Global energy storage system shipment ranking

The global Battery Energy Storage Systems (BESS) integrator market has grown increasingly competitive in 2022, with the top five global system integrators accounting for 62% of overall

Energy Storage Battery Shipments 2025: Market Trends, Top

Dec 28, 2024 · Global energy storage battery shipments are projected to reach 392 GWh in 2025, up from 314.7 GWh in 2024 [2] [9]. That''s like replacing every AA battery in your junk drawer

1Q24 Energy-storage cell shipment ranking:

May 10, 2024 · The world shipped 38.82 GWh of energy-storage cells in the first quarter this year, with utility-scale and C&I projects accounting for 34.75 GWh

2025 energy storage integrator shipment ranking

Energy-storage cell shipment ranking: Top five dominates still. The world shipped 196.7 GWh of energy-storage cells in 2023, with utility-scale and C& I energy storage projects accounting for

2025 energy storage inverter shipment ranking

Are energy storage inverters the future of energy storage? Shipments of energy storage inverters more than doubled in 2020 to reach over 11 GW. As the world''s major economies increasingly

AlphaESS Ranks the TOP 5 Supplier of the Global Residential Storage

Jun 25, 2021 · Recently IHS Markit has released the 2020 global residential energy storage shipment rankings. According to the report, global residential energy storage shipments

REPT BATTERO Ranks #1 in Global Residential Energy Storage

Jul 22, 2025 · We''re thrilled to announce that REPT BATTERO ranks #1 in Global Residential Energy Storage Battery Shipments for H1 2025! *Source: InfoLink ''s Global Energy Storage

1Q25 Global energy storage system (ESS) shipment ranking:

May 26, 2025 · InfoLink Consulting has released its 1Q25 global energy storage system (ESS) shipment ranking, based on its energy storage supply chain database.

Energy-storage cell shipment ranking: Top five dominates still

Feb 6, 2024 · As for small-scale energy storage projects, CATL, REPT, EVE Energy, BYD, and Great Power shipped the most. The top 5 list remained unchanged in the first three quarters of

EESA Releases 2024 Global Energy Storage Industry Data and Rankings

May 5, 2025 · EESA Releases 2024 Global Energy Storage Industry Data and Ranking of Chinese Storage Companies On March 28, the Energy Storage Leaders Alliance hosted the

1H25 Global energy storage system (ESS) shipment rankings

Aug 18, 2025 · InfoLink Consulting has released its 1H25 global energy storage system (ESS) shipment rankings, based on its energy storage supply chain database. In 1H25, global ESS

InfoLink''s 2024 global module shipment ranking: significant

Feb 18, 2025 · The shipment data for this ranking was based on InfoLink''s database and surveys conducted with manufacturers. If the statistics for a certain manufacturers are not fully

InfoLink Releases Q1 2025 Global Energy Storage System Shipment Rankings

The rankings are based on shipment data from InfoLink''s Energy Storage Supply Chain Database. In Q1 2025, China''s market showed steady growth, the U.S. market saw front

Module shipment ranking 2022: Top 10 manufacturers

Jan 13, 2023 · In 2022, the top 10 Chinese manufacturers have shipped over 240 GW modules globally, up 60% and occupying over 90% of global demand, according to the annual module

CNESA Officially Released the 2024 China Energy Storage Vendor Rankings

Jul 10, 2025 · Figure 2: Top 5 Chinese energy storage base station/IDC technology providers in the 2024 global market, Unit: GWh Note: The shipment data of backup power batteries for

1Q25 Global energy storage cell shipment rankings

May 20, 2025 · According to InfoLink''s Global Energy Storage Supply Chain Database, global energy storage cell shipments totaled 99.58 GWh in 1Q25, up 150.62% YoY but down 7.75%

1H25 global and non-China energy storage cell shipment rankings

Aug 13, 2025 · Chinese-funded manufacturers maintain dominance as shipment share to non-China markets continues to rise In 1H25, cell shipments to non-China markets reached 108.98

Sino-American showdown! The top 10 global energy storage

Feb 23, 2025 · Despite the short-term disruptions caused by geopolitical and other factors, InfoLink expects system shipments to exceed 300GWh in 2025, driven by the rigid demand of

Global energy storage cell, system shipment ranking 1H24

Aug 6, 2024 · In terms of energy storage systems, InfoLink''s database shows that global energy storage system shipment stood at 90 GWh in the first half. The top five BESS integrators in the

2024 Global energy storage system (ESS) shipment ranking

Feb 21, 2025 · InfoLink Consulting has released its 2024 global energy storage system (ESS) shipment ranking, based on its Energy Storage Supply Chain Database. In 2024, global ESS

2024 Global and non-China shipments of energy storage

Feb 14, 2025 · According to InfoLink''s Global Energy Storage Supply Chain Database, global energy storage cell shipments totaled 314.7 GWh in 2024, up 60% YoY. The market showed a

6 FAQs about [Home energy storage shipment ranking]

Which energy storage companies shipped the most in 2023?

Additionally, Samsung SDI and LG’s energy-storage cell shipments totaled nearly 14 GWh in 2023, translating to a slightly lower market share of 7%. For utility-scale energy storage, CATL, BYD, EVE Energy, Hithium, and REPT BATTERO shipped the most in 2023. CATL shipped more than 65 GWh and the rest less than 22 GWh.

How will the energy storage industry perform in 2024?

InfoLink sees global energy-storage installation increase by 50% to 165 GWh and energy-storage cell shipments by 35% to 266 GWh in 2024. Database contains the global lithium-ion battery market supply and demand analysis, focusing on the cell segment in the ESS sector.

How many energy-storage cells are shipped in 2023?

Energy-storage cell shipment ranking: Top five dominates still. The world shipped 196.7 GWh of energy-storage cells in 2023, with utility-scale and C& I energy storage projects accounting for 168.5 GWh and 28.1 GWh, respectively, according to the Global Lithium-Ion

Which energy companies have the most GWh shipments?

BYD and EVE Energy followed closely each with shipments of over 25 GWh, while REPT BATTERO and Hithium each ranked fourth and fifth with shipments of over 15 GWh. Despite intense price competition, the leading companies demonstrated significant cost control advantages, reinforcing the "the strong get stronger" pattern.

What are the top 5 energy storage cell manufacturers?

The top five largest energy storage cell manufacturers in the first half are CATL, EVE Energy, REPT, Hithium, and BYD. CATL secured the top position with orders from major customers like Tesla and Fluence. EVE Energy received orders from all big customers, sustaining second place in the industry.

Which companies shipments the most in 2023?

The top 5 companies shipping the most in 2023 remained CATL, BYD, EVE Energy, REPT BATTERO, and Hithium. CATL led with shipments exceeding 70 GWh. BYD and EVE Energy followed closely each with shipments of over 25 GWh, while REPT BATTERO and Hithium each ranked fourth and fifth with shipments of over 15 GWh.

Update Information

- Photovoltaic energy storage shipment ranking

- Niger outdoor energy storage cabinet manufacturers ranking

- The first choice for home energy storage batteries

- Bahrain Heavy Industry Energy Storage Cabinet Brand Ranking

- Tbilisi Home Energy Storage Battery

- Freetown Home Energy Storage Series

- How is Huawei s home power station energy storage

- Can the energy storage cabinet battery be used at home

- Algiers energy storage power supply export shipment

- Multifunctional energy storage equipment for home use

- Home energy storage voltage

- Apia Energy Storage Battery Home

- Home photovoltaic energy storage is the largest

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

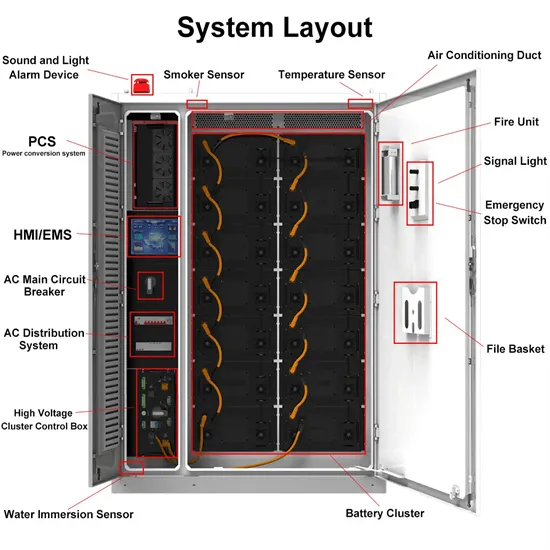

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.