How much is the revenue share of energy storage power stations?

Jul 7, 2024 · The primary revenue streams for energy storage power stations encompass energy arbitrage, capacity payments, and ancillary services. Energy arbitrage involves purchasing

1mw energy storage power station efficiency

Techno-economic review of existing and new pumped hydro energy storage Liquid air energy storage (LAES) is a large-scale energy storage technology that has gained wide popularity

1MW Battery Energy Storage System

4 days ago · The MEGATRON 1MW Battery Energy Storage System (AC Coupled) is an essential component and a critical supporting technology for smart grid and renewable energy (wind and

Economic Analysis of Energy Storage Stations: Costs, Profits,

Jun 22, 2022 · Let''s slice through the financial layers of a typical 100MW/200MWh lithium-ion storage station: Initial investments (60-80% of total cost): Battery systems still eat up 50-60%

Why Energy Storage Stations Are the Smart Investor''s Power

Jan 6, 2022 · Imagine this: a giant power bank, but for cities. That''s essentially what modern energy storage stations are – and they''re rewriting the rules of how we invest in energy

1MW Solar Power Plant: Real Costs and Revenue Potential

Feb 19, 2025 · A 1-megawatt solar power plant represents a significant yet increasingly accessible investment opportunity in renewable energy, typically requiring $700,000 to $1.3 million in

Calculation of energy storage cost for a 1MW power station

Aug 12, 2025 · Calculation of energy storage cost for a 1MW power station Cost Analysis: Utilizing Used Li-Ion Batteries. Economic Analysis of Deploying Used Batteries in Power Systems by

How many billion yuan does the energy storage power station

Aug 2, 2024 · According to industry analysis, energy storage power stations earn between 1 billion to 5 billion yuan annually, influenced by several factors such as location, technology

In-depth explainer on energy storage revenue

Jan 25, 2022 · The following article provides a high-level overview of the revenue models for non-residential energy storage projects and how financing parties

Cost of building a 1MW electrochemical energy storage

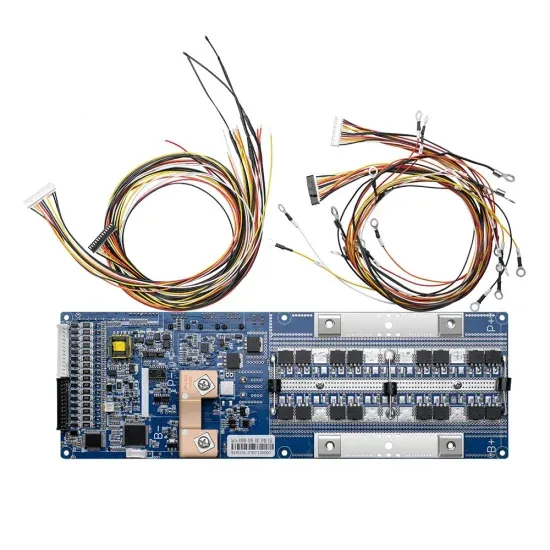

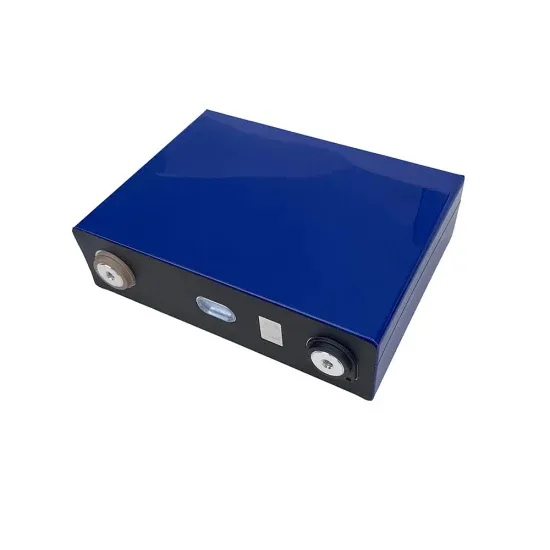

The MEGATRON 1MW Battery Energy Storage System (AC Coupled) is an essential component and a critical supporting technology for smart grid and renewable energy (wind and solar). The

Cost-Benefit Analysis of 2MWh Energy Storage System

Dec 11, 2024 · Introduction: In an era of increasing energy demand and the growing importance of renewable energy sources, energy storage systems have become a crucial component of the

Application of 1MW/4.18mwh Energy Storage System Grid

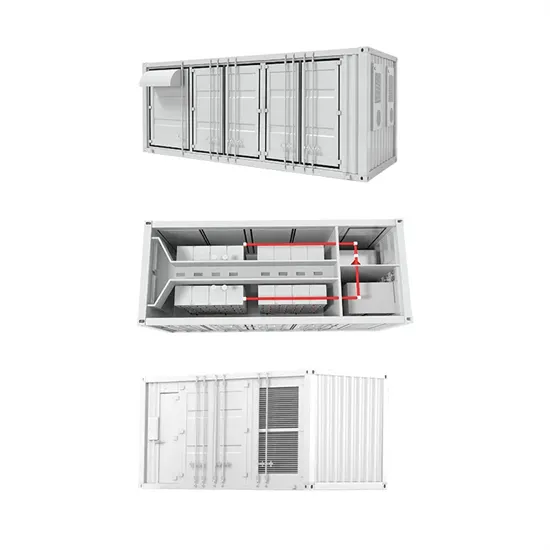

Jul 30, 2025 · System configuration The energy storage system of this scheme is configured as 1MW/4.18MWh, adopts the integrated design scheme of containers, and is integrated with

Malaysia''s energy gets smarter with the rise of grid-scale battery storage

6 days ago · Battery energy storage systems (BESS), once relegated to the margins of policy discussions, are fast becoming a keystone in Malaysia''s energy transformation story. As solar

What are the revenues of energy storage power stations?

Mar 23, 2024 · 1. Energy storage power stations generate revenues through various streams, including operational efficiency, ancillary services, and market participation.2. The total income

China''s Huawei unveils world''s first 100MW charging hub to power

1 day ago · The facility also incorporates nearly 1MW of solar capacity through a photovoltaic carport and two 215kWh wind-liquid energy storage units for intelligent cooling and power

Battery storage profitability looking up in

Dec 9, 2024 · Investments in battery storage within Australia''s National Electricity Market (NEM) are increasingly profitable due to higher power price volatility

CHINA''S ACCELERATING GROWTH IN NEW TYPE

Jun 13, 2024 · The scope includes two categories: dispatch-controlled new type energy storage and self-used new type energy storage by power stations. The former one refers to the new

total investment of 1mw electrochemical energy storage power station

New Energy Storage Technologies Empower Energy Transition In 2023, the electrochemical energy storage will have 3,680 GWh of charging capacity, 3,195 GWh of discharge capacity,

1mw energy storage power station capacity

A 1 MW solar power plant is a facility designed to generate electricity from sunlight. It consists of multiple interconnected solar panels that convert solar energy into electrical energy. This

6 FAQs about [1mw energy storage power station revenue]

How much money can a 1 MW power plant make?

Monthly revenue potential varies seasonally but typically ranges from $12,000-18,000 for a 1 MW plant. One notable example from Nevada demonstrated consistent monthly earnings of $15,500 during peak summer months and $12,800 during winter.

How much money can a 1 MW solar plant make?

A case study from Texas showed complete investment recovery in just 5.2 years, thanks to high local energy demand and excellent solar conditions. Monthly revenue potential varies seasonally but typically ranges from $12,000-18,000 for a 1 MW plant.

How much electricity does a 1 MW solar power plant produce?

A 1 MW solar power plant typically generates between 1,600 to 1,800 kilowatt-hours (kWh) per day under optimal conditions, translating to approximately 4-4.5 units of electricity annually per installed kilowatt. This means a well-designed 1 MW plant can produce between 1.6-1.8 million units of electricity per year.

Should you invest in a 1 MW solar power plant?

Investing in a 1 MW solar power plant becomes more financially attractive when you factor in various solar panel incentives and tax benefits offered by governments worldwide. In the United States, the Investment Tax Credit (ITC) allows you to deduct 30% of your total solar installation costs from your federal taxes.

What is the 'value stack' in energy storage?

Owners of batteries, including storage facilities that are co-located with solar or wind projects, derive revenue under multiple contracts and generate multiple layers of revenue or 'value stack.' Developers then seek financing based on anticipated cash flows from all or a portion of the components of this value stack.

How long does a 1 MW solar power plant last?

A typical 1 MW solar power plant reaches its break-even point within 4-6 years, depending on factors like location, sunlight availability, and local electricity rates. The return on investment for solar installations follows a predictable timeline.

Update Information

- Energy storage power station revenue model

- What is the volume of a 1MW base station container energy storage power station

- 1mw container energy storage power station volume

- 1MW Base Station Container Energy Storage Power Station

- Comprehensive cost of energy storage power station

- Bangladesh energy storage power station battery manufacturer

- Bissau Energy Storage Power Station Company

- Lebanon Photovoltaic Power Station Energy Storage Demonstration

- Total cost of chemical energy storage power station

- Romania power battery energy storage power station

- Power station cost lithium battery energy storage

- Peru air energy storage power station efficiency

- Energy Storage Container Battery System ESS Power Base Station

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.