Global Flywheel Energy Storage Systems Market Size,

Mar 28, 2025 · Chapter 4: Provides profiles of key companies, introducing the basic situation of the main companies in the market in detail, including product descriptions and specifications,

India Flywheel Energy Storage System Market (2025-2031)

India Flywheel Energy Storage System Market Synopsis The India flywheel energy storage system market is experiencing steady growth due to the increasing demand for efficient energy

Flywheel Energy Storage Systems and their Applications:

Oct 19, 2024 · Flywheel energy storage systems are suitable and economical when frequent charge and discharge cycles are required. Furthermore, flywheel batteries have high power

Flywheel Energy Storage Industry: Key Players Shaping the

Feb 19, 2024 · Imagine a 20-ton steel rotor spinning at 16,000 RPM in a vacuum chamber - this isn''t sci-fi, but the heart of modern flywheel energy storage systems. As the world races toward

10 New Energy Storage Companies | StartUs Insights

Jan 31, 2025 · Gain data-driven insights on energy storage, an industry consisting of 14K+ organizations worldwide. We have selected 10 standout innovators from 2.8K+ new energy

Opportunities in Flywheel Energy Storage Market 2025-2033

May 14, 2025 · The flywheel energy storage market, currently valued at $159.6 million in 2025, is projected to experience steady growth, driven by increasing demand for reliable and efficient

Top 10 flywheel energy storage manufacturers in

4 days ago · Flywheel energy storage is widely used in electric vehicle batteries, uninterruptible power supplies, uninterrupted power supply of wind power

Top 10 Leading Companies in Flywheel Energy Storage

Oct 26, 2021 · Flywheel serves as a reliable energy storage solution in developing areas with less reliable grid infrastructure and high electricity costs, and in island areas where grids are reliant

Flywheel Energy Storage Industry: Key Players Shaping the

Feb 19, 2024 · As the world races toward carbon neutrality, the flywheel energy storage industry has become the dark horse of renewable energy solutions, with companies like Beijing

Flywheel Energy Storage Market Size | Growth Report [2032]

Jul 28, 2025 · The global flywheel energy storage market size is projected to grow from $351.94 million in 2025 to $564.91 million by 2032, at a CAGR of 6.99%

Top Foreign Companies Revolutionizing Flywheel Energy Storage

Imagine a giant spinning wheel that could power your home during blackouts—or even stabilize entire power grids. That''s the magic of flywheel energy storage, and foreign companies are

What are the Chinese flywheel energy storage companies?

Jun 29, 2024 · Leading players in the flywheel energy storage sector within China exhibit innovative designs that enhance energy efficiency and performance. 1. Companies focus on

Top 10 Energy Storage Companies in Europe

Jul 14, 2025 · Numerous companies have emerged as key players in the green energy revolution, including project developers, renewable energy investors, and financial, technical, or legal

6 FAQs about [Key flywheel energy storage companies]

What is flywheel energy storage?

Flywheel energy storage is widely used in electric vehicle batteries, uninterruptible power supplies, uninterrupted power supply of wind power generation systems, high-power pulse discharge power supplies, etc. This article has compiled top 10 flywheel energy storage manufacturers in China for reference. Company profile:

How many flywheel energy storage companies are there in China?

At present, there are many companies producing flywheel energy storage products in the world, and companies including Top 10 flywheel energy storage companies in China are actively deploying flywheel energy storage technology. If playback doesn't begin shortly, try restarting your device.

What are the benefits of a flywheel system?

2. Renewable Energy Integration These systems are particularly effective for integrating renewable energy sources, such as wind and solar. Flywheels can store excess energy generated during peak production times and release it when generation is low, ensuring a consistent energy supply.

Why do we need advanced flywheel energy storage systems?

This brings us to the pressing need for innovative solutions such as Advanced Flywheel Energy Storage Systems (FESS), which offers a sustainable and efficient alternative. FESS offers unparalleled longevity and reliability, with lifespans exceeding 50,000 cycles and design lives of over 25 years.

What is a flywheel energy storage system (fess)?

To solve this problem, London-based startup Levistor has developed an innovative Flywheel Energy Storage System (FESS), which acts as a kinetic battery. This technology stores energy from the grid during periods of low demand and releases it rapidly when an EV needs a quick charge. It can deliver 100 miles of range in just five minutes.

What is the landscape of Flywheel energy storage in China?

In summation, the landscape of flywheel energy storage in China is rich with innovation, investment, and potential. The sector reflects a broader movement towards sustainable energy solutions that are becoming increasingly vital in addressing global energy challenges.

Update Information

- How many communication base station flywheel energy storage companies are there in China

- Which companies have flywheel energy storage for Uruguayan communication base stations

- London CRRC Flywheel Energy Storage Project

- Why do communication base stations have batteries for flywheel energy storage

- Magadan flywheel energy storage

- Flywheel energy storage synchronous motor price

- Which battery companies distribute energy storage

- Eastern European stacked energy storage battery companies

- Energy storage companies acquire new energy companies

- Male companies that make energy storage products

- Companies doing photovoltaic energy storage in Valparaiso Chile

- New energy storage companies in the Middle East

- Egypt Communication Base Station Flywheel Energy Storage Construction Company

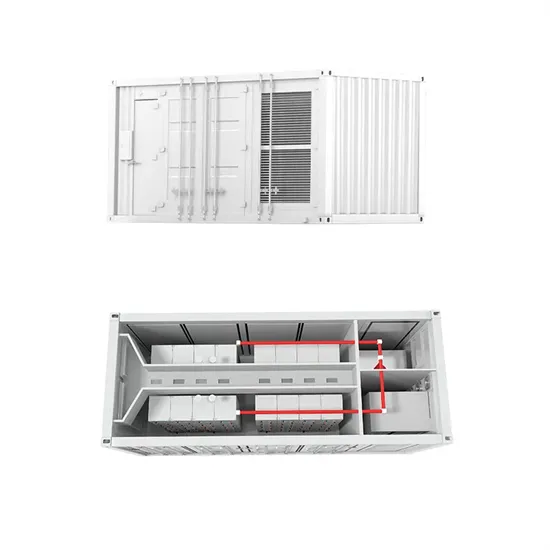

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.