Battery for Communication Base Stations Market

The Battery for Communication Base Stations market can be segmented by battery type, including lithium-ion, lead acid, nickel cadmium, and others. Among these, lithium-ion batteries

Carbon emission assessment of lithium iron phosphate batteries

Nov 1, 2024 · The demand for lithium-ion batteries has been rapidly increasing with the development of new energy vehicles. The cascaded utilization of lithium iron phosphate (LFP)

What are the characteristics of communication base stations and lithium

grid-side projects and the development of 5G base stations have brought changes and opportunities to the industry, and the communication energy storage market is regarded by

Environmental feasibility of secondary use of electric vehicle lithium

Jan 22, 2020 · Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles (EVs), yet

Lithium Battery for Communication Base Stations Market

The global Lithium Battery for Communication Base Stations market is poised to experience significant growth, with the market size expected to expand from USD 3.5 billion in 2023 to an

Battery for base stations of mobile operators

Buy Basic Link Lithium Ion Batteries - Battery Specifications Lithium iron phosphate batteries differ in a number of performance indicators: light weight, compactness - lithium iron phosphate

Application of lithium iron phosphate batteries for base

How to charge lithium iron phosphate batteries? For Li-ion battery, it is best to use constant current and voltage charging method, if the NiCad battery is charged by the charger-DV

Lithium iron phosphate battery for communication base stations

Our range of products is designed to meet the diverse needs of base station energy storage. From high-capacity lithium-ion batteries to advanced energy management systems, each

Environmental-economic analysis of the secondary use of

Nov 30, 2022 · This study examines the environmental and economic feasibility of using repurposed spent electric vehicle (EV) lithium-ion batteries (LIBs) in the ESS of

Lithium Battery for Communication and Energy Storage:

As global data traffic surges 35% annually, lithium battery systems have become the backbone of communication networks and renewable energy storage. But can current technologies keep

5G base station application of lithium iron phosphate battery

Jan 19, 2021 5G base station application of lithium iron phosphate battery advantages rolling lead-acid batteries With the pilot and commercial use of 5G systems, the large power consumption

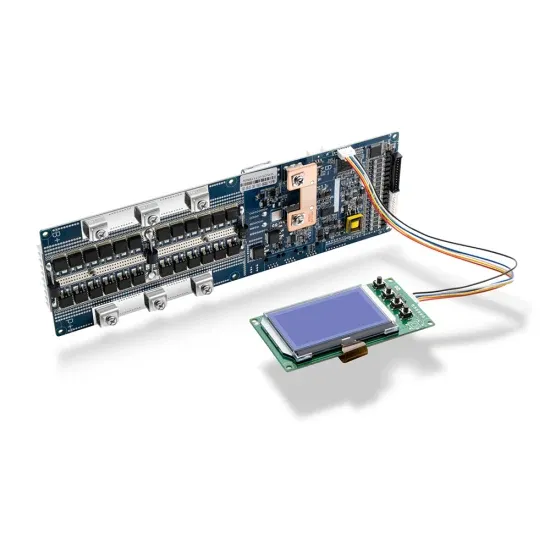

Battery Management Systems for Telecom Base

Mar 17, 2025 · In this article, we explore the application of BMS in telecom base backup batteries, examining its critical role, key features, challenges, and

Lithium Iron Phosphate Battery for Communication Base

The Silent Crisis in Telecom Power Systems Have you ever wondered why 23% of mobile network outages occur during power fluctuations? As global data traffic surges by 35%

Lithium Iron Batteries for Telecommunications Base Stations

REVOV''s lithium iron phosphate (LiFePO4) batteries are ideal telecom base station batteries. These batteries offer reliable, cost-effective backup power for communication networks. They

Can You Use an 18V Charger for a 14.4V Battery?

Jul 23, 2025 · Modern lithium-ion and NiMH batteries demand precise voltage inputs. An 18V charger forces excessive energy into a 14.4V battery, like overfilling a balloon until it bursts.

Lithium battery for communication base station

In this paper, we closely examine the base station features and backup battery features from a 1.5-year dataset of a major cellular service provider, including 4,206 base stations distributed

Can telecom lithium batteries be used in 5G telecom base stations?

Jul 1, 2025 · It is easy to install and provides reliable backup power. Conclusion In conclusion, telecom lithium batteries can indeed be used in 5G telecom base stations. Their high energy

Carbon emission assessment of lithium iron phosphate

Jul 29, 2024 · The demand for lithium-ion batteries has been rapidly increasing with the development of new energy vehicles. The cascaded utilization of lithium iron phosphate (LFP)

Microsoft Word

Jan 3, 2021 · Lithium ion battery is also a better choice for various Telecom Applications as well as other applications. The demand of these batteries has been increasing rapidly. This paper

Carbon emission assessment of lithium iron phosphate batteries

Nov 1, 2024 · This study conducts a comparative assessment of the environmental impact of new and cascaded LFP batteries applied in communication base stations using a life cycle

What is the purpose of batteries at telecom base

Feb 10, 2025 · The lead storage battery is the most widely used energy storage battery in the current communication power supply. Among the many types of

Selection and maintenance of batteries for communication base stations

Focused on the engineering applications of batteries in the communication stations, this paper introduces the selections, installations and maintenances of batteries for communication

Lithium battery for communication base station

Through exploiting the correlations between the battery working conditions and battery statuses, we build up a deep learning based model to estimate the remaining lifetime of backup

Lithium Battery For Communication Base Stations Market

Jun 25, 2025 · Explore Market Research Intellect''s Lithium Battery For Communication Base Stations Market Report, valued at USD 1.2 billion in 2024, with a projected market growth to

通信基站用耐低温钠离子电池研究与应用-【维普期刊官网

WebIM,接待通信基站用耐低温钠离子电池研究与应用 认领 Research and application of low-temperature sodium ion batteries for communication base stations

6 FAQs about [Maintenance process of lithium-ion batteries for communication base stations]

Why do telecom base stations need a battery management system?

As the backbone of modern communications, telecom base stations demand a highly reliable and efficient power backup system. The application of Battery Management Systems in telecom backup batteries is a game-changing innovation that enhances safety, extends battery lifespan, improves operational efficiency, and ensures regulatory compliance.

What are lithium-ion batteries & battery management standards?

These standards have been selected because they pertain to lithium-ion Batteries and Battery Management in stationary applications, including uninterruptible power supply (UPS), rural electrification, and solar photovoltaic (PV) systems. These standards should be referenced when procuring and evaluating equipment and professional services.

Why do telecom base stations need backup batteries?

Backup batteries ensure that telecom base stations remain operational even during extended power outages. With increasing demand for reliable data connectivity and the critical nature of emergency communications, maintaining battery health is essential.

Why is a battery management system important?

In a telecom environment, operational efficiency is key to sustaining high uptime and performance. A BMS contributes to this by: Providing Real-Time Data: Operators gain immediate insights into battery performance, allowing for informed decision-making and rapid response to issues.

Are lithium ion batteries a good choice for a telecom backup system?

Lithium-Ion Batteries: Although more expensive upfront, lithium-ion batteries provide a higher energy density, longer lifespan, and deeper discharge capabilities. Their superior performance is driving increased adoption in modern telecom backup systems.

Why do power stations need backup batteries?

These stations depend on backup battery systems to maintain network availability during power disruptions. Backup batteries not only safeguard critical communications infrastructure but also support essential services such as emergency response, mobile connectivity, and data transmission.

Update Information

- The evolution of lithium-ion batteries for communication base stations

- The crux of the difficulty in generating power through lithium-ion batteries for communication base stations

- New quota for lithium-ion batteries for communication base stations in 2016

- What are the obstacles to the treatment of lithium-ion batteries in communication base stations

- What cables are used for flow batteries in communication base stations

- What are the flow batteries for Kiribati s high-altitude communication base stations

- Which companies have liquid flow batteries for communication base stations in Argentina

- Which manufacturers have flow batteries for Prague communication base stations

- Detailed process of power generation at communication base stations

- Construction process of flywheel energy storage for foreign communication base stations

- What are the uninterrupted power supply maintenance for communication base stations

- Lead-acid batteries for communication base stations and photovoltaic batteries

- Research direction of lithium-ion battery construction for communication base stations

Solar Storage Container Market Growth

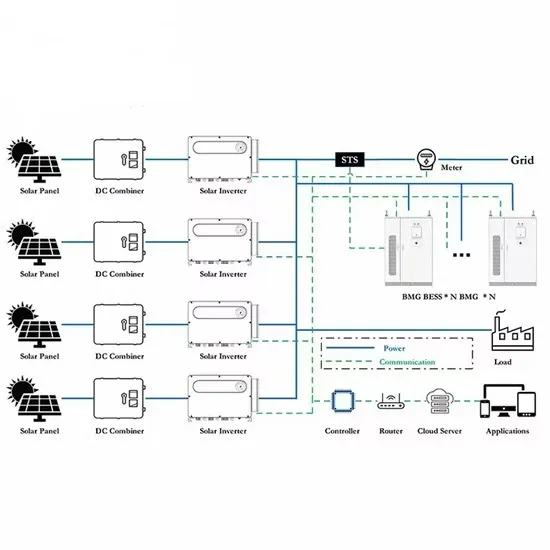

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.