage systems (Bess) costs falling?

A growing industry trend towards larger battery cell sizes and higher energy density containers is contributing significantly to falling battery energy storage system (BESS) costs.

Does Sweden have a battery energy storage system?

Sweden has traditionally lagged behind continental Europe in Battery Energy Storage Systems (BESS) growth, but recent developments have propelled rapid expansion. Until 2022, only a few projects were launched, mainly supported by subsidies and specific storage needs.

What happened to battery energy storage systems in Germany?

Small-scale lithium-ion residential battery systems in the German market suggest that between 2014 and 2020, battery energy storage systems (BESS) prices fell by 71%, to USD 776/kWh.

Why is Bess important in Sweden?

Sweden’s renewable energy sector continues to expand rapidly. In 2018, solar and wind energy accounted for just 13% of total electricity consumption, but this figure is projected to reach 40% by 2025. This shift significantly increases the value of energy flexibility, making BESS essential for balancing energy supply and demand.

Will Eneco & Eph build a Bess in the Netherlands?

Vertically integrated utilities Eneco and EPH will build a 50MW/200MWh BESS in the Netherlands via a 50:50 joint venture. Trend towards larger battery cell sizes and higher energy density containers is contributing significantly to falling BESS costs.

Update Information

- Apia Energy Storage Station Container BESS Price

- Ecuador container energy storage BESS price

- Ngerulmud sodium sulfur battery energy storage container price

- Serbia Energy Storage Cabinet Container BESS Company

- Container energy storage battery working price

- Turkmenistan energy storage explosion-proof container BESS

- Container energy storage price structure

- 4-hour energy storage capacity BESS price

- Maseru Energy Storage BESS Price

- Nordic energy storage container price comparison

- Business building commercial park energy storage container price

- North Asia Energy Storage Container BESS Company

- Castrie Liquid Cooled Energy Storage Container Selling Price

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

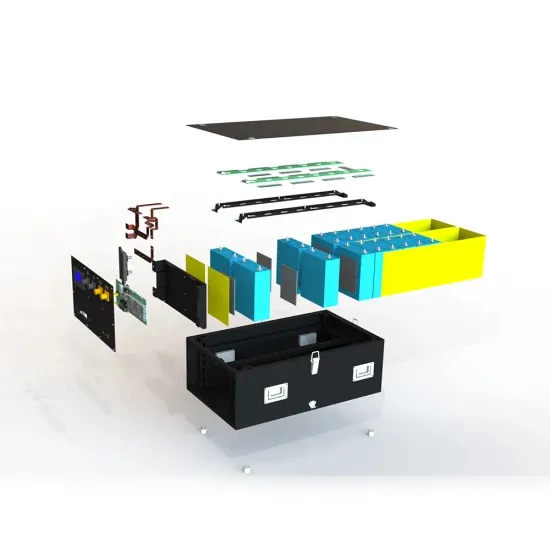

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.