Top Portable Power Supply Companies in Southeast Asia

Summary: Discover leading portable power supply providers in Southeast Asia, their market advantages, and industry trends. Learn how solar-integrated solutions like EK SOLAR''s

Uninterruptible Power Supply Suppliers, all Quality Uninterruptible

Uninterruptible Power Supply, Uninterruptible Power Supply Suppliers Directory - Find variety Uninterruptible Power Supply Suppliers, Manufacturers, Companies from around the World at

Asia-Pacific Industrial Uninterruptible Power Supply (UPS)

In this report, the Asia-Pacific Industrial Uninterruptible Power Supply (UPS) market is valued at USD XX million in 2017 and is expected to reach USD XX million by the end of 2025, growing

What is Uninterruptible Power Supply UPS with Lithium

What is Uninterruptible Power Supply UPS with Lithium Battery Backup Ship to Southeast Asia From China UPS Factory Supported OEM Customizable, M48 manufacturers & suppliers on

Southeast Asia Uninterruptible Power Supply (UPS)

Jul 18, 2025 · Market Report | 2025-04-28 | 110 pages | Mordor Intelligence AVAILABLE LICENSES: - Single User License $4750.00 - Team License (1-7 Users) $5250.00 - Site

What is Shanpu Single-Phase DC Uninterruptible Power Supply

What is Shanpu Single-Phase DC Uninterruptible Power Supply 18W Poe 8800mAh Lithium Battery Household WiFi UPS, 18W MINI UPS 2 manufacturers & suppliers on Video Channel

What is Shanpu UPS Uninterruptible Power Supply for Household

What is Shanpu UPS Uninterruptible Power Supply for Household 220V Desktop Computers, 2kVA Backup Voltage Stabilizer Sp2000 for Power Outage Prevention, sp series video

東南亞不斷電系統 (UPS) -市場佔有率分析、產業趨勢/統計

Jan 5, 2025 · The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include

Asia Pacific Healthcare Uninterruptible Power Supply (UPS)

Jun 26, 2025 · Healthcare Uninterruptible Power Supply (UPS) System Market size is estimated to be USD 1.5 Billion in 2024 and is expected to reach USD 3.

Uninterruptible Power Supply Archives

May 11, 2022 · Recent Articles Philippines DOTr to invest PHP20 billion in the MAPALLA Ferry System July 17, 2024 | Key Developments, Philippines Start of construction on the Koh Samui

Regenerative Uninterruptible Power Supply Ups Market by

Aug 12, 2025 · The Regenerative Uninterruptible Power Supply (UPS) market is experiencing significant growth driven by increasing demand for reliable and sustainable power solutions

Southeast Asia Uninterruptible Power Supply (UPS)

Apr 28, 2025 · The Southeast Asia Uninterruptible Power Supply Market is expected to register a CAGR of greater than 3.3% during the forecast period. The market was moderately impacted

6 FAQs about [Southeast Asia household uninterruptible power supply manufacturers]

How is the Southeast Asian uninterruptible power supply market segmented?

The Southeast Asian uninterruptible power supply (UPS) market is segmented by capacity, type, application, and geography. By capacity, the market is segmented into less than 10 kVA, 10-100 kVA, and above 100 kVA. The market is segmented by type into standby UPS systems, online UPS systems, and line-interactive UPS systems.

Why is the Southeast Asia UPS market growing?

The Southeast Asia UPS market has been witnessing significant growth in recent years. The increasing demand for reliable power supply, rising investments in data centers, and the need for uninterrupted operations in various industries are driving the market growth.

Which ups are available in South East Asia region?

Fuji Electric’s UPS are available in the 1kVA to 2400kVA range for single modules for South East Asia region. For higher ratings, these can be paralleled to deliver 4800 kVA. Fuji Electric's high-efficiency UPS helps in reducing costs, weight, footprint, and heat. For more products, please visit the link below.

What is the demand for ups in Southeast Asia?

Demand from Emerging Economies: Countries such as Vietnam, Indonesia, and the Philippines are witnessing rapid economic growth and urbanization. This creates a significant demand for UPS systems as industries and infrastructure projects expand. Market Dynamics The Southeast Asia UPS market is highly competitive and dynamic.

Does Vietnam have a high demand for UPS systems?

Such growth and investments in Vietnam indicate the rise in the manufacturing sector, which in turn, is expected to increase the demand for UPS systems during the forecast period. The Southeast Asian uninterruptible power supply (UPS) market is moderately fragmented in nature.

What is uninterruptible power supply (UPS)?

Meaning Uninterruptible Power Supply (UPS) is a device that provides backup power when the main power source fails or experiences fluctuations. It ensures a continuous flow of electricity to connected equipment by using stored energy in batteries or flywheels.

Update Information

- How big an uninterruptible power supply should a household use

- Uninterruptible power supply box manufacturers

- Uninterruptible power supply battery manufacturers

- East Asia Small Uninterruptible Power Supply

- Household uninterruptible power supply OEM processing

- Large household UPS uninterruptible power supply

- West Asia UPS Uninterruptible Power Supply 30kva

- Southern European household energy storage power supply manufacturers

- Vietnam Ho Chi Minh outdoor UPS uninterruptible power supply

- Korea Busan Data Center UPS Uninterruptible Power Supply Company

- Dominica Uninterruptible Power Supply Agent

- Svcups uninterruptible power supply 3kva

- Uninterruptible Power Supply for Praia Industry

Solar Storage Container Market Growth

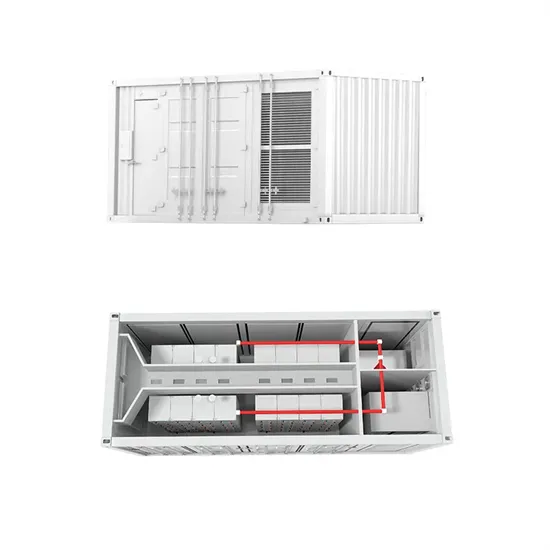

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

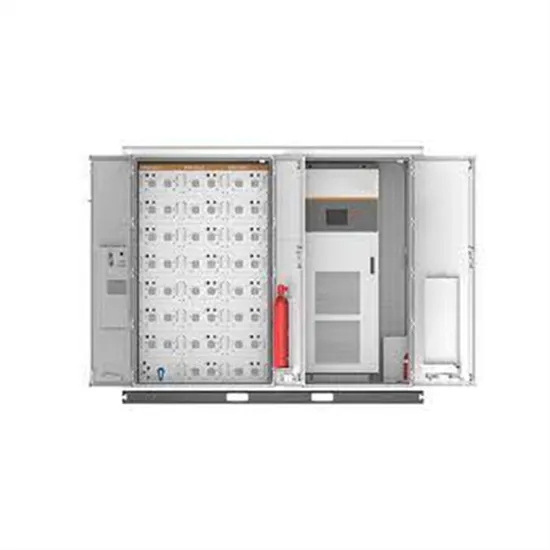

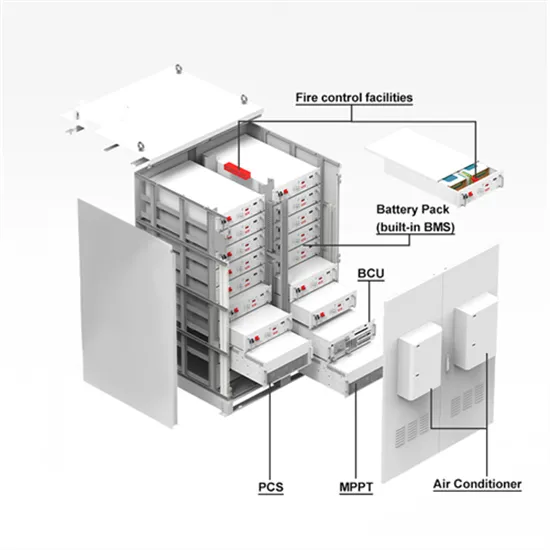

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.