Energy-storage cell shipment ranking: Top five dominates still

Feb 6, 2024 · The world shipped 196.7 GWh of energy-storage cells in 2023, with utility-scale and C&I energy storage projects accounting for 168.5 GWh and 28.1 GWh, respectively, according

Photovoltaic energy storage inverter shipment ranking

Global PV inverter shipments grew by 56% in 2023 to 536 GWac Solar & Energy Storage Summit 23-24 April 2025, Denver Register now. Browse Events To view the full shipment rankings of

Sino-American showdown! The top 10 global energy storage

Feb 23, 2025 · According to the data, the global energy storage system shipments will reach 240GWh in 2024, a year-on-year increase of more than 60%, and the growth trend is still on a

1Q25 Global energy storage system (ESS) shipment ranking:

May 26, 2025 · InfoLink Consulting has released its 1Q25 global energy storage system (ESS) shipment ranking, based on its energy storage supply chain database.

PHOTOVOLTAIC ENERGY STORAGE INVERTER EXPORT RANKING

Photovoltaic energy storage inverter shipment ranking The top five vendors – Huawei, Sungrow, Ginlong Solis, Growatt, and GoodWe – shipped more than 200 GWac and accounted for 71%

Global energy storage system shipment ranking

Global energy storage system shipment ranking The five largest battery energy storage system (BESS) integrators have installed over a quarter of global projects. Mainland China battery

2024 Global energy storage system (ESS) shipment ranking

Feb 21, 2025 · InfoLink Consulting has released its 2024 global energy storage system (ESS) shipment ranking, based on its Energy Storage Supply Chain Database. In 2024, global ESS

Sineng Electric Rises to No.4 in Global PV Inverter Shipment Rankings

Jul 18, 2025 · As a top-tier inverter manufacturer, the company''s vision is to promote the extensive adoption of reliable, cost-effective, and sustainable energy solutions through

Ranking of Photovoltaic and Energy Storage Product

The Sinovoltaics analysts note that while the rankings do not say anythingabout the actual quality of PV equipment,buyers and other industry stakeholders,such as financial institutions,can use

Cell shipment ranking 2022: Tongwei, Aiko, Runergy

Apr 17, 2023 · The top five cell manufacturers aim to ship over 210 GW of cells, with 23% being n-type products. Jietai sets the highest shipment target for n-type products. Professional cell

2025上半年度全球储能系统出货排名-产业-InfoLink Consulting

Aug 18, 2025 · InfoLink 2025 上半年度全球储能系统出货排名出炉,本次排名出货量数据采用 InfoLink 储能供应链数据库。2025 上半年度,全球储能系统出货量继续维持高增,全球出货量

Photovoltaic energy storage inverter shipment ranking

Recently, the globally authoritative research institution S&P Global released the shipment volume market ranking for global photovoltaic inverters in 2022. Chinese companies continue to

Photovoltaic energy storage shipment ranking

As the photovoltaic (PV) industry continues to evolve, advancements in Photovoltaic energy storage shipment ranking have become critical to optimizing the utilization of renewable

InfoLink''s 2024 cell shipment ranking: Top five manufacturers

Feb 17, 2025 · Cell shipment ranking reshuffled: Top five maintain above 25 GW+ According to InfoLink''s research, the global top-five cell suppliers shipped 162.8 GW in total in 2024, down

2024 Global and non-China shipments of energy storage

Feb 14, 2025 · In 2024, global utility-scale energy storage cell shipments reached 283 GWh, up 68% YoY and 22.6% QoQ in Q4. The top five manufacturers were CATL, EVE Energy,

Infolink releases global ranking of photovoltaic

Mar 6, 2025 · Infolink Consulting has released the global photovoltaic module supply ranking for the first half of 2024. In a survey of manufacturers, changes

6 FAQs about [Photovoltaic energy storage shipment ranking]

What are the top 5 energy storage cell shipments in 2024?

The top five companies in global energy storage cell shipments for 2024 were: CATL, EVE Energy, BYD, Hithium Energy Storage, and CALB. The top themes for the year were: stability, market shift, and key clients. Stability: With years of industry experience, CATL maintains a clear market advantage and firmly holds the top position in the industry.

What are the top 5 energy storage manufacturers?

The top five manufacturers were CATL, EVE Energy, Hithium, BYD, and CALB. CR5 has surpassed 75%, signaling a highly concentrated market with limited growth opportunities for new entrants. According to InfoLink, 300Ah+ cells now account for nearly 50% of the global utility-scale energy storage market in a single quarter.

Which solar company has the most solar shipments in the world?

According to Trina Solar, its shipments of 50.5GW in the first three quarters ranked fourth in the world, slightly less than LONGi Green’s 51.23GW, with a difference of only 0.83GW between the two. Jinko Solar, JA Solar, LONGi and Trina Solar remain in the top four in terms of module shipments. Tongwei currently ranks fifth.

What was the energy storage industry like in 2024?

In 2024, industry concentration remains high, with CR10 reaching 90.9%, roughly the same as in the first three quarters of the year. The top five companies in global energy storage cell shipments for 2024 were: CATL, EVE Energy, BYD, Hithium Energy Storage, and CALB. The top themes for the year were: stability, market shift, and key clients.

Who makes the most photovoltaic modules in the world?

Infolink Consulting has released the global photovoltaic module supply ranking for the first half of 2024. In a survey of manufacturers, changes were detected in the major global leaders. Jinko Solar ranks first, followed by JA Solar and Trina Solar. Longi ranks fourth, followed by Tongwei, Astronergy and Canadian Solar.

Which energy storage cell manufacturers grew the most in 2024?

In 2024, global utility-scale energy storage cell shipments reached 283 GWh, up 68% YoY and 22.6% QoQ in Q4. The top five manufacturers were CATL, EVE Energy, Hithium, BYD, and CALB. CR5 has surpassed 75%, signaling a highly concentrated market with limited growth opportunities for new entrants.

Update Information

- Photovoltaic energy storage performance ranking

- Home energy storage shipment ranking

- Sri Lanka Photovoltaic Energy Storage Inverter

- How is the solar medium of photovoltaic energy storage cabinet

- Tdk Photovoltaic Energy Storage

- The next step for photovoltaic energy storage

- Belize Photovoltaic Energy Storage

- Energy storage equipment container photovoltaic

- Huawei Port Moresby Energy Storage Photovoltaic Panel

- Lebanon Photovoltaic Power Station Energy Storage Demonstration

- Bogota container photovoltaic energy storage

- Basseterre photovoltaic energy storage battery

- Lesotho Photovoltaic Energy Storage Cabinet Manufacturer

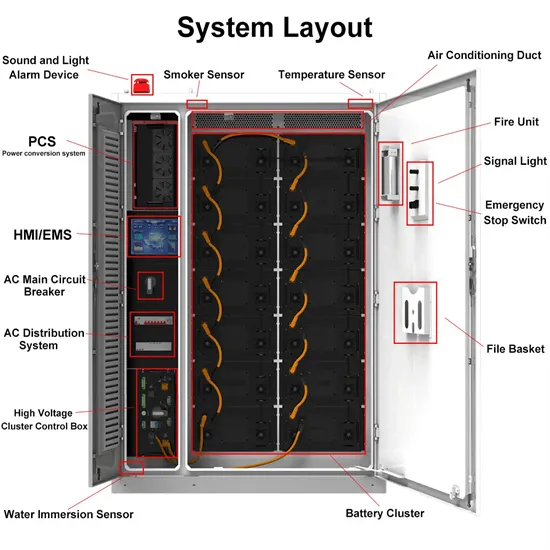

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.