How is the investment profit of energy storage power station?

Oct 2, 2024 · 1. The investment profit of energy storage power stations is determined by several factors including initial costs, operational efficiency, market demand, and regulatory

BESS revenue models: tolling, floor & fully merchant

Feb 4, 2025 · These revenue strategies determine the bankability and economic feasibility of a BESS (battery energy storage system) use case and range from high-risk, high-reward fully

How much is the revenue of energy storage power station?

Jan 7, 2024 · The revenue generated by energy storage power stations varies significantly depending on multiple factors such as location, technology, and market conditions. 1. Typical

New Energy Storage Business Models and Revenue Levels

Jun 15, 2024 · Under the current energy storage market conditions in China, analyzing the application scenarios, business models, and economic benefits of energy storage is

Comparative economic analysis across business models of

Mar 10, 2025 · Consequently, the energy sector can encourage MPSPPs to participate in the power dispatching process with more flexible operational business models. Combined with

Optimal revenue sharing model of a wind–solar-storage hybrid energy

Aug 13, 2024 · It also enhances the operating revenue of energy storage power stations by considering the contributions of both energy storage and renewable energy plant in the green

How Energy Storage Power Stations Generate Operating Income: Key Models

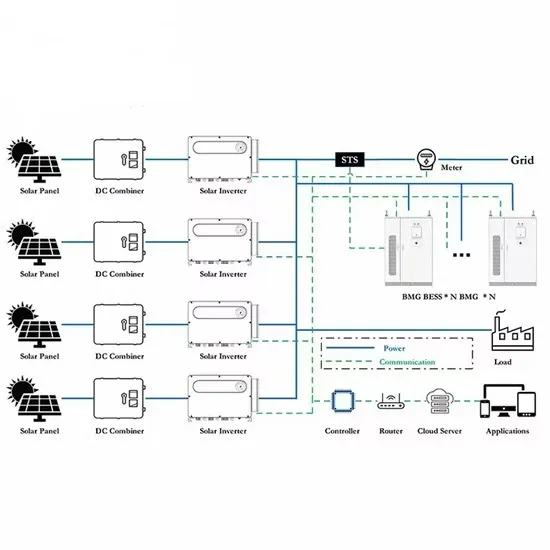

From California to Guangdong, operators are cracking the code on energy storage power station operating income using four primary models: capacity leasing, spot market arbitrage, grid

Configuration and operation model for integrated energy power station

Jun 29, 2024 · Integration of energy storage in wind and photovoltaic stations improves power balance and grid reliability. A two-stage model optimizes configuration and operation,

How many billion yuan does the energy storage power station

Aug 2, 2024 · WHAT ROLE DOES GEOGRAPHY PLAY IN THE EARNings OF ENERGY STORAGE POWER STATIONS? Geography plays a crucial role in determining the earnings

Hierarchical game optimization of independent shared energy storage

Apr 15, 2025 · The numerical results demonstrate that the proposed penalty mechanism increases the independent shared energy storage operator''s revenue by 35.6 %, while the

What is the valuation of energy storage power station

Jul 26, 2024 · The valuation of energy storage power station acquisition involves several critical factors that collectively dictate the financial assessment and potential investment returns of

How is the profit of Hunan energy storage power station?

Feb 20, 2024 · The profit of Hunan energy storage power station can be analyzed through several key aspects: 1. Revenue generation from energy sales, 2. Operational cost efficiencies, 3.

How much does the energy storage power station earn per

Jan 5, 2024 · 2.1 LOCATION AND MARKET ACCESS The geographical positioning of an energy storage power station profoundly influences its revenue potential. Regions with high electricity

analysis of the revenue model of energy storage power stations

Here''s some videos on about analysis of the revenue model of energy storage power stations Partnership to generate revenue from battery storage and Flexible energy specialist

Analysis of various types of new energy storage revenue

Comprehensive the above literature, this paper analyzes the revenue model of various types of energy storage, and establishes the revenue model of different types of energy storage,

How is the energy storage power station priced? | NenPower

Jan 30, 2024 · 1. Energy storage power station pricing is influenced by various factors, including construction costs, capacity, technology type, and market demand.2. Alternative pricing

Revenue prediction for integrated renewable energy and energy storage

Jun 1, 2022 · A straightforward and computationally efficient tool for estimating revenue and optimizing energy storage sizing is useful to help interested parties consider appropriate

What are the business models of energy storage power stations?

Apr 6, 2024 · The rising demand for renewable energy sources has catalyzed the exploration of energy storage technologies. As the transition towards low-carbon energy systems

How much profit does Tesla''s energy storage power station

Mar 11, 2024 · Profit generated by Tesla''s energy storage power station can be understood through several key aspects: 1. Diverse income streams contribute significantly to overall

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Summary Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their

Energy storage and new energy revenue model

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

The economic use of centralized photovoltaic power

Jan 15, 2025 · Photovoltaic energy is the highest proportion of renewable energy in China, but its scientific utilization has great room for improvement. This study established a cost-benefit

Configuration optimization and benefit allocation model of

Feb 15, 2022 · Configuration optimization and benefit allocation model of multi-park integrated energy systems considering electric vehicle charging station to assist services of shared

Techno-economic assessment and mechanism discussion of

Apr 15, 2024 · Consequently, to enhance the efficiency and economic viability of energy storage power stations, particularly in the domain of electrochemical energy storage, a paradigm shift

6 FAQs about [Energy storage power station revenue model]

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

What is a profit model for energy storage?

Operational Models: From "peak-valley arbitrage" to "carbon credit monetization," the profit models of commercial and industrial energy storage are becoming increasingly diversified. These new models not only provide investors and users with more choices and opportunities but also drive the continuous development of energy storage technology.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

What is a business model for storage?

We propose to characterize a “business model” for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue stream obtained from its operation (Massa et al., 2017).

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

Update Information

- Practical operation of the profit model of energy storage power station

- Equatorial Guinea energy storage power station revenue

- Norway air compression energy storage power station project plan

- Battery life of independent energy storage power station

- Chemical Energy Storage Power Station Subsidy

- Cote d Ivoire power station energy storage policy

- What industries does containerized energy storage power station involve

- The main body of the energy storage power station in Kiribati

- Energy storage power station high voltage grid connection

- Battery Energy Storage Power Station Feasibility

- Nicosia Photovoltaic Power Station Energy Storage Wholesale Manufacturer

- Energy Storage Power Station Safety Warning

- Peru air energy storage power station efficiency

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.