United Arab Emirates Power Storage: Leading the Global Energy

Ranked 8th globally in energy storage project reserves [1] [2], the UAE''s 400 MW EWEC-backed storage project might seem modest compared to Saudi Arabia''s 2,200 MW NEOM gigaproject.

Liquid-cooled Energy Storage Cabinet

Commercial & Industrial ESSExcellent Life Cycle Cost • Cells with up to 12,000 cycles. • Lifespan of over 5 years; payback within 3 years. • Intelligent Liquid Cooling, maintaining a temperature

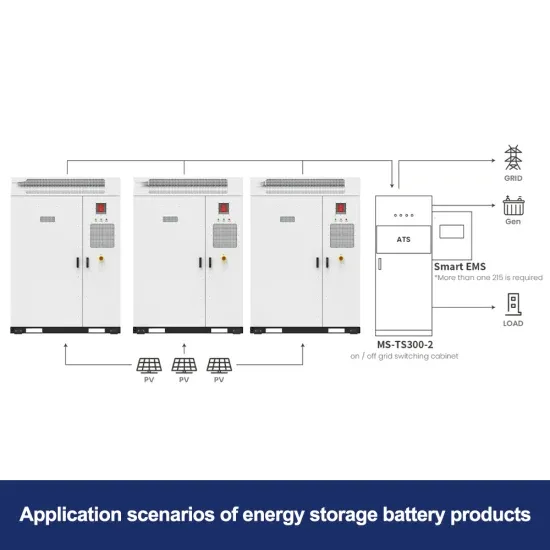

Application of energy storage in integrated energy systems

Aug 1, 2022 · Typical configurations of integrating an energy storage unit with a renewable energy unit in an IES: (a) the energy storage unit and wind power unit are connected to the grid via a

Envison Fully-Integrated

Aug 9, 2025 · The potential for solar energy in MENA thus extends beyond power generation to other applications such as water desalination, cooling systems, and industrial processes,

Top five energy storage projects in the UAE

Sep 10, 2024 · Listed below are the five largest energy storage projects by capacity in the UAE, according to GlobalData''s power database. GlobalData uses proprietary data and analytics to

United Arab Emirates Power Storage: Leading the Global Energy

Why the UAE Is Becoming a Power Storage Superstar When you think of the United Arab Emirates (UAE), towering skyscrapers and oil fields might come to mind. But here''s the kicker

PCS-8812PB Liquid cooled energy storage cabinet

NR Electric Co. LtdPCS-8812 liquid cooled energy storage cabinet adopts liquid cooling technology with high system protection level to conduct fine temperature control for outdoor

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Feb 4, 2022 · Energy Storage Systems (ESS) play a critical role in the integration of VRE into the power grid, as these systems manage the intermittencies of renewable energy resources and

Energy storage: Status and future perspective in Arab countries

Dec 26, 2023 · In this paper, the present status of energy storage implementation and research in Arab countries (ACs) is investigated. The different technologies of energy storage are

Role of Energy Storage

Sep 8, 2024 · Saudi Arabia, the UAE, and Oman are leading the GCC region in the transition to renewable energy. Saudi Arabia aims to have a 50% share of renewable sources in its energy

6 FAQs about [Heavy industry energy storage cabinet integrated system in Arab countries]

Does the UAE have energy storage systems in the GCC region?

The UAE has installed most of the energy storage systems in the GCC region. In 2016, Abu Dhabi Water & Electricity Authority announced the deployment of around 108 MW of sodium-sulfur-based BESS with an individual capacity of around 4 MW and 8 MW at diferent locations to support their distribution network.

What is the potential for energy storage in Saudi Arabia?

The potential for energy storage in the Kingdom of Saudi Arabia (KSA) is significant, given the country’s abundant resources and growing demand for energy. With a rapidly expanding population and economy, KSA is facing increasing energy demand.

Which energy storage technology has the most installed capacity in MENA?

Pumped hydro storage (PHS) has the largest share of installed capacity in MENA at 55%, as compared to a global share of 90%. Pumped hydro storage is one of the oldest energy storage technologies, which explains its dominance in the global ESS market.

What is energy storage system deployment in MENA?

Energy Storage System deployment in MENA Energy Storage Systems (ESS) play a critical role in the integration of VRE into the power grid, as these systems manage the intermittencies of renewable energy resources and mitigate potential power supply disruptions.

Which energy storage solutions will be the leading energy storage solution in MENA?

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

Can energy storage be integrated in MENA?

Although the energy storage market in MENA is bound to grow, several barriers exist that hinder the integration of ESS and the ramping up of investments. Financial, regulatory, and market barriers need to be addressed via policy tools that lay the foundations for an evolved power market to integrate the deployed ESS.

Update Information

- Oslo Heavy Industry Energy Storage Cabinet Cost

- West Africa Heavy Industry Energy Storage Cabinet Customized Manufacturer

- Heavy industry energy storage cabinet wholesaler in Hamburg Germany

- Paraguay Heavy Industry Energy Storage Cabinet

- Kampala Heavy Industry Energy Storage Cabinet Brand

- Bridgetown Heavy Industry Energy Storage Cabinet Quote

- Castrie Heavy Industry Energy Storage Cabinet Brand

- Saudi Arabia Heavy Industry Energy Storage Cabinet Quote

- Bangji Heavy Industry Energy Storage Cabinet Brand

- Finland Heavy Industry Energy Storage Cabinet Wholesaler

- Hargeisa Heavy Industry Energy Storage Cabinet Cost

- Damascus Heavy Industry Energy Storage Cabinet Model Query

- Price of integrated energy storage cabinet in Zurich Switzerland

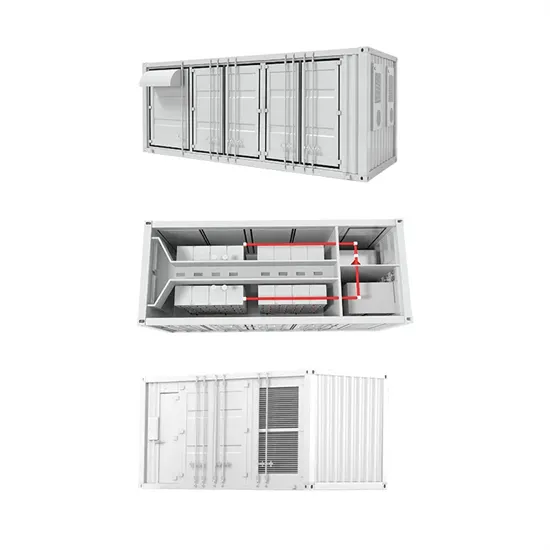

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.