Optimal planning of energy storage system under the business model

Nov 1, 2023 · As the penetration rate of renewable energy increases in the electric power system, the issues of renewable power curtailment and system inertia shortage become more severe.

Energy Storage Industry Report: Energy Storage Business Model

Through the sharing of the past few days, we have learned about the development background of China''s energy storage industry, the overview of the main energy storage technologies, the

Optimal scheduling strategies for electrochemical

Oct 1, 2024 · This paper constructs a revenue model for an independent electrochemical energy storage (EES) power station with the aim of analyzing its full life-cycle economic benefits under

Electrochemical Energy Storage Business Models | Canvas

Apr 2, 2025 · Vizologi is a platform powered by artificial intelligence that searches, analyzes and visualizes the world''s collective business model intelligence to help answer strategic

A study on the energy storage scenarios design and the business model

Sep 1, 2023 · Therefore, this paper focuses on the energy storage scenarios for a big data industrial park and studies the energy storage capacity allocation plan and business model of

Analysis of business models in the energy storage industry

The Journal of Energy Storage focusses on all aspects of energy storage, in particular systems integration, electric grid integration, modelling and analysis, novel energy storage

new energy storage power station business model

China''''s largest single station-type electrochemical energy storage On November 16, Fujian GW-level Ningde Xiapu Energy Storage Power Station (Phase I) of State Grid Times successfully

Economic analysis of energy storage multi-business models

Feb 1, 2021 · With the continuous improvement of China''s electricity market mechanism, a flexible market environment will provide more feasible business models and market space for energy

Battery energy storage system modeling: A combined

Feb 1, 2019 · Battery pack modeling is essential to improve the understanding of large battery energy storage systems, whether for transportation or grid storage. I

Business model of electrochemical energy storage

What is electrochemical energy storage (EES) technology? Electrochemical energy storage (EES) technology, as a new and clean energy technology that enhances the capacity of power

Electrochemical Energy Storage – Li''s Energy and

Rechargeable lithium batteries are electrochemical devices widely used in portable electronics and electric-powered vehicles. A breakthrough in battery performance requires advancements

Progress and prospects of energy storage technology

Jan 1, 2024 · The results show that, in terms of technology types, the annual publication volume and publication ratio of various energy storage types from high to low are: electrochemical

Development and forecasting of electrochemical energy storage

May 10, 2024 · Abstract In this study, the cost and installed capacity of China''s electrochemical energy storage were analyzed using the single-factor experience curve, and the economy of

Lecture 3: Electrochemical Energy Storage

Feb 4, 2025 · electrochemical energy storage system is shown in Figure1. Charge process: When the electrochemical energy system is connected to an external source (connect OB in

Energy storage in China: Development progress and business model

Nov 15, 2023 · According to the different investors, beneficiaries and profit models, the business models of energy storage are temporarily classified into six types, namely the ancillary service

New Energy Storage Business Models and Revenue Levels

Jun 15, 2024 · Result Currently, the cost per kilowatt-hour for novel electrochemical energy storage in China is relatively high, leading to low overall economic benefits. Investment entities

Business model of electrochemical energy storage

Electrochemical energy storage (EES) technology,as a new and clean energy technology that enhances the capacity of power systems to absorb electricity,has become a key area of focus

2020 Energy Storage Industry Summary: A New

Mar 1, 2021 · Despite the effect of COVID-19 on the energy storage industry in 2020, internal industry drivers, external policies, carbon neutralization goals,

Electrochemical energy storage business plan

Energy Conversion and Storage Technologies. As a sustainable and clean technology, EES has been among the most valuable storage options in meeting increasing energy requirements

Electrochemical energy storage business park 2025

Through shared energy storage and other energy storage business models, the application scope of energy storage on the power generation side, transmission and distribution side, and user

Techno-economic assessment and mechanism discussion of

Apr 15, 2024 · Consequently, to enhance the efficiency and economic viability of energy storage power stations, particularly in the domain of electrochemical energy storage, a paradigm shift

New Energy Storage Business Models and Revenue Levels

Jun 15, 2024 · Under the current energy storage market conditions in China, analyzing the application scenarios, business models, and economic benefits of energy storage is

Electrochemical energy storage – a comprehensive guide

Aug 1, 2025 · Initially, electrochemical energy storage technology will be comprehensively interpreted and analyzed from the advantages and disadvantages, use scenarios, technical

''Renewable Energy + Energy Storage'' Business Model

Jan 1, 2024 · Abstract. Recent reforms in the power industry include the promotion of ''dual carbon'' targets, the develop-ment of large-scale and high-penetration, renewable energy and

''Renewable Energy + Energy Storage'' Business Model

Based on the existing research results of business model innovation such as the business model canvas model, this study deconstructs the connotation structure of ''renewable energy+energy

6 FAQs about [Electrochemical Energy Storage Business Model]

What is shared energy storage & other energy storage business models?

Through shared energy storage and other energy storage business models, the application scope of energy storage on the power generation side, transmission and distribution side, and user side will be blurred. And many application scenarios can realize the composite utilization of energy storage according to demand.

Are energy storage business models the future?

The lessons from twelve case studies on energy storage business models give a glimpse of the future and show what players can do today. The advent of new energy storage business models will affect all players in the energy value chain. In this publication we offer some recommendations.

How to realize the large-scale commercialization of energy storage?

Therefore, to realize the large-scale commercialization of energy storage, it is necessary to analyze the business model of energy storage. Providing readers with an overview of energy storage will contribute to the future development of energy storage business models.

What is energy storage & its revenue models?

Energy storage is applied across various segments of the power system, including generation, transmission, distribution, and consumer sides. The roles of energy storage and its revenue models vary with each application. 3.1. Price arbitrage

What is China's energy storage business model?

China is gradually forming an open electricity sales market with diversified competitors. With ancillary services as the main base, the two-part tariff business model is used for electricity price incentives. Due to its flexibility, energy storage should be widely used in competitive models.

What are the emerging energy storage business models?

The independent energy storage model under the spot power market and the shared energy storage model are emerging energy storage business models. They emphasized the independent status of energy storage. The energy storage has truly been upgraded from an auxiliary industry to the main industry.

Update Information

- Huawei s flywheel energy storage business model

- Huawei s energy storage equipment business model

- Middle East Electrochemical Energy Storage System

- Energy Storage Project Business Plan

- Outdoor Energy Storage Vehicle Cooperation Model

- Abu Dhabi City Energy Storage Cabinet Cooperation Model

- Telecom lithium battery energy storage cabinet model

- Ghana energy storage battery model

- Profit model of grid-side energy storage power station

- Abuja containerized energy storage cabinet cooperation model

- Grid-side energy storage model

- Energy storage cabinet battery model

- Profit model of Laayoune grid-side energy storage power station

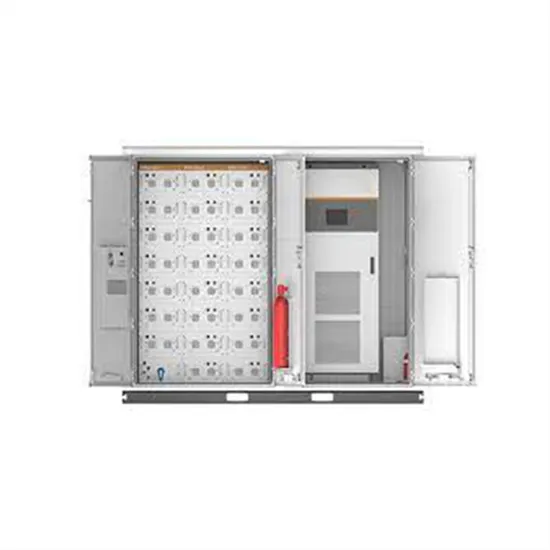

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

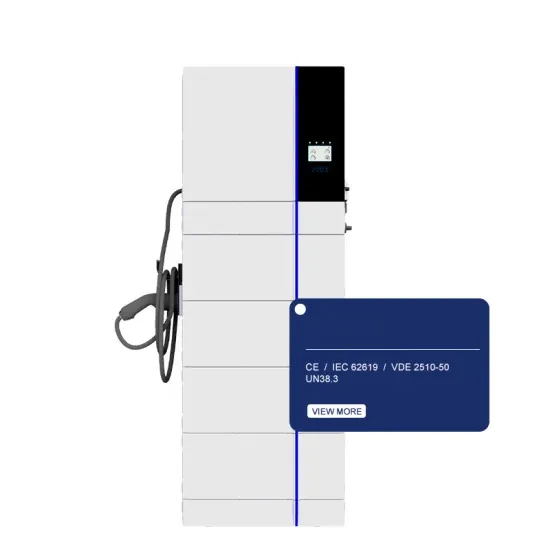

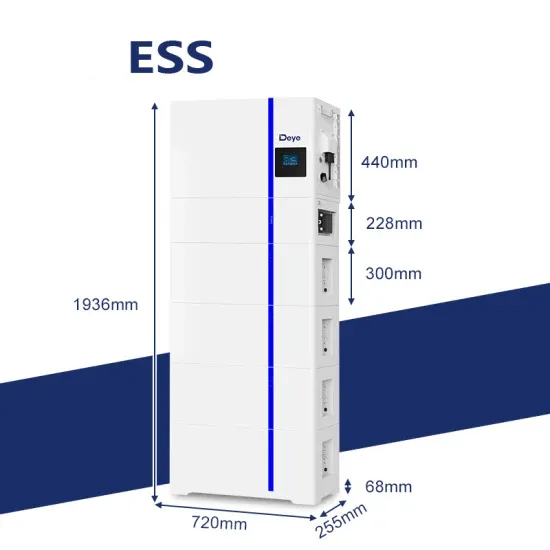

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.