Critical review of energy storage systems

Jan 1, 2021 · This review article critically highlights the latest trends in energy storage applications, both cradle and grave. Several energy storage applications along with their

Powering the Future: The Booming Electrochemical Energy Storage

Jun 6, 2025 · As the region aims to diversify its energy mix and meet ambitious net-zero targets, battery energy storage systems (BESS) are becoming increasingly crucial. This article delves

Middle East and Africa Energy Storage Outlook 2025

Jan 28, 2025 · ''The Middle East and Africa (MEA) Energy Storage Outlook'' analyses key market drivers, barriers, and policies shaping energy storage adoption across grid-scale and

Comprehensive review of energy storage systems

Jul 1, 2024 · The applications of energy storage systems have been reviewed in the last section of this paper including general applications, energy utility applications, renewable energy

Implementation of large-scale Li-ion battery energy storage systems

Feb 15, 2020 · Large-scale Lithium-ion Battery Energy Storage Systems (BESS) are gradually playing a very relevant role within electric networks in Europe, the Middle East and Africa

Powering the Future: The Booming Electrochemical Energy Storage

Jun 6, 2025 · Introduction The Middle East is undergoing a transformative shift in its energy landscape, with electrochemical energy storage emerging as a pivotal player. As the region

Middle East Energy | Energy series Energy Storage in MENA

5 days ago · It discusses current energy storage technologies, including pumped storage, battery energy storage systems (BESS), and concentrated solar power (CSP) plants. What to expect:

Electrochemical Energy Storage Market Report | Global

The global electrochemical energy storage market is poised for substantial growth with an estimated market size of USD 38 billion in 2023, projected to reach USD 102 billion by 2032,

Lecture 3: Electrochemical Energy Storage

Feb 4, 2025 · electrochemical energy storage system is shown in Figure1. Charge process: When the electrochemical energy system is connected to an external source (connect OB in

Middle East Energy | Product Sector | Battery & Energy Storage

Aug 18, 2025 · The Battery & Energy Storage sector at Middle East Energy will serve as the essential connection point for stakeholders across the value chain—from manufacturers and

Electro‐Chemical Battery Energy Storage Systems ‐ A Comprehensive

Aug 10, 2021 · The technology of electro-chemical energy conversion has evolved with time. The concerns are majorly evolving around the implementation aspects of these electrochemical

Energy Storage Trends and Opportunities in Emerging

Aug 17, 2025 · Energy storage deployments in emerging markets worldwide are expected to grow over 40 percent annually in the coming decade, adding approximately 80 GW of new storage

6 FAQs about [Middle East Electrochemical Energy Storage System]

What is energy storage system deployment in MENA?

Energy Storage System deployment in MENA Energy Storage Systems (ESS) play a critical role in the integration of VRE into the power grid, as these systems manage the intermittencies of renewable energy resources and mitigate potential power supply disruptions.

Which energy storage solutions will be the leading energy storage solution in MENA?

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

Which energy storage technology has the most installed capacity in MENA?

Pumped hydro storage (PHS) has the largest share of installed capacity in MENA at 55%, as compared to a global share of 90%. Pumped hydro storage is one of the oldest energy storage technologies, which explains its dominance in the global ESS market.

Can energy storage be integrated in MENA?

Although the energy storage market in MENA is bound to grow, several barriers exist that hinder the integration of ESS and the ramping up of investments. Financial, regulatory, and market barriers need to be addressed via policy tools that lay the foundations for an evolved power market to integrate the deployed ESS.

What is an energy storage system?

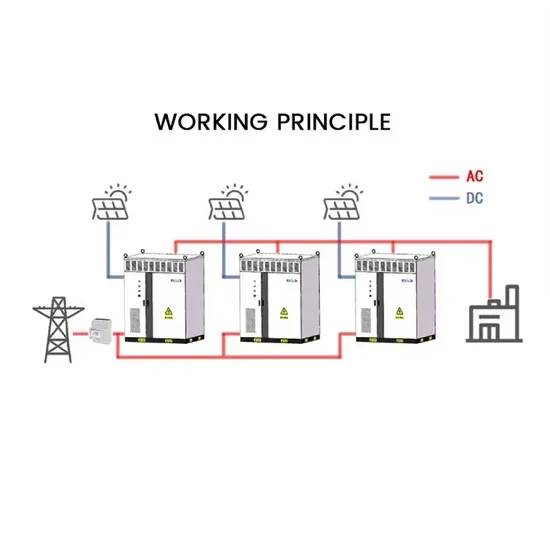

An energy storage system is charged from the grid or by on-site generation to be used at a later time to take advantage of price diferentials. Energy storage is used instead of upgrading the transmission network infrastructure. The storage system provides the grid with the necessary output to ensure the voltage level on the network remains steady.

Is ESS a viable technology in MENA?

With the lack of a long-duration grid-scale ESS to date, ESS is still viewed as an emerging technology in MENA and associated with high technology and financing risks by the private sector. Accordingly, ESS projects might require more equity spending as compared to conventional power and renewables projects for the short to medium term.

Update Information

- Middle East Portable Emergency Energy Storage Power Supply

- Middle East lithium battery portable energy storage manufacturer

- Huawei s energy storage projects in the Middle East

- Middle East 10kw energy storage solution

- Middle East large capacity energy storage battery

- Middle East zinc-bromine flow energy storage battery

- Deep Valley Electricity Price Electrochemical Energy Storage

- Lithuania Electrochemical Energy Storage

- Electricity cost of electrochemical energy storage system

- European Electrochemical Energy Storage System Quote

- Practical application of electrochemical energy storage

- Chemical bond energy storage and electrochemical energy storage

- Electrochemical Energy Storage in Latvia

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.