Worldwide Energy Storage Battery Cabinets Market Research

In conclusion, energy storage battery cabinets play a crucial role in the efficient and safe storage of energy from renewable sources. Their technical aspects, such as energy capacity, charging

Set sail! Tengi Commercial and Industrial Energy Storage Cabinets

Sep 6, 2024 · This overseas shipment of Industrial and Commercial Energy Storage system also means that Tengi energy storage products will further open up overseas markets and explore

United Arab Emirates (UAE) Closed Storage Cabinets Market

Drivers of the Market Outlook The UAE Closed Storage Cabinets market is driven by the need for efficient storage solutions in various sectors, including offices, healthcare, and manufacturing.

Saudi Arabia''s demand for energy storage solutions is

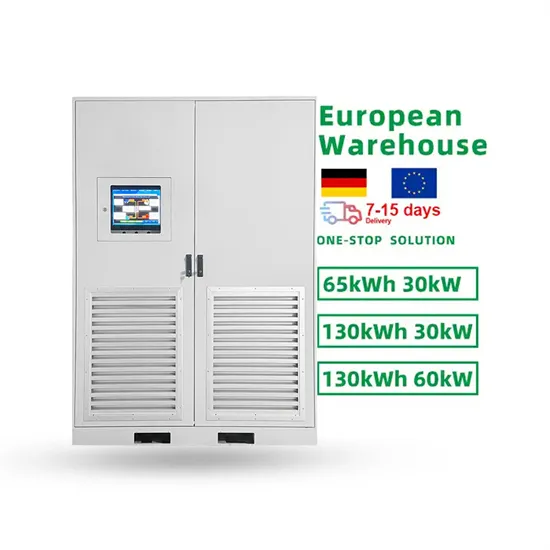

6 days ago · Commercial and industrial energy storage: GSL''s high-voltage battery cabinets (80kWh-140kWh) and liquid-cooled BESS containers (1MWh+) are ideal for large-scale solar

Energy Storage Cabinets: Providing Reliable Energy

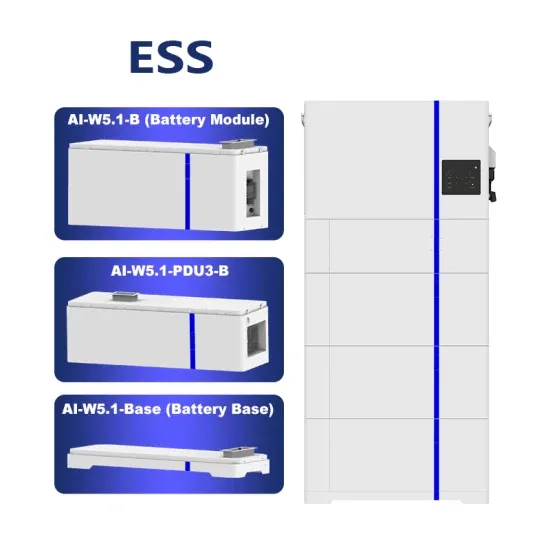

Jul 16, 2025 · In this context, energy storage cabinets, as an innovative energy storage device, have gradually become an essential part of commercial buildings. Energy storage cabinets not

Global Industrial and Commercial Energy Storage Cabinet

The global Industrial and Commercial Energy Storage Cabinet market was valued at US$ 2395 million in 2023 and is anticipated to reach US$ 4203.8 million by 2030, witnessing a CAGR of

Industrial and Commercial Energy Storage Cabinets (ESS) in

5 days ago · Conclusion The use of industrial and commercial energy storage cabinets is critical for sectors looking to optimize their energy use, reduce costs, and enhance sustainability.

power storage cabinets in developed countries

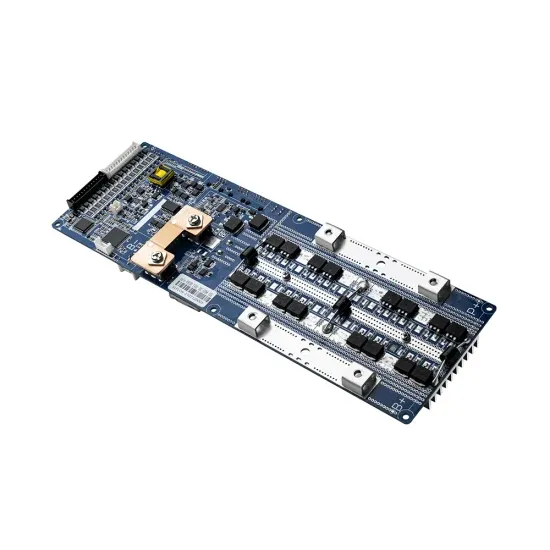

The Smart Energy Storage Integrated Cabinet is an integrated energy storage solution widely used in power systems, industrial, and commercial applications. This cabinet integrates

The MENA region – the next hot market for

Nov 28, 2024 · The rapid growth rate of energy storage in the MENA region, led by the GCC, is surprising many analysts. Saudi Arabia, in particular, is set to

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Feb 4, 2022 · Several MENA countries - especially in the GCC - are equipped with competitive advantages in renewable plus storage procurement, due to the availability of vast lands and

types of smart energy storage cabinets in east africa

This report focuses on the Industrial and Commercial Energy Storage Cabinet in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa.

United Arab Emirates (UAE) Energy Storage Systems Market

COVID-19 Impact on the Market Outlook The UAE Energy Storage Systems Market faced challenges amidst the COVID-19 pandemic. Disruptions in the supply chain and construction

Energy storage: Status and future perspective in Arab countries

Dec 26, 2023 · In this paper, the present status of energy storage implementation and research in Arab countries (ACs) is investigated. The different technologies of energy storage are

Where are energy storage cabinets used? | NenPower

Oct 7, 2024 · These technologies are characteristically variable, producing energy that fluctuates based on environmental conditions. Thus, energy storage cabinets serve as a buffer, capturing

How about the export of energy storage cabinets | NenPower

Aug 27, 2024 · The increase in global awareness regarding sustainable energy solutions has led to a surge in the demand for energy storage systems. Countries are increasingly adopting

Energy Series Advancing Energy Storage in the MENA

Dec 16, 2024 · To date, the most popular way to store excess energy has been pumped storage hydropower plants, but battery energy storage systems (BESS) and thermal storage in the

Advantages and Disadvantages of Commercial Energy

Some of the advantages of commercial power storage include: The benefits of installing battery storage at your facility can be great; however, one must evaluate the total cost of ownership of

Industrial and Commercial Liquid Cooled Energy Storage Cabinet

This report provides a comprehensive assessment of recent tariff adjustments and international strategic countermeasures on Industrial and Commercial Liquid Cooled Energy Storage

6 FAQs about [Supply of commercial energy storage cabinets in Arab countries]

Which energy storage technology has the most installed capacity in MENA?

Pumped hydro storage (PHS) has the largest share of installed capacity in MENA at 55%, as compared to a global share of 90%. Pumped hydro storage is one of the oldest energy storage technologies, which explains its dominance in the global ESS market.

Which energy storage solutions will be the leading energy storage solution in MENA?

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

What is energy storage system deployment in MENA?

Energy Storage System deployment in MENA Energy Storage Systems (ESS) play a critical role in the integration of VRE into the power grid, as these systems manage the intermittencies of renewable energy resources and mitigate potential power supply disruptions.

Which country has the most battery storage capacity in MENA?

Currently, NaS battery technology dominates the battery storage capacity in operation in MENA, particularly in the UAE, with a total of 108 MW/648 MWh projects developed by the Abu Dhabi Water and Electricity Authority (ADWEA).

Is the MENA region a good place to invest in battery energy?

The MENA region is starting to witness a drastic increase in large-scale battery energy storage systems (“BESS”) projects, accompanying a soaring penetration of renewable energy. This has happened at a pace, which seems to have surprised many market analysts. In the past, forecasts for the MENA region showed a few GWh for the coming years at best.

Can energy storage be integrated in MENA?

Although the energy storage market in MENA is bound to grow, several barriers exist that hinder the integration of ESS and the ramping up of investments. Financial, regulatory, and market barriers need to be addressed via policy tools that lay the foundations for an evolved power market to integrate the deployed ESS.

Update Information

- Cameroon Industrial and Commercial Energy Storage Cabinets

- Commissioning methods for industrial and commercial energy storage cabinets

- Industrial and commercial energy storage is considered energy storage power supply

- How many phases of electricity are used in industrial and commercial energy storage cabinets

- Commercial energy storage power supply manufacturers

- Heavy industry energy storage cabinet integrated system in Arab countries

- Algeria Industrial and Commercial Energy Storage Cabinets

- Mogadishu Industrial and Commercial Energy Storage Cabinet Supply

- How about commercial energy storage cabinets

- Amman Power Supply Energy Storage Project

- Does wind power communication have base station energy storage cabinets

- Estonian energy storage power supply customization company

- Lithium power supply energy storage portable energy storage power supply

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.