Shell Subsidiaries & Acquisitions

Mar 11, 2025 · Shell has broadened its reach into diverse industries through targeted acquisitions and new subsidiaries. By acquiring companies in renewable energy, electric vehicle

EnerSys Announces Agreement to Acquire the Alpha

Oct 29, 2018 · EnerSys Announces Agreement to Acquire the Alpha Technologies Group of Companies, Creating the Only Complete Power Solution Provider for Broadband, Telecom

10 New Energy Storage Companies | StartUs Insights

Jan 31, 2025 · Gain data-driven insights on energy storage, an industry consisting of 14K+ organizations worldwide. We have selected 10 standout innovators from 2.8K+ new energy

How energy storage M&A performed in the power industry

Nov 27, 2024 · Analysis of the key themes driving M&A activity reveals that energy storage accounted for 52 power deals announced in Q3 2024, worth a total value of $7.8bn. The

Complete List of Recent Energy Mergers And Acquisitions

Usearch found 5529 recent M&A deals involving energy companies. The most recent M&A deals within the energy industry are: • BKV Corporation is acquiring Bedrock Energy Partners''

How do energy storage companies raise funds? | NenPower

Apr 3, 2024 · Energy storage companies explore a range of strategies to raise funds, encompassing options like venture capital, government grants, strategic partnerships, debt

Stem Inc becomes ''first publicly-traded smart energy storage company

Apr 29, 2021 · Stem Inc''s shares begin trading on the New York Stock Exchange today, after the "artificial intelligence-driven clean energy storage services" company completed its business

Clean Technology Mergers in Battery Energy Storage and

Jun 5, 2023 · From renewable integration to grid stability, acquiring specialized firms offers instant access to cutting-edge tech and market footholds. But hold on—this isn''t just a corporate

Crescent Energy to acquire Vital Energy in $3.1 billion shale

13 hours ago · U.S. shale producer Crescent Energy said on Monday it would acquire smaller peer Vital Energy in an all-stock deal valued at $3.1 billion, including debt.

Top Energy Storage Services Companies-2023

Top 10 Energy Storage Services Companies - 2023 Sustainable energy storage is critical to a cleaner and greener future. It plays a pivotal role in ensuring a reliable and sustainable power

mergers and acquisitions Archives

Mar 8, 2023 · Corporate funding of energy storage companies exceeded US$26 billion worldwide in 2022, a 55% jump from 2021''s total US$17 billion. Masdar has acquired battery storage

List of top Acquired Energy Storage Companies

May 26, 2004 · This list of companies and startups in the energy storage space that have been acquired provides data on their funding history, investment activities, and acquisition trends.

Double Carbon Evening News: United States allocates $3

Sep 24, 2024 · Double Carbon Evening News: United States allocates $3 billion to support domestic battery and material production Huadian plans to acquire five new energy companies

List of top Energy Storage Companies

Jan 28, 2008 · This list of companies and startups in the energy storage space provides data on their funding history, investment activities, and acquisition trends. Insights about top trending

EQT introduces the EQT Transition Infrastructure strategy

Dec 4, 2024 · EQT will acquire the Company from its founder, Dr. Franz Hauk. Increasing reliance on renewable, intermittent energy sources, coupled with rising power demand from the

6 FAQs about [Energy storage companies acquire new energy companies]

How much money did energy storage companies make in 2022?

Corporate funding of energy storage companies exceeded US$26 billion worldwide in 2022, a 55% jump from 2021’s total US$17 billion. Masdar acquires UK battery storage developer Arlington Energy October 26, 2022 Masdar has acquired battery storage developer Arlington Energy in a bid to expand its presence in UK and European renewables markets.

What are the most recent M&A deals involving energy companies?

Usearch found 5488 recent M&A deals involving energy companies. The most recent M&A deals within the energy industry are: • Baker Hughes is acquiring Chart Industries. • Hecate Holdings is acquiring Hecate Energy. • Tamarack Valley Energy is acquiring PrivateCo.

Who owns enverus & Excelerate Energy?

Excelerate Energy, Inc. is a U.S.-based LNG company located in The Woodlands, Texas, providing integrated services along the LNG-to-power value chain. Enverus is an energy data platform. InterContinental Exchange, the parent of the New York Stock Exchange, is in discussions to purchase Enverus.

Who owns new fortress energy?

New Fortress Energy Inc.'s integrated LNG and power platform in Jamaica was acquired by Excelerate Energy. Excelerate Energy, Inc. is a U.S.-based LNG company located in The Woodlands, Texas, providing integrated services along the LNG-to-power value chain. Enverus is an energy data platform.

Who owns Downing Renewables & Infrastructure Trust plc?

DORE is being acquired by Bidco, a subsidiary of Bagnall Energy Limited. Bidco, a subsidiary of Bagnall Energy Limited, is acquiring Downing Renewables & Infrastructure Trust plc (DORE) through a Court-sanctioned scheme of arrangement.

Who owns enverus?

Enverus is an energy data platform. InterContinental Exchange, the parent of the New York Stock Exchange, is in discussions to purchase Enverus. Lyons Electric is a full-service commercial and industrial contractor with 50 employees. Potawatomi Ventures is the economic development arm of the Forest County Potawatomi community.

Update Information

- New energy companies engaged in energy storage

- New energy storage companies in the Middle East

- About supporting new energy storage policies

- Design of a new energy storage power station in Sri Lanka

- N Djamena Distributed New Energy Storage Battery

- New energy storage vehicles are customized on demand

- Swiss energy storage photovoltaic companies

- USA New York Wind and Solar Energy Storage Project

- Spanish new energy storage battery manufacturer

- Is there any new energy storage company in Niamey

- Luxembourg s new energy storage capacity is

- New power station wind and solar energy storage power station

- New Energy Lithium Battery Solar Energy Storage

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

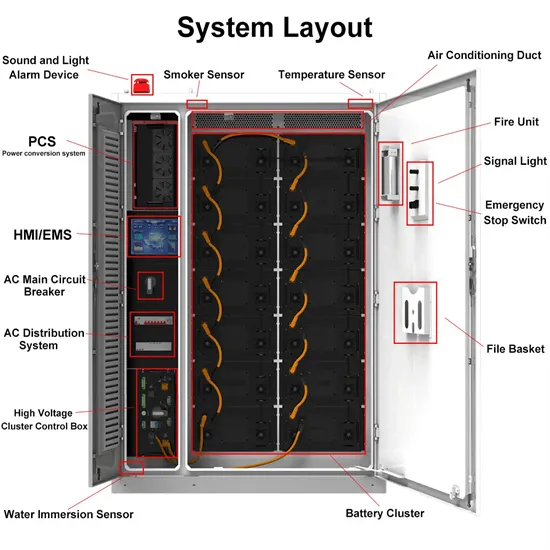

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.